BEYOND THE NUMBERS

House Budget Committee Chairman Paul Ryan (R-WI) extolled the anti-poverty effects of the Earned Income Tax Credit (EITC) and, in his new poverty proposal, wisely proposed expanding it for childless adults (including non-custodial parents). The praise that Chairman Ryan correctly gave the EITC also applies to the refundable portion of the Child Tax Credit (CTC). Both of these essential tax credits encourage work, expand opportunity, and reduce poverty.

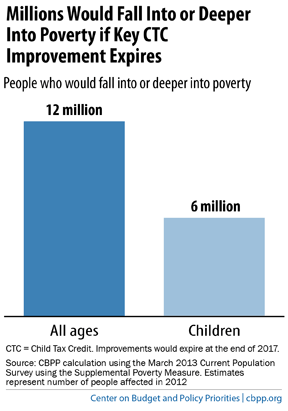

Today, however, House Republicans are considering on the House floor permanent CTC legislation — a bill for which Rep. Ryan voted as a Ways and Means Committee member — that would lead to more poverty, not less. The bill permanently alters the CTC by extending it higher up the income scale so that more families with six-figure incomes can benefit from it, while failing to make permanent a key CTC improvement from 2009 for working-poor and near-poor families that’s slated to expire at the end of 2017. Census data show that letting the CTC improvement for low-income working families expire after 2017 would push 12 million people — including 6 million children — into or deeper into poverty (see chart).

As we have explained, the House bill raises the income levels at which the CTC begins to phase out and indexes those thresholds to inflation. Couples with two children making between $150,000 and $205,000 would become newly eligible for the credit; a family making $160,000, for example, would receive a new tax cut of $2,200 in 2018. But because the bill fails to make permanent the 2009 reduction in the CTC’s earnings threshold after 2017, a single mother with two children who works full time throughout the year at the minimum wage and earns $14,500 would lose her entire CTC of $1,725 in 2018.

The bill also indexes the current maximum credit of $1,000 per child to inflation, but that would not help most working families with low or moderate incomes because it benefits only those with incomes high enough to receive the maximum credit. If the credit’s $3,000 earnings threshold (the level of family earnings at which the credit starts to phase in) is allowed to expire at the end of 2017, the threshold will nearly quintuple — and families making less than about $14,500 will lose their CTC altogether. In addition, many working families with incomes somewhat above $14,500 will have their CTC cut substantially and no longer receive the maximum credit, making the inflation adjustment meaningless for them. Under the House bill, indexing would not benefit a family with two children in 2018 until the family has earnings of at least $28,050 — nearly double full-time work at the minimum wage.

Chairman Ryan’s colleagues should consider the poverty-fighting effects of tax credits such as the CTC for low-income working families. Then they should reverse course and put these families’ needs first, rather than last.