- Home

- TANF Responded Unevenly To Increase In N...

TANF Responded Unevenly to Increase in Need During Downturn (with state-by-state fact sheets)

Findings Suggest Needed Improvements When Program Reauthorized

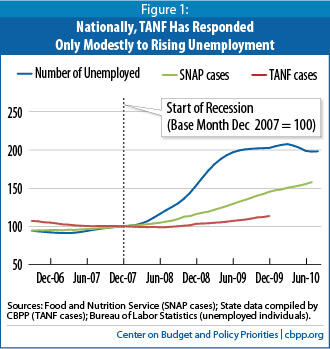

Nationally, the Temporary Assistance for Needy Families (TANF) program, which provides basic assistance to low-income families with little or no income, has only been modestly responsive to the economic downturn. Using data collected directly from the states, [1] we estimate that between December 2007 and December 2009, TANF caseloads increased by just 13 percent, while Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps) caseloads grew by 45 percent and the number of unemployed persons doubled. (See Figure 1 and Appendix Table B-1.) Moreover, in 22 states, TANF caseloads responded very little or not at all to the recession: 16 states had caseload increases of less than 10 percent and six states had caseload declines.

This paper examines TANF’s responsiveness during the first two years of the economic downturn both nationally and at the state level; accompanying fact sheets for each state and the District of Columbia document trends in the TANF caseload since October 2006. [2] This paper is the first in a series that will examine how the TANF caseload is responding to the rise in joblessness and the accompanying economic hardship that has defined the Great Recession, which officially began in December 2007 and ended in June 2009. While the recession may have technically ended, hard economic times continue and a long and slow recovery is anticipated. Future analyses will report on how the TANF caseload changes as the economic recovery progresses.

The Context: Sustained High Unemployment Creating Widespread Hardship

The recession followed a disappointing economic recovery that started at the end of 2001 and culminated in 2007. That recovery marked the first time on record that poverty and the incomes of typical working-age households worsened despite six years of economic growth. The share of Americans in poverty climbed from 11.7 percent in 2001 to 12.5 percent in 2007, while the median income for working-age households (those headed by someone younger than 65) declined from $59,640 in 2001 to $56,575 in 2007 (in inflation-adjusted 2009 dollars). [5]

The situation worsened from 2007 to 2009: the number of people in poverty increased by 6.3 million to 43.6 million, the poverty rate rose to 14.3 percent (its highest level since 1994), and the median income of working-age households declined by 4.6 percent or $2,700, after adjusting for inflation (falling to its lowest point since 1996).

The percentage of people in deep poverty — that is, with incomes below half the poverty line — rose from 5.2 percent in 2007 to 6.3 percent in 2009, which is the highest level on record with data going back to 1975. (Half of the poverty line corresponds to an annual income of $9,155 for a family of three.) The 19 million people in deep poverty made up 43.7 percent of all poor people, which was the highest share ever recorded.

Recent economic news suggests poverty will be even higher in 2010 and 2011 than in 2009. Poverty is likely to remain high even longer than unemployment does: in the last three recessions, poverty did not begin to decline until a year after the annual unemployment rate started to fall.

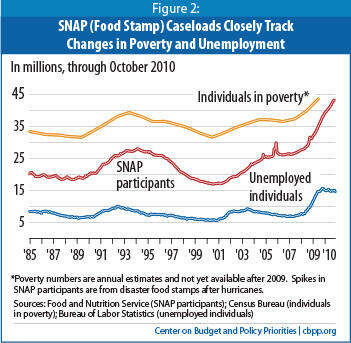

After unemployment insurance, SNAP historically has been the most responsive federal program during economic downturns, providing additional assistance to families and individuals who see their economic circumstances change during periods of high and rising unemployment. This economic downturn has been no exception: national SNAP (Food Stamp Program) enrollment is at an all-time high (see Figure 2).

Some of the states hit hardest by the recession saw the largest food stamp caseload increases between December 2007 and December 2009. For example, in Nevada, where the number of unemployed increased by 157 percent, the number of food stamp cases increased by 89 percent during this period. In Florida, where the number of unemployed increased by 149 percent, the number of food stamp cases increased by 83 percent.

Food stamp caseloads can grow for two reasons: because more households are becoming eligible for the program and enrolling, or because a larger share of already-eligible households is signing up for the program. During most of the early to mid-2000s, both were occurring. With a weaker economy, the number of eligible households climbed from 14 million in 2000 to 18 million by 2005. Meanwhile, the participation rate among eligible households increased from 50 percent in 2000 to 63 percent in 2006, as states and the U.S. Department of Agriculture (USDA) worked to increase enrollment by eligible households. The rapid caseload growth in more recent years appears to primarily reflect the fact that more households are becoming eligible because of the recession. Between 2006 and 2008, USDA estimated a modest increase in the participation rate (from 62.7 percent to 63.7 percent), which suggests that the growth in participation rates may have leveled off. [8]

Moreover, while the recession is the principal reason for food stamp caseload increases over the 2007 to 2009 period, other factors could have contributed to caseload growth. In particular, effective April 2009, the economic recovery act temporarily lifted the 3-month time-limit that unemployed childless adults otherwise face. In addition, during 2007 to 2009 period, several states adopted a state option to expand food stamp eligibility modestly (known as expanded categorical eligibility) and states may also have engaged in targeted outreach (for example, to provide application assistance to seniors or working families) or improved their enrollment practices (by, for example, adopting an online application or call center).

TANF Caseloads Have Risen Substantially in Some States But Not in Others

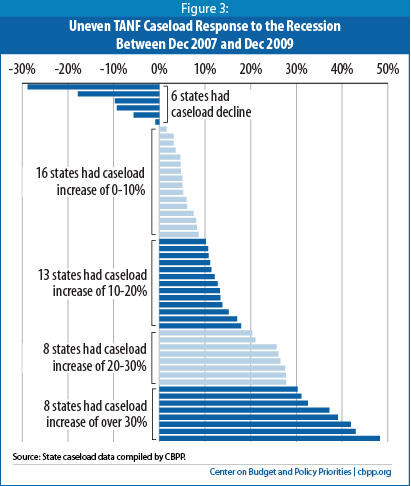

In marked contrast to food stamps, TANF has been only modestly responsive to rising unemployment and greater economic hardship. The total number of families with children receiving cash assistance increased by just 13 percent between December 2007 and December 2009, despite a doubling of the number of unemployed persons. However, the national data mask significant state-by-state variation (see Figure 3):

- Sixteen states had caseload increases of at least 20 percent; in eight of them, caseloads increased by more than 30 percent.

