BEYOND THE NUMBERS

Today’s House Ways and Means hearing examined multinational companies’ use of tax havens and profit shifting — among other strategies — to minimize the corporate income taxes that they pay to the United States. As we’ve explained, multinationals shift lots of U.S.-earned profits to foreign tax havens as one way to pay a much lower overall tax rate for their foreign income than their domestic income.

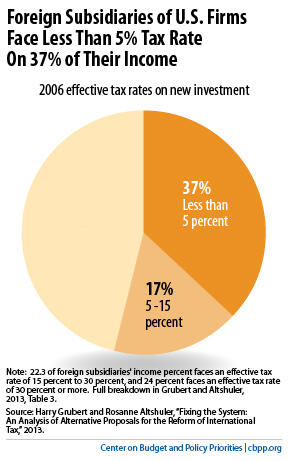

Ed Kleinbard, former chief of staff of the congressional Joint Tax Committee (and now University of Southern California Law School Professor) testified to the frequency with which U.S. multinationals use so-called tax planning strategies. He highlighted recent findings from researchers Harry Grubert and Rosanne Altschuler that reaffirm that many U.S. firms’ foreign subsidiaries face extremely low effective tax rates:

Foreign subsidiaries of U.S. firms today enjoy effective tax rates of less than 5 percent on nearly 37 percent of their total income. Fifty-four percent of U.S.-controlled foreign corporations’ total income is taxed at effective rates of 15 percent or lower (see graph).

Kleinbard also debunked myths about profit shifting and provided recommendations for increasing tax transparency. His testimony also shed light on Starbucks and Apple's tax planning activities as examples of how easy it is for multinationals to avoid taxes by using accounting techniques to report the bulk of their profits in tax havens where they face very little tax.

As we’ve explained, the most watertight way to stop this behavior is for the President and Congress to eliminate or reduce the incentive that the tax code now gives multinationals to shift their profits offshore in the first place: the fact that it taxes those profits only when companies bring them back to the United States. Congress should end or scale back this benefit, known as “deferral.”