BEYOND THE NUMBERS

The House Ways and Means Committee is expected to begin considering a proposal tomorrow to make permanent a group of heavily lobbied corporate “tax extenders” — known as “extenders” because Congress routinely extends them only a year or two at a time. The proposal, however, wouldn’t offset the costs of making these provisions permanent by, for instance, scaling back or eliminating any of the other tax breaks or subsidies that litter the tax code.

This would be a wrong move for several reasons.

- It’s a fiscal double standard. By not paying for the costs of making these provisions permanent, the proposal contrasts sharply with congressional demands to pay for other budget priorities. The Murray-Ryan budget deal of December partly and temporarily eased the deep sequestration cuts that were damaging important programs and services (and slowing the economy) on the condition that Congress fully offset the costs. In addition, House and Senate members have reached bipartisan agreement on a proposal to make permanent relief from severe cuts in Medicare payments to doctors, also conditioned on fully offsetting the costs (although they have not yet agreed on how to do that). And, at substantial human and economic cost, Congress has not restored urgently needed unemployment benefits in part due to disagreements over how to offset the $10 billion cost — and it’s clear the legislation won’t pass without such offsets. Yet, the House Ways and Means Committee will likely approve bills tomorrow to make permanent costly tax breaks — including a tax break for the overseas profits of Wall Street banks — without offsetting any of the costs.

- It’s a tax double standard. The Ways and Means Committee has turned the traditional “tax extenders” debate — about continuing these provisions for a year or two — into a discussion about which expiring tax provisions of all kinds to make permanent. In that context, policymakers should give priority to the key improvements to the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) that are due to expire at the end of 2017. If Congress lets them expire, a mother with two children who works full time at the minimum wage would lose $1,725 a year in her CTC beginning in 2018. Marriage penalties would be higher for many working married couples, and many working families with three or more children would lose part of their EITC. In all, about 26 million children in 13 million low- and moderate-income working families would be worse off. Policymakers should not make heavily lobbied, regressive corporate tax breaks permanent while ignoring the fate of effective improvements to the CTC and EITC that help millions of working families struggling to make ends meet.

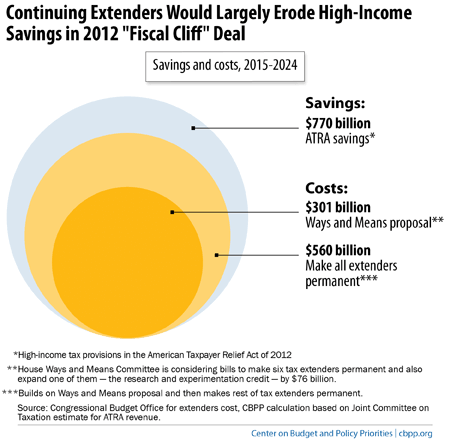

- It’s a fiscal reversal. The 2012 “fiscal cliff” tax legislation raised $770 billion over the next decade. The Ways and Means proposal would make permanent six of the tax extenders (while expanding one of them — the research and experimentation credit) at a cost of over $300 billion, thus eroding two-fifths of the “fiscal cliff” savings. If policymakers build on that package and make the rest of the extenders permanent, the cost would be about $560 billion, cancelling nearly three-quarters of the “fiscal cliff” savings (see chart). If, as some policymakers have proposed, they also make permanent “bonus depreciation,” which Congress enacted as a temporary measure to boost a weak economy and which they should allow to expire (as we’ve previously explained), they would eliminate all of the “fiscal cliff” savings. In fact, were policymakers to make permanent all of the current tax extenders other than bonus depreciation without offsetting the costs, they would increase the already substantial rise that’s projected in the ratio of federal debt to gross domestic product (i.e., the “debt-to-GDP ratio”) between now and 2040 by one-quarter.

All told, then, the Ways and Means proposal would impose a fiscal double standard that favors the tax extenders over other budget priorities; create a tax double standard that favors the extenders over EITC and CTC improvements that help millions of working people; and significantly erode “fiscal cliff” deficit savings that policymakers worked so hard to secure. That’s simply the wrong way to go.