- Thirteen states had caseload increases of between 10 and 20 percent.

- In the remaining 22 states, TANF caseloads responded very little or not at all: 16 states had caseload increases of less than 10 percent and six states had caseload declines.

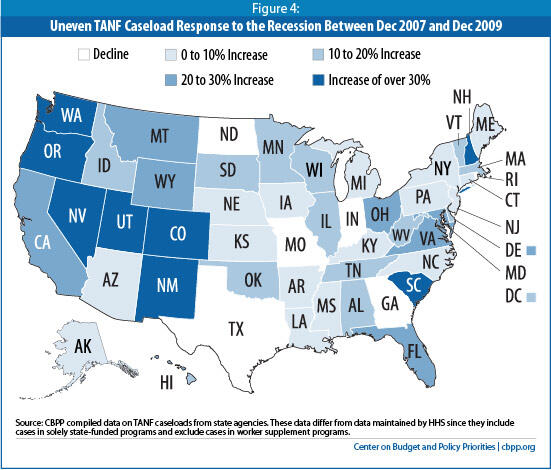

As Figure 4 shows, six of the eight states with the biggest caseload increases were in the West and Southwest. The states whose TANF caseloads declined or increased very little were concentrated in the central and northeastern regions of the country.

A comparison of TANF caseloads over a different time period could reach different conclusions than our analysis. Most states experienced caseload declines after the 2006 TANF changes in the Deficit Reduction Act, but the points at which caseloads subsequently began to rise vary significantly among states. A few states’ caseloads were already rising in the 15 months prior to the start of the recession (October 2006 to December 2007); other states’ caseloads only began rising during the recession, and some states’ caseloads did not begin to increase until after December 2009. For some states, caseloads were near peak or flattening out by December 2009, while in others, the growth was just beginning.

Changes in state TANF caseloads prior to the recession are also an important factor to consider when assessing TANF’s responsiveness to the recession. In the 15 months prior to the recession, Colorado’s caseload declined by 28 percent, more than any other state. While Colorado also had the largest caseload increase from December 2007 to December 2009 (48 percent), its December 2009 caseload was only modestly (6 percent) above its October 2006 caseload because of the dramatic pre-recession decrease. This is a contrast to Nevada, whose caseload increased by 20 percent between October 2006 and December 2007 and another 30 percent during the recession; the pattern here is one of continual climb. (See Appendix Table B-4.)

Variations in Unemployment Don’t Fully Explain Different TANF Caseload Responses

Likewise, states with similar changes in TANF caseloads registered very different changes in unemployment. The eight states with the largest caseload increases had peak unemployment rates that ranged from 6.8 percent to 13 percent, and the six states with caseload declines had peak unemployment rates that ranged from 4.4 percent to 12.7 percent. Three of the six states with caseload declines saw the number of unemployed more than double during the recession.

Rhode Island experienced the nation’s largest caseload decline (29 percent), even though its peak unemployment rate of 12.7 percent was the third highest in the nation. Rhode Island’s TANF caseload decline can be explained, at least in part, by significant policy changes the state implemented near the start of the recession: between July 2008 and July 2009, Rhode Island both shortened its TANF time limit and began cutting off benefits to the entire family (rather than just the parents) when the time limit was reached. In the 15 months prior to the start of the recession, Rhode Island’s caseload declined by 11 percent; this was followed by the additional 29 percent decline after the recession hit.

TANF Not Designed for Hard Economic Times

Since Congress created TANF in 1996 to replace AFDC, researchers and policymakers have speculated about how it might respond to an extended period of joblessness. Some have indicated that the real success of welfare reform could only be determined after witnessing the program’s response to a significant economic downturn.[9]

AFDC protected states from the full economic costs of serving more families when the economy weakened, since the federal government shared the costs of increased caseloads with the states. TANF operates very differently. States generally do not get more federal funding when caseloads increase in hard economic times (the TANF Emergency Fund is an exception, as explained below), and because TANF is a block grant, decisions on whether or how to reallocate funds to address greater economic hardship rest solely with the state. Moreover, three key features of TANF create a disincentive to serve more families during periods of greater need:

- The block grant structure means that if a state uses more TANF funding for cash assistance, it will have less for other TANF-funded programs. Because states can allocate TANF funds to many different purposes, they have a significant financial incentive to keep their cash assistance caseloads low. This incentive is even greater when the economy is weak because this is when state budget pressures are greatest. When caseloads declined during the early years of welfare reform, states shifted TANF funds to many other worthwhile purposes such as child care, homelessness prevention, and child welfare services. Once TANF funds have been reallocated to other purposes, it becomes very difficult to reclaim them to provide cash assistance to more families, no matter how great the need.

- TANF’s primary performance measure, the work participation rate, rewards states for reducing their TANF caseloads, even if the economy is weak. [10] States receive a “caseload reduction credit” toward their work participation rate requirement if their TANF caseload declines below its 2005 level. The credit has helped many states meet their work participation rates, but it gives states an incentive to keep TANF caseloads down, as states that allow their caseloads to rise in response to increased need generally would be penalized by a reduced credit. [11] In addition, because states must achieve specified work participation rates, the number of families they must engage in work-related activities to achieve the rate increases as caseloads increase; this further discourages states from allowing their caseloads to grow when need increases.

- The activities through which TANF recipients can meet their work requirement are narrowly focused on employment, even if jobs are not available. States primarily rely on unsubsidized employment of TANF recipients to meet their work participation rates. It is more difficult for states to get credit toward the work rate for recipients’ participation in other activities; for example, there are limits on states’ ability to count participation in job search, post-secondary education, and activities to remove barriers to work (such as substance abuse treatment) toward their work participation rates. Hence, when the economy weakens and fewer jobs are available, it becomes more difficult for states to meet their prescribed work participation rates unless they keep caseloads down, even as the number of families in need is swelling.

