BEYOND THE NUMBERS

Update, February 24, 2021: Click here for an updated post with more recent projections.

Concerns about growing federal debt should not dissuade policymakers from enacting additional measures to respond to COVID-19 and the economic crisis it spurred, such as those President-elect Biden proposed yesterday. Although the debt is expected to reach new highs even without those measures, federal interest payments — which are the inescapable cost of debt — are low and projected to remain so for many years due to historically low interest rates.

The federal government pays interest on its debt to those who hold Treasury securities. Those interest payments compete for federal funds with government programs. Interest rates on the debt vary substantially from period to period. In examining the cost of debt over time, it is therefore more meaningful to examine the interest ratio (interest costs as a share of gross domestic product, or GDP) than the debt-to-GDP ratio (federal debt as a share of GDP).

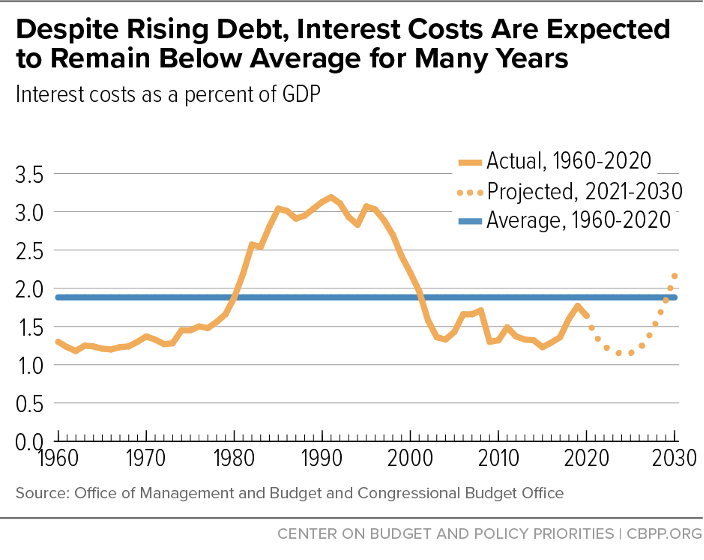

As the figure shows, federal net interest costs as a percent of GDP were highest in the late 1980s and early 1990s, due to high interest rates on outstanding Treasury debt. Interest costs peaked at 3.2 percent of GDP in 1991, when debt held by the public equaled 44 percent of GDP.

Currently, Treasury interest rates are quite low — in fact, negative in inflation-adjusted terms. As a result, interest costs in fiscal year 2020 amounted to only 1.6 percent of GDP — just half their peak value — even though debt held by the public reached 100 percent of GDP.

The Congressional Budget Office (CBO) expects interest rates to stay below historical levels for at least a decade, projecting that the average interest rate on Treasury securities will drop from 2.0 percent in 2020 to 1.2 percent in 2024 and 2025 before rising to 2.1 percent by 2030. As a result, CBO expects net interest costs to fall as a percent of GDP through 2024, notwithstanding growing debt. Net interest costs will reach 2.2 percent of GDP by 2030, CBO projected in September — less than what it had projected before the pandemic and well below the 1991 peak, although slightly above the average from 1960 to 2020. The COVID-19 relief and other measures enacted in December will add no more than 0.1 percent of GDP to that figure.

Today’s low interest rates indicate that rising debt is neither overheating the economy nor crowding out private investment in physical or human capital, which could raise future productivity and incomes. Low rates also suggest that the economy can support a higher debt ratio than was appropriate when borrowing costs were much greater. Interest costs will rise when interest rates return to more normal levels, but the new normal will likely be lower interest rates than the historical normal, according to CBO and other economists.

Policymakers ultimately will need to address rising deficits and debt. But such concerns should not forestall needed efforts to fight the virus, care for those whom it and the recession have harmed, and restore the economy to health.