BEYOND THE NUMBERS

Arizona voters will decide this fall whether to enact a targeted tax increase on high-income residents through Proposition 208 (the Invest in Education Initiative), which could deliver a sizable boost to the state’s finances, make its tax system fairer, provide big benefits to children and schools, and boost the state economy’s long-term potential.

The ballot measure calls for a 3.5 percent tax surcharge on income over $250,000 for individuals and $500,000 for joint filers. That would bring the top rate to 8 percent on income above those thresholds, while keeping other rates in the state’s relatively low income tax structure the same: 4.5 percent on income over $159,000 (for individuals) and $318,000 (for joint filers), with lower rates on lower income amounts.

The measure could raise between $827 million and $940 million a year, all dedicated to bolstering K-12 schools. That could deliver a potentially game-changing boost to Arizona’s children and communities, as we detail here.

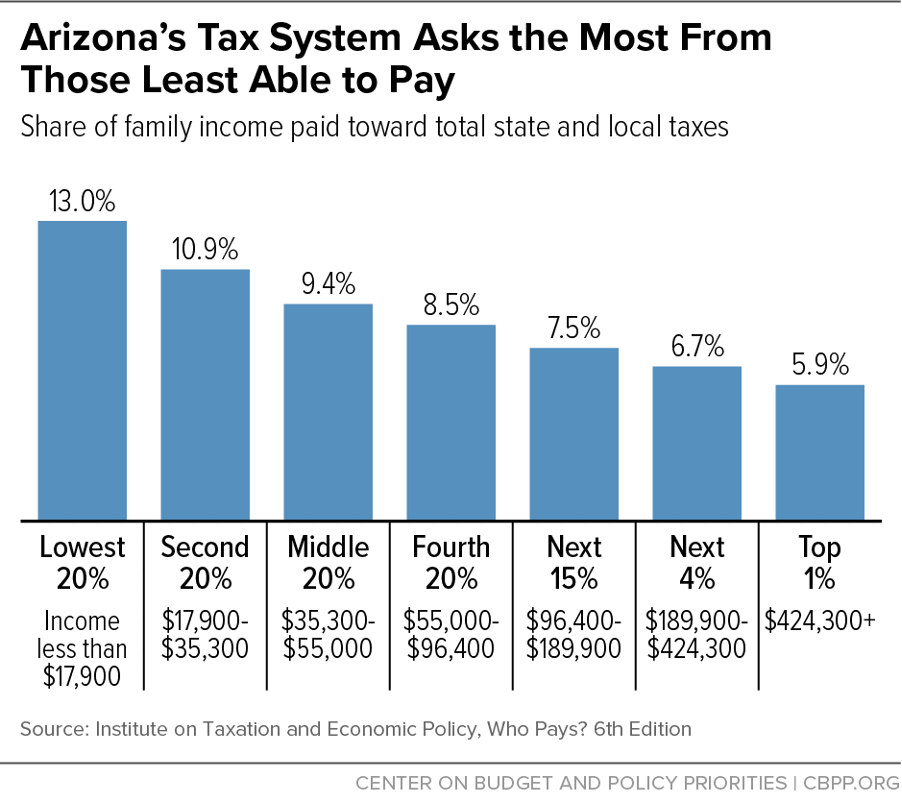

By requiring those at the very top to pay a fairer share, the measure also would make the state’s tax system less regressive – in other words, lessen the degree to which it worsens inequality. Arizona’s tax system is the nation’s 11th most regressive, according to the Institute on Taxation and Economic Policy: its tax burden falls much more sharply on low- and middle-income taxpayers than those at the very top, when accounting for not just income tax levels but other standard state and local taxes on sales and property (see chart).

Proposition 208’s surcharge would fall almost entirely on the state’s highest-income 1 percent – those making more than about $424,300 a year — who now pay less in state income taxes than their counterparts in 33 other states. If Proposition 208 passes, their effective tax rate would still be lower than in 25 other states.

In addition to enhancing tax fairness, the measure offers Arizona an economic upside, despite opponents’ claims that it could weaken the state economy or hurt small businesses. For one, interstate differences in tax rates, including higher rates on top incomes, are unlikely to harm a state’s economic performance, mainstream research consistently finds. And looking at small businesses specifically, most owners in Arizona or elsewhere don’t make enough taxable profits to meet the surcharge’s threshold. The median income for Arizona small business owners is only about $51,000, and fewer than 2 in 10 small business owners nationwide generate taxable profits above $50,000.

In fact, the ballot initiative might offer Arizona some modest economic payoff in the short term, while laying the foundation for a more resilient, inclusive economy over time.

Right now, the measure would generate sizable new funding for teacher hiring and pay raises, among other important support for students and schools, which means more money in the pockets of Arizona families and communities. State and local tax revenue crashed nationwide due to COVID-19 and the resulting recession, and many states are already enacting harmful budget cuts. Local governments, meanwhile, are imposing massive layoffs or providing lower pay for teachers and other staff. All of that hurts local economies, because affected families are less equipped to spend at local shops, restaurants, and other small businesses.

Measures that keep money churning in local economies can do the opposite. Enabling consumers to spend and institutions such as schools and other public agencies to continue buying goods and services from local vendors is among the most effective ways to bolster local economic activity, research finds.

Such investments – while crucial to families and communities today – provide their strongest economic returns over the long haul.

That’s because smart investments to enhance school quality, improve a state’s critical infrastructure, and eliminate barriers to people of color and other historically excluded communities can boost a state’s productivity, such as by raising family incomes, improving workers’ skills, and expanding the pool of talent. Strong support for quality public education, in particular, appears linked to states’ capacity for long-term economic growth and more equitable access to opportunity. Adequate school funding helps raise high school completion rates, close achievement gaps, and make the future workforce more productive by boosting student outcomes, studies show.

Bolstering schools and services can also make a state’s economy more vibrant over time by making its communities’ quality of life more attractive to families, young professionals, and entrepreneurs and innovators. As one prominent survey of highly successful entrepreneurs found, the strength of local talent and the general quality of local amenities and lifestyle were far more important factors than taxes in deciding where to launch their companies. For these reasons and others, Arizona’s ballot measure is a sound approach for boosting investment in crucial services today and building a more inclusive economy over the long term.