In addition, the work participation rate structure encourages states to concentrate their efforts on the most employable families — those that are already working or who have demonstrated their ability to participate in a work program almost full time — rather than families with the greatest barriers to employment, even though the latter would likely benefit the most from assistance. Because the work participation requirements do not change when the economy is weak, the incentive to focus services on the most employable becomes stronger when few jobs are available.

The TANF Emergency Fund: Extra Help During a Time of Unprecedented Need

The TANF Emergency Fund, created as a part of the 2009 Recovery Act, provided much-needed assistance to help states respond to increased need. Without it, TANF caseloads likely would have been even less responsive to the economic downturn. The fund made $5 billion available to states to provide additional help to needy families in three categories: basic assistance, one-time non-recurring assistance, and subsidized jobs. For 2009 and 2010, a state could draw down up to 50 percent of one year’s TANF block grant allocation to cover 80 percent of the state’s increased costs of providing aid in those three categories.

By the time the fund expired on September 30, 2010, 49 states (all except Wyoming), the District of Columbia, Puerto Rico, the Virgin Islands, and 25 Indian tribes had received assistance from the fund. A total of $1.6 billion from the fund was used to cover the increased cost of providing basic assistance to families. The largest share of the fund, $2.1 billion, was spent for increases in one-time non-recurring benefits, and $1.3 billion was spent to provide subsidized jobs to low-income parents and youth. The emergency assistance and subsidized jobs provided through the TANF Emergency Fund undoubtedly helped some families to stay off the regular TANF rolls.

Some states also were eligible to receive assistance from the permanent TANF Contingency Fund, which contained $1.4 billion at the start of the recession — all of which states had claimed by December 2009. [12] To qualify for funds from the Contingency Fund, states had to meet an economic distress trigger as well as a maintenance-of-effort (MOE) requirement that is more stringent than the standard TANF MOE requirement.[13] Because of the special MOE requirement and other complicated requirements, only 19 states — and only six of the 24 states whose peak unemployment rates exceeded the national average — received funds from the Contingency Fund. In addition, while the TANF Emergency Fund required states to increase their expenditures in the three specified categories to receive additional funding, the regular Contingency Fund has no such requirement.

Policy Changes to Increase TANF’s Responsiveness During Hard Economic Times

The recession has exposed serious weaknesses in TANF’s ability to respond to significant changes in the economy. TANF is often the safety net of last resort for parents who cannot find work and do not qualify for unemployment insurance. Thus, TANF has an important role to play in helping families with children weather the crises that result when jobs are not available. TANF reauthorization provides an opportunity to make the program more responsive in such situations. Potential changes that policymakers should consider include:

- Redesign the Contingency Fund. The Contingency Fund has not been effective in helping many states respond to the economic downturn. Because of its complex design and requirement that states significantly increase their TANF spending, fewer than half of the states qualified for money from the Contingency Fund, even though nearly all states met the economic distress triggers. Moreover, the fund’s current design does not require that states use the resources to fund programs or services that explicitly respond to families’ special needs during an economic downturn. They must, however, be used for purposes allowed under TANF. It is important that TANF include a Contingency Fund that states can draw on during future downturns and that helps strengthen the responsiveness of TANF in difficult economic times.

The redesigned Contingency Fund should incorporate several features that helped make the TANF Emergency Fund so effective. States should be able to get extra federal help during difficult economic periods if they are devoting more resources to help families meet their basic needs through an increase in expenditures for basic assistance, subsidized employment programs, or other supports for families facing hard times (such as one-time emergency assistance to avert homelessness). In addition, the economic distress trigger should be redesigned to account for long recessions and to make it possible for states to qualify for a specified period after their economy begins to recover. The current period is a case in point — the economy is technically in recovery, but the unemployment rate remains stuck at 9.4 percent, and indications are that poverty is continuing to rise.

- Systematically track, by state, measures that assess the effectiveness of TANF as a safety net for deeply poor children. Since TANF was created in 1996, its effectiveness as a safety net for very poor families with children has declined dramatically. To begin to reverse this trend, HHS could begin tracking and reporting on multiple measures of the program’s effectiveness as a safety net, including responsiveness during economic downturns. These measures should focus on assessing the extent to which a state’s TANF program serves children in deep poverty and the progress that a state is making in decreasing the share of deeply poor children that fail to receive such aid.

- Replace the work participation rate and caseload reduction credit with a new performance measure that focuses on employment outcomes or other measures of family well-being, with adjustments during hard economic times. The work participation rate has proven to be an ineffective performance measure for TANF. A better approach would be to identify a new performance measure that rewards states for positive outcomes such as increasing employment or earnings or improving recipients’ education and skills. Such a measure would maintain the program’s emphasis on work but would not reward states for simply removing families from the TANF caseload. Also, the performance measure should adjust to reflect the availability of jobs; states cannot be expected to meet the same employment-related outcomes when unemployment is high as when it is low.

- Make modest changes in the types of work activities that states can count in order to refocus TANF employment activities on improving outcomes for families. The current work participation rate structure drives state TANF programs to use very narrowly defined pathways to work for program recipients. To the extent that the work participation measure is retained, either for some or all families, now seems the ideal time to consider expanding what can count toward the work rate so as to remove disincentives that often lead states to prevent recipients from pursuing the most promising path to employment. While immediate job placement is likely to continue to be the preferred strategy for most recipients, parents who have the interest and ability to pursue an educational or training path that will lead to higher wages and less dependence on government assistance over the long term should be able to do so.

This is especially important when the economy is weak. Improving one’s education or skill level is a productive activity when few job opportunities are available. Similarly, families experiencing personal and family crises should be encouraged to participate in activities that will improve their circumstances over the long term.

- Provide additional funds to help states maintain and build on the successful subsidized employment programs they created through the TANF Emergency Fund. States were enormously successful in creating subsidized employment programs during this recession. In many cases, states built these programs from scratch and implemented them in a short period of time. These programs allowed states to provide new job opportunities to individuals with the least favorable employment prospects. They also allowed TANF agencies to forge new partnerships with workforce development agencies and private-sector employers. Because Congress did not extend the TANF Emergency Fund beyond September 30, 2010, a number of states have now ended their programs (or will shortly) since they do not have the funds to sustain them; many of these states would rekindle (or continue) their programs if new dedicated funding were available. These programs have an important role to play in enabling TANF agencies to help TANF recipients find jobs. While these programs may be more important during economic downturns, they would strengthen TANF work programs even when the economy is stronger.

Appendix A

Methodology: TANF Caseload Data Used for This Analysis

This paper looks to national and state trends — over time and across states — in caseloads for cash assistance to families with children, often referred to as state welfare caseloads or state TANF caseloads. The analysis uses caseload data collected directly from the states rather than the official data reported by the Department of Health and Human Services (HHS) in order to more consistently reflect the number of families with children receiving cash welfare in each state over time.

The Deficit Reduction Act of 2005 and its implementing rules made it more difficult for states to meet the TANF work participation rates. Since states that fail to meet these rates face a potential fiscal penalty, many states responded by changing the configuration of funding in their TANF programs. Two of these changes in particular affect the caseload data that states report to HHS. [14]

- Solely state-funded programs: Over half the states serve some groups of families outside of the TANF or MOE funding structure. [15] Often these are families whose needs cannot be met through the narrowly defined set of “countable” TANF work activities — for example, families needing extended time in activities designed to help them address personal and family challenges that limit their employability, or families participating in post-secondary education for longer than a year. Many states also serve two-parent families in solely state-funded programs since these families are subject to a higher (and difficult to achieve) work participation rate. Failure to account for these programs could lead one to underestimate the TANF program’s responsiveness to the recession if these families are removed from the state’s TANF caseload near the start of the recession and to overestimate the program’s responsiveness if they are added back in during the recession (as some states have done due to state budget shortfalls).

- Worker supplement programs: Over one-third of states provide some type of supplemental “assistance” payment to low-income working families outside of their regular TANF or welfare caseload in order to provide additional work support and better achieve state policy goals. [16] Most states provide these as transitional benefits to families that work their way off of TANF. A few states also have served a broader group of low-income working families that receive other benefits such as SNAP. Because these supplemental payments are supported by TANF or MOE funds, the recipients are included in caseload data reported to HHS, but they are not eligible for cash assistance under the state’s regular eligibility rules. Depending in part on when a state began providing these payments to working families, including these cases as a part of the TANF caseload could overestimate a state’s TANF responsiveness to the economic downturn because these programs include families that are not really considered part of the state’s basic cash assistance caseload.

The methodology we employed treats TANF caseload numbers differently from HHS with respect to these two populations. Families served in solely state-funded programs are not included in the HHS data but are included in our data; working families that receive monthly cash assistance supplements are included in the HHS data but not in our data. These two methodological decisions ensure that we are comparing a consistent cash assistance caseload over time and across states. While the HHS data accurately reflect the number of families that states have chosen to serve with their TANF block grant and MOE funds over time, they do not always reflect the state’s caseload of families with children receiving cash assistance. Moreover, because state choices have changed over time, the HHS data are not well suited to monitoring changes in the number of individuals or families serviced over time even within a state.

We collected data from state websites and contacted state officials for data when the website data were not available, incomplete, or unclear. Because states post their caseload data in different ways — with some separately identifying separate state programs, solely state-funded programs, or worker supplement programs and others not separately breaking out data — we selected data that correspond to the definition of caseload that we are using in this analysis. Some states also report their TANF-funded child-only or kinship care assistance caseload separately; we included these data as part of state caseloads to ensure that the caseload data are comparable across states.

Because the caseload data are obtained from the states, for some states they may differ somewhat from the data submitted to HHS even if a state does not have a solely state-funded program or a worker supplement program. (For some states, the data exactly match the HHS data.) This is because state caseload data are often more immediate and represent all benefits issued in a month, while the HHS data that are submitted some months later include adjustments. Welfare caseloads are very dynamic, with families entering, exiting, and having brief closures with subsequent reopenings. While there may be some small differences between the state caseload data and the data reported to HHS that go beyond the adjustments for solely state-funded or worker supplement programs, our consistent use of the state caseload data over a period of time means that the data used for each state are comparable over the period of time and that the trends within a state should be consistent.

Appendix B - Data Tables

| APPENDIX TABLE B1: Changes in TANF and Food Stamp Caseloads DECEMBER 2007 TO DECEMBER 2009 |

||||||

| TANF | Food Stamps | |||||

| Dec-07 | Dec-09 | % change | Dec-07 | Dec-09 | % change | |

| Alabama | 18,830 | 21,330 | 13.3 | 226,401 | 335,354 | 48.1 |

| Alaska | 2,989 | 3,082 | 3.1 | 20,969 | 28,379 | 35.3 |

| Arizona | 37,887 | 39,858 | 5.2 | 245,225 | 429,370 | 75.1 |

| Arkansas | 7,684 | 7,957 | 3.6 | 158,080 | 195,332 | 23.6 |

| California | 466,853 | 561,909 | 20.4 | 871,358 | 1,327,580 | 52.4 |

| Colorado | 9,226 | 13,681 | 48.3 | 106,650 | 169,691 | 59.1 |

| Connecticut | 18,736 | 19,595 | 4.6 | 117,550 | 170,340 | 44.9 |

| Delaware | 4,628 | 5,833 | 26.0 | 31,330 | 48,356 | 54.3 |

| District of Columbia | 14,853 | 16,453 | 10.8 | 47,404 | 63,253 | 33.4 |

| Florida | 48,608 | 61,097 | 25.7 | 707,984 | 1,296,324 | 83.1 |

| Georgia | 22,719 | 21,444 | -5.6 | 401,851 | 650,006 | 61.8 |

| Hawaii | 7,676 | 8,984 | 17.0 | 47,344 | 67,278 | 42.1 |

| Idaho | 1,537 | 1,770 | 15.2 | 38,568 | 71,636 | 85.7 |

| Illinois | 26,621 | 29,582 | 11.1 | 589,819 | 760,630 | 29.0 |

| Indiana | 40,985 | 36,989 | -9.7 | 260,901 | 338,287 | 29.7 |

| Iowa | 16,459 | 17,781 | 8.0 | 112,647 | 152,274 | 35.2 |

| Kansas | 12,837 | 13,599 | 5.9 | 84,038 | 116,377 | 38.5 |

| Kentucky | 29,323 | 30,243 | 3.1 | 278,716 | 345,797 | 24.1 |

| Louisiana | 11,178 | 11,740 | 5.0 | 276,247 | 346,880 | 25.6 |

| Maine | 13,169 | 14,302 | 8.6 | 83,059 | 110,917 | 33.5 |

| Maryland | 22,338 | 28,486 | 27.5 | 160,154 | 252,148 | 57.4 |

| Massachusetts | 45,915 | 50,822 | 10.7 | 254,061 | 392,999 | 54.7 |

| Michigan | 74,666 | 79,203 | 6.1 | 575,711 | 816,056 | 41.7 |

| Minnesota | 28,851 | 32,349 | 12.1 | 137,943 | 201,924 | 46.4 |

| Mississippi | 11,641 | 12,598 | 8.2 | 201,694 | 245,662 | 21.8 |

| Missouri | 42,951 | 42,589 | -0.8 | 307,570 | 401,304 | 30.5 |

| Montana | 3,189 | 3,859 | 21.0 | 34,978 | 48,600 | 38.9 |

| Nebraska | 9,849 | 10,309 | 4.7 | 51,658 | 68,114 | 31.9 |

| Nevada | 8,732 | 11,377 | 30.3 | 63,429 | 119,919 | 89.1 |

| New Hampshire | 4,584 | 6,505 | 41.9 | 30,066 | 47,201 | 57.0 |

| New Jersey | 38,615 | 39,233 | 1.6 | 206,285 | 287,923 | 39.6 |

| New Mexico | 14,060 | 20,103 | 43.0 | 92,080 | 142,174 | 54.4 |

| New York | 153,949 | 161,179 | 4.7 | 979,989 | 1,414,173 | 44.3 |

| North Carolina | 25,634 | 27,562 | 7.5 | 409,244 | 587,490 | 43.6 |

| North Dakota | 2,423 | 1,991 | -17.8 | 21,540 | 26,709 | 24.0 |

| Ohio | 80,212 | 102,489 | 27.8 | 515,483 | 731,783 | 42.0 |

| Oklahoma | 9,238 | 10,179 | 10.2 | 174,799 | 243,143 | 39.1 |

| Oregon | 19,126 | 26,599 | 39.1 | 233,413 | 359,243 | 53.9 |

| Pennsylvania | 81,420 | 85,534 | 5.1 | 548,518 | 718,299 | 31.0 |

| Rhode Island | 10,929 | 7,780 | -28.8 | 38,898 | 66,664 | 71.4 |

| South Carolina | 15,736 | 20,854 | 32.5 | 248,868 | 348,116 | 39.9 |

| South Dakota | 2,918 | 3,250 | 11.4 | 25,660 | 38,458 | 49.9 |

| Tennessee | 55,161 | 62,760 | 13.8 | 398,134 | 561,024 | 40.9 |

| Texas | 54,858 | 49,764 | -9.3 | 963,856 | 1,310,466 | 36.0 |

| Utah | 5,390 | 7,397 | 37.2 | 51,399 | 87,858 | 70.9 |

| Vermont | 4,884 | 5,759 | 17.9 | 26,828 | 41,643 | 55.2 |

| Virginia | 29,680 | 37,545 | 26.5 | 240,425 | 351,911 | 46.4 |

| Washington | 49,908 | 65,421 | 31.1 | 298,755 | 450,032 | 50.6 |

| West Virginia | 9,689 | 10,924 | 12.7 | 122,736 | 162,769 | 32.6 |

| Wisconsin | 18,327 | 20,777 | 13.4 | 170,508 | 305,216 | 79.0 |

| Wyoming | 278 | 355 | 27.7 | 9,496 | 13,743 | 44.7 |

| US Total | 1,747,949 | 1,982,781 | 13.4% | 12,300,319 | 17,866,825 | 45.3% |

| APPENDIX TABLE B2: Changes in the Number of Unemployed DECEMBER 2007 TO DECEMBER 2009 |

||||||

| Number of Unemployed | Unemployment Rate | |||||

| Dec-07 | Dec-09 | % change | Dec-07 | Dec-09 | Peak Rate Dec07- Dec09 |

|

| Alabama | 84,572 | 224,175 | 165.1 | 3.9 | 10.9 | 10.9 |

| Alaska | 21,975 | 31,008 | 41.1 | 6.2 | 8.6 | 8.6 |

| Arizona | 131,047 | 287,041 | 119.0 | 4.3 | 9.2 | 9.5 |

| Arkansas | 68,689 | 104,513 | 52.2 | 5.0 | 7.6 | 7.6 |

| California | 1,049,107 | 2,233,878 | 112.9 | 5.8 | 12.3 | 12.3 |

| Colorado | 116,631 | 191,887 | 64.5 | 4.3 | 7.3 | 8.3 |

| Connecticut | 91,071 | 165,861 | 82.1 | 4.9 | 8.8 | 8.8 |

| Delaware | 16,860 | 37,614 | 123.1 | 3.8 | 8.8 | 8.8 |

| District of Columbia | 18,321 | 39,526 | 115.7 | 5.5 | 11.9 | 11.9 |

| Florida | 433,134 | 1,078,998 | 149.1 | 4.7 | 11.7 | 11.7 |

| Georgia | 245,224 | 482,245 | 96.7 | 5.1 | 10.3 | 10.3 |

| Hawaii | 19,057 | 43,310 | 127.3 | 3.0 | 6.8 | 7.0 |

| Idaho | 26,791 | 68,263 | 154.8 | 3.5 | 9.1 | 9.1 |

| Illinois | 369,584 | 725,293 | 96.2 | 5.5 | 11.0 | 11.0 |

| Indiana | 148,134 | 300,834 | 103.1 | 4.6 | 9.7 | 10.6 |

| Iowa | 65,302 | 109,797 | 68.1 | 3.9 | 6.5 | 6.5 |

| Kansas | 59,121 | 99,155 | 67.7 | 4.0 | 6.5 | 7.2 |

| Kentucky | 112,846 | 219,656 | 94.7 | 5.5 | 10.6 | 10.8 |

| Louisiana | 76,729 | 151,513 | 97.5 | 3.8 | 7.3 | 7.3 |

| Maine | 33,303 | 56,998 | 71.1 | 4.7 | 8.1 | 8.2 |

| Maryland | 107,337 | 217,291 | 102.4 | 3.5 | 7.4 | 7.4 |

| Massachusetts | 151,638 | 322,527 | 112.7 | 4.4 | 9.3 | 9.3 |

| Michigan | 357,575 | 699,663 | 95.7 | 7.1 | 14.5 | 14.5 |

| Minnesota | 136,620 | 219,267 | 60.5 | 4.7 | 7.4 | 8.4 |

| Mississippi | 79,371 | 135,891 | 71.2 | 6.1 | 10.5 | 10.5 |

| Missouri | 163,087 | 288,047 | 76.6 | 5.3 | 9.6 | 9.7 |

| Montana | 19,575 | 33,149 | 69.3 | 3.9 | 6.7 | 6.7 |

| Nebraska | 28,927 | 44,754 | 54.7 | 2.9 | 4.6 | 4.8 |

| Nevada | 69,243 | 178,261 | 157.4 | 5.2 | 13.0 | 13.0 |

| New Hampshire | 25,365 | 51,132 | 101.6 | 3.4 | 6.9 | 6.9 |

| New Jersey | 202,826 | 452,499 | 123.1 | 4.5 | 10.0 | 10.0 |

| New Mexico | 34,489 | 79,024 | 129.1 | 3.6 | 8.2 | 8.2 |

| New York | 448,055 | 857,578 | 91.4 | 4.7 | 8.9 | 8.9 |

| North Carolina | 223,502 | 494,208 | 121.1 | 4.9 | 10.9 | 11.0 |

| North Dakota | 11,018 | 15,625 | 41.8 | 3.0 | 4.3 | 4.4 |

| Ohio | 337,602 | 637,513 | 88.8 | 5.6 | 10.8 | 10.8 |

| Oklahoma | 62,245 | 121,400 | 95.0 | 3.6 | 6.8 | 6.9 |

| Oregon | 100,917 | 205,681 | 103.8 | 5.2 | 10.6 | 11.6 |

| Pennsylvania | 288,632 | 559,643 | 93.9 | 4.5 | 8.8 | 8.8 |

| Rhode Island | 34,132 | 72,750 | 113.1 | 6.0 | 12.7 | 12.7 |

| South Carolina | 117,917 | 268,850 | 128.0 | 5.6 | 12.4 | 12.4 |

| South Dakota | 12,233 | 20,943 | 71.2 | 2.8 | 4.7 | 5.0 |

| Tennessee | 167,299 | 319,962 | 91.3 | 5.5 | 10.7 | 10.9 |

| Texas | 508,268 | 987,161 | 94.2 | 4.4 | 8.2 | 8.2 |

| Utah | 43,008 | 88,684 | 106.2 | 3.1 | 6.6 | 6.8 |

| Vermont | 14,347 | 23,945 | 66.9 | 4.0 | 6.7 | 7.3 |

| Virginia | 132,124 | 280,791 | 112.5 | 3.2 | 6.8 | 6.9 |

| Washington | 157,744 | 324,477 | 105.7 | 4.6 | 9.2 | 9.2 |

| West Virginia | 33,068 | 70,576 | 113.4 | 4.0 | 9.0 | 9.0 |

| Wisconsin | 138,684 | 258,156 | 86.1 | 4.5 | 8.5 | 8.9 |

| Wyoming | 8,125 | 22,085 | 171.8 | 2.8 | 7.6 | 7.6 |

| US Total | 7,402,471 | 15,003,098 | 102.7% | 5.0% | 10.0% | 10.1% |

| APPENDIX TABLE B3: Changes in TANF and Food Stamp Caseloads and the Number of Unemployed DECEMBER 2007 TO DECEMBER 2009 |

||||||

| TANF Cases | Food Stamp Cases | No. of Unemployed | ||||

| % change | Rank | % change | Rank | % change | Rank | |

| Alabama | 13.3 | 22 | 48.1 | 20 | 165.1 | 2 |

| Alaska | 3.1 | 44 | 35.3 | 37 | 41.1 | 51 |

| Arizona | 5.2 | 36 | 75.1 | 5 | 119.0 | 12 |

| Arkansas | 3.6 | 42 | 23.6 | 50 | 52.2 | 49 |

| California | 20.4 | 16 | 52.4 | 17 | 112.9 | 16 |

| Colorado | 48.3 | 1 | 59.1 | 9 | 64.5 | 46 |

| Connecticut | 4.6 | 41 | 44.9 | 23 | 82.1 | 37 |

| Delaware | 26.0 | 13 | 54.3 | 15 | 123.1 | 10 |

| District of Columbia | 10.8 | 27 | 33.4 | 40 | 115.7 | 13 |

| Florida | 25.7 | 14 | 83.1 | 3 | 149.1 | 5 |

| Georgia | -5.6 | 47 | 61.8 | 8 | 96.7 | 26 |

| Hawaii | 17.0 | 18 | 42.1 | 27 | 127.3 | 8 |

| Idaho | 15.2 | 19 | 85.7 | 2 | 154.8 | 4 |

| Illinois | 11.1 | 26 | 29.0 | 46 | 96.2 | 27 |

| Indiana | -9.7 | 49 | 29.7 | 45 | 103.1 | 22 |

| Iowa | 8.0 | 32 | 35.2 | 38 | 68.1 | 43 |

| Kansas | 5.9 | 35 | 38.5 | 35 | 67.7 | 44 |

| Kentucky | 3.1 | 43 | 24.1 | 48 | 94.7 | 30 |

| Louisiana | 5.0 | 38 | 25.6 | 47 | 97.5 | 25 |

| Maine | 8.6 | 30 | 33.5 | 39 | 71.1 | 41 |

| Maryland | 27.5 | 11 | 57.4 | 10 | 102.4 | 23 |

| Massachusetts | 10.7 | 28 | 54.7 | 13 | 112.7 | 17 |

| Michigan | 6.1 | 34 | 41.7 | 29 | 95.7 | 28 |

| Minnesota | 12.1 | 24 | 46.4 | 21 | 60.5 | 47 |

| Mississippi | 8.2 | 31 | 21.8 | 51 | 71.2 | 39 |

| Missouri | -0.8 | 46 | 30.5 | 44 | 76.6 | 38 |

| Montana | 21.0 | 15 | 38.9 | 34 | 69.3 | 42 |

| Nebraska | 4.7 | 40 | 31.9 | 42 | 54.7 | 48 |

| Nevada | 30.3 | 8 | 89.1 | 1 | 157.4 | 3 |

| New Hampshire | 41.9 | 3 | 57.0 | 11 | 101.6 | 24 |

| New Jersey | 1.6 | 45 | 39.6 | 32 | 123.1 | 9 |

| New Mexico | 43.0 | 2 | 54.4 | 14 | 129.1 | 6 |

| New York | 4.7 | 39 | 44.3 | 25 | 91.4 | 33 |

| North Carolina | 7.5 | 33 | 43.6 | 26 | 121.1 | 11 |

| North Dakota | -17.8 | 50 | 24.0 | 49 | 41.8 | 50 |

| Ohio | 27.8 | 9 | 42.0 | 28 | 88.8 | 35 |

| Oklahoma | 10.2 | 29 | 39.1 | 33 | 95.0 | 29 |

| Oregon | 39.1 | 4 | 53.9 | 16 | 103.8 | 21 |

| Pennsylvania | 5.1 | 37 | 31.0 | 43 | 93.9 | 32 |

| Rhode Island | -28.8 | 51 | 71.4 | 6 | 113.1 | 15 |

| South Carolina | 32.5 | 6 | 39.9 | 31 | 128.0 | 7 |

| South Dakota | 11.4 | 25 | 49.9 | 19 | 71.2 | 40 |

| Tennessee | 13.8 | 20 | 40.9 | 30 | 91.3 | 34 |

| Texas | -9.3 | 48 | 36.0 | 36 | 94.2 | 31 |

| Utah | 37.2 | 5 | 70.9 | 7 | 106.2 | 19 |

| Vermont | 17.9 | 17 | 55.2 | 12 | 66.9 | 45 |

| Virginia | 26.5 | 12 | 46.4 | 22 | 112.5 | 18 |

| Washington | 31.1 | 7 | 50.6 | 18 | 105.7 | 20 |

| West Virginia | 12.7 | 23 | 32.6 | 41 | 113.4 | 14 |

| Wisconsin | 13.4 | 21 | 79.0 | 4 | 86.1 | 36 |

| Wyoming | 27.7 | 10 | 44.7 | 24 | 171.8 | 1 |

| US Total | 13.4% | 45.3% | 102.7% | |||

| APPENDIX TABLE B4: Changes in TANF Caseloads Before and After the Start of the Recession |

||||||

| Prior to Recession Oct-06 - Dec07 |

Two Years After Start Dec-07 - Dec-09 |

Over Entire Period Oct-06 - Dec-09 |

||||

| % change | Rank | % change | Rank | % change | Rank | |

| Alabama | -5.4 | 23 | 13.3 | 22 | 7.2 | 20 |

| Alaska | -9.0 | 32 | 3.1 | 44 | -6.2 | 39 |

| Arizona | -2.9 | 13 | 5.2 | 36 | 2.1 | 28 |

| Arkansas | -8.1 | 28 | 3.6 | 42 | -4.9 | 35 |

| California | 0.1 | 8 | 20.4 | 16 | 20.4 | 9 |

| Colorado | -28.3 | 51 | 48.3 | 1 | 6.4 | 21 |

| Connecticut | -4.6 | 19 | 4.6 | 41 | -0.3 | 30 |

| Delaware | -18.5 | 46 | 26.0 | 13 | 2.8 | 26 |

| District of Columbia | -5.3 | 21 | 10.8 | 27 | 4.9 | 23 |

| Florida | -2.0 | 11 | 25.7 | 14 | 23.2 | 7 |

| Georgia | -16.2 | 42 | -5.6 | 47 | -20.9 | 48 |

| Hawaii | -18.8 | 47 | 17.0 | 18 | -5.0 | 36 |

| Idaho | -12.5 | 36 | 15.2 | 19 | 0.7 | 29 |

| Illinois | -21.8 | 50 | 11.1 | 26 | -13.2 | 46 |

| Indiana | -3.5 | 17 | -9.7 | 49 | -12.9 | 44 |

| Iowa | -4.8 | 20 | 8.0 | 32 | 2.9 | 25 |

| Kansas | -19.7 | 48 | 5.9 | 35 | -15.0 | 47 |

| Kentucky | -8.4 | 29 | 3.1 | 43 | -5.5 | 38 |

| Louisiana | -6.2 | 25 | 5.0 | 38 | -1.5 | 31 |

| Maine | -2.8 | 12 | 8.6 | 30 | 5.5 | 22 |

| Maryland | 1.2 | 4 | 27.5 | 11 | 29.0 | 4 |

| Massachusetts | 0.2 | 7 | 10.7 | 28 | 10.9 | 17 |

| Michigan | -15.3 | 39 | 6.1 | 34 | -10.1 | 42 |

| Minnesota | -3.0 | 14 | 12.1 | 24 | 8.7 | 19 |

| Mississippi | -5.4 | 22 | 8.2 | 31 | 2.4 | 27 |

| Missouri | -3.4 | 16 | -0.8 | 46 | -4.2 | 34 |

| Montana | -4.0 | 18 | 21.0 | 15 | 16.2 | 12 |

| Nebraska | -17.0 | 44 | 4.7 | 40 | -13.1 | 45 |

| Nevada | 19.9 | 1 | 30.3 | 8 | 56.3 | 1 |

| New Hampshire | -20.8 | 49 | 41.9 | 3 | 12.3 | 15 |

| New Jersey | -6.6 | 26 | 1.6 | 45 | -5.1 | 37 |

| New Mexico | -0.3 | 9 | 43.0 | 2 | 42.5 | 3 |

| New York | -6.0 | 24 | 4.7 | 39 | -1.6 | 32 |

| North Carolina | -13.0 | 37 | 7.5 | 33 | -6.4 | 40 |

| North Dakota | -9.0 | 31 | -17.8 | 50 | -25.2 | 50 |

| Ohio | -0.5 | 10 | 27.8 | 9 | 27.2 | 5 |

| Oklahoma | -11.5 | 35 | 10.2 | 29 | -2.5 | 33 |

| Oregon | 9.6 | 2 | 39.1 | 4 | 52.4 | 2 |

| Pennsylvania | -16.1 | 41 | 5.1 | 37 | -11.8 | 43 |

| Rhode Island | -10.7 | 34 | -28.8 | 51 | -36.4 | 51 |

| South Carolina | -16.9 | 43 | 32.5 | 6 | 10.2 | 18 |

| South Dakota | 0.4 | 6 | 11.4 | 25 | 11.8 | 16 |

| Tennessee | -18.0 | 45 | 13.8 | 20 | -6.7 | 41 |

| Texas | -15.5 | 40 | -9.3 | 48 | -23.4 | 49 |

| Utah | -14.8 | 38 | 37.2 | 5 | 17.0 | 11 |

| Vermont | 3.0 | 3 | 17.9 | 17 | 21.4 | 8 |

| Virginia | -9.9 | 33 | 26.5 | 12 | 13.9 | 14 |

| Washington | -3.2 | 15 | 31.1 | 7 | 26.9 | 6 |

| West Virginia | -8.6 | 30 | 12.7 | 23 | 3.0 | 24 |

| Wisconsin | 1.1 | 5 | 13.4 | 21 | 14.6 | 13 |

| Wyoming | -7.0 | 27 | 27.7 | 10 | 18.7 | 10 |

| US Total | -6.3% | 13.4% | 6.3% | |||

End Notes

[1] We use caseload data collected directly from states for this analysis rather than caseload data reported by the states to the Department of Health and Human Services (HHS) in order to more consistently reflect the number of families with children receiving cash welfare in each state over time, and across states. In response to TANF changes in the Deficit Reduction Act of 2005, many states changed their funding configurations (and did so at various times in the past several years) and the caseload data that states report to HHS may not consistently represent the number of families relying on cash assistance in the state. See fuller discussion of the reasons why states made these changes and of the data choices we made in Appendix A.

[2] See Appendix B tables for state-specific data. Additional state-specific fact sheets and the underlying monthly data used in this analysis can be found at https://www.cbpp.org/research/index.cfm?fa=topic&id=42.

[3] http://data.bls.gov/cgi-bin/surveymost

[4] The Employment Situation – January 2010, Bureau of Labor Statistics, http://www.bls.gov/news.release/pdf/empsit.pdf.

[5] Robert Greenstein, Sharon Parrott, and Arloc Sherman, “Poverty and Share of Americans Without Health Insurance Were Higher in 2007 — And Median Income for Working-Age Households Was Lower — Than at the Bottom of Last Recession,” Center on Budget and Policy Priorities, August 26, 2008, https://www.cbpp.org/cms/?fa=view&id=621.

[6] The food stamp data are for December 2009, which is the most recent month for which we have comparable TANF caseload data for every state. In the ensuing eight months, food stamp caseloads continued to grow and stood in August 2010 at 19.7 million households containing 42.4 million individuals (nearly one in seven Americans and one in four children).

[7] This calculation excludes months that a state operated a disaster food stamp program, usually in the aftermath of a hurricane or other natural disaster.

[8] “Trends in Supplemental Nutritional Assistance Program Participation Rates: 2001 to 2008,” USDA, Table 2, (Households), at http://www.fns.usda.gov/ora/menu/Published/SNAP/FILES/Participation/Trends2001-2008.pdf .

[9] LaDonna A. Pavetti, “What Will States Do When Jobs Are Not Plentiful: Policy and Implementation Challenges,” and David N. Figlio and James P. Ziliak, “Welfare Reform, the Business Cycle, and the Decline in AFDC Caseloads,” in Sheldon H. Danziger, ed., Economic Conditions and Welfare Reform, W.E. Upjohn Institute for Employment Research. 1999.

[10] States are required to meet two work participation rates — 50 percent for all work-eligible families and 90 percent for two-parent families — and each of these rates is reduced by the caseload reduction credit to set the target work rate that a state must meet. If states fail to meet their target rates, they are subject to financial penalties.

[11] ARRA included a temporary provision that allows a state an option to use its caseload reduction credit based on circumstances from 2007 or 2008 in lieu of the most recent fiscal year in setting its target work rate for 2009, 2010, and 2011. This provision temporarily lessens some of the pressure on states to keep caseloads from increasing despite rising need.

[12] Additional funds initially were added to the Contingency Fund for FY 2011 but subsequently rescinded effective December 8, 2010. The outcome of this was that 21 states received a total of $334 million in Contingency Funds for October through December and no additional Contingency Funds are available for the remainder of 2011.

[13] States must meet a special 100 percent MOE requirement to receive help from the Contingency Fund, and the extent to which a state exceeds this 100 percent level determines whether the state can keep or must repay the Contingency Funds it receives. Moreover, unlike a state’s regular MOE requirement, the Contingency Fund MOE does not include state spending on child care or separate state programs.

[14] For a fuller discussion of these state changes and the impact on caseloads, see LaDonna Pavetti, Linda Rosenberg, and Michelle K. Derr, “Understanding Temporary Assistance for Needy Families Caseloads After Passage of the Deficit Reduction Act of 2005, Final Report,” Mathematica Policy Research, September 21, 2009, http://www.mathematica-mpr.com/publications/PDFs/family_support/TANF_caseloads.pdf . See also, “Temporary Assistance for Needy Families: Implications of Recent Legislative and Economic Changes for State Programs and Work Participation Rates,” GAO-10-525, May 2010.

[15] For additional information on solely state-funded programs, see Liz Schott and Sharon Parrott, “Designing Solely State-Funded Programs: Implementation Guide for One “Win-Win” Solution for Families and States,” Center on Budget and Policy Priorities, revised January, 2009, https://www.cbpp.org/sites/default/files/atoms/files/12-7-06tanf.pdf.

[16] For more information about worker supplement programs, see Liz Schott, “Using TANF or MOE Funds to Provide Supplemental Assistance to Low-Income Working Families,” Center on Budget and Policy Priorities, revised September 2008, https://www.cbpp.org/sites/default/files/atoms/files/5-24-07tanf.pdf.

More from the Authors

Areas of Expertise

Recent Work: