Montana’s Fiscal Gains From Medicaid Expansion Are a Model for Wyoming

End Notes

[1] Madeline Guth, Rachel Garfield, and Robin Rudowitz, “The Effects of Medicaid Expansion under the ACA: Studies from January 2014 to January 2020,” Kaiser Family Foundation, March 17, 2020, https://www.kff.org/report-section/the-effects-of-medicaid-expansion-under-the-aca-updated-findings-from-a-literature-review-report/; Inna Rubin, Jesse Cross-Call, and Gideon Lukens, “Medicaid Expansion: Frequently Asked Questions,” CBPP, June 16, 2021, https://www.cbpp.org/research/health/medicaid-expansion-frequently-asked-questions.

[2] Noam N. Levey, “100 Million People in America Are Saddled With Health Care Debt,” Kaiser Health News, June 16, 2022, https://khn.org/news/article/diagnosis-debt-investigation-100-million-americans-hidden-medical-debt/.

[3] Katherine Baicker et al., “The Oregon Experiment — Effects of Medicaid on Clinical Outcomes,” New England Journal of Medicine, Vol. 368, May 2, 2013, https://www.nejm.org/doi/pdf/10.1056/NEJMsa1212321.

[4] See Heidi L. Allen et al., “Can Medicaid Expansion Prevent Housing Evictions?” Health Affairs, Vol. 38, No. 9, 2019, https://www.healthaffairs.org/doi/pdf/10.1377/hlthaff.2018.05071; Sarah Miller et al., “The ACA Medicaid Expansion in Michigan and Financial Health,” National Bureau of Economic Research Working Paper 25053, revised March 2020, http://www.nber.org/papers/w25053; Kenneth Brevoort, Daniel Grodzicki, and Martin B. Hackmann, “Medicaid and Financial Health,” National Bureau of Economic Research Working Paper 24002, November 2017, https://www.nber.org/papers/w24002.

[5] Manatt Health, “Assessing the Fiscal Impact of Medicaid Expansion Following the Enactment of the American Rescue Plan Act of 2021,” April 2021, https://www.manatt.com/Manatt/media/Documents/Articles/ARP-Medicaid-Expansion.pdf.

[6] Centers for Medicare & Medicaid Services, Monthly Medicaid & CHIP Application, Eligibility Determination, and Enrollment Reports & Data: December 2015 – December 2017, https://www.medicaid.gov/medicaid/national-medicaid-chip-program-information/medicaid-chip-enrollment-data/monthly-medicaid-chip-application-eligibility-determination-and-enrollment-reports-data/index.html.

[7] Guth, Garfield, and Rudowitz, op. cit.

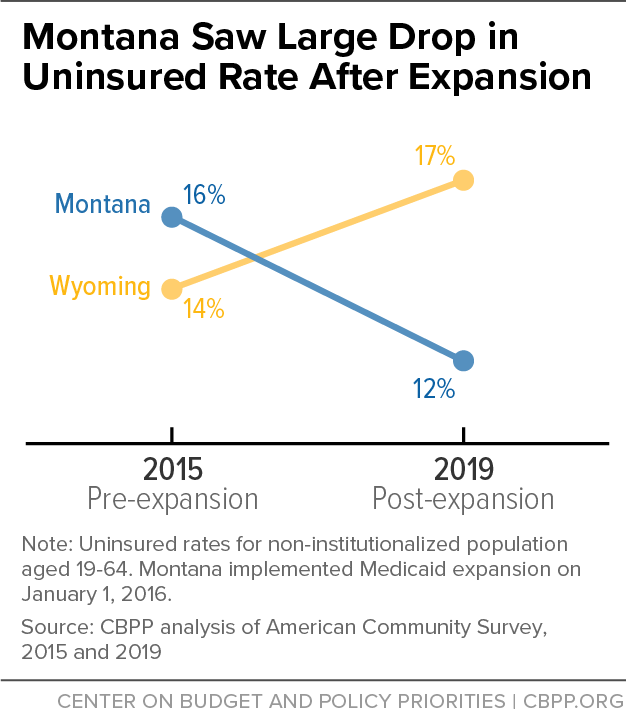

[8] This age group is the most impacted by Medicaid expansion because children who might otherwise be impacted are typically already eligible for the Children’s Health Insurance Program (CHIP), while elderly people are eligible for Medicare. Montana implemented expansion on January 1, 2016.

[9] Matthew Buettgens and Urmi Ramchandani, “3.7 Million People Would Gain Health Coverage in 2023 If the Remaining 12 States Were to Expand Medicaid Eligibility,” July 2022, https://www.urban.org/research/publication/3-7-million-people-would-gain-health-coverage-2023-if-remaining-12-states-were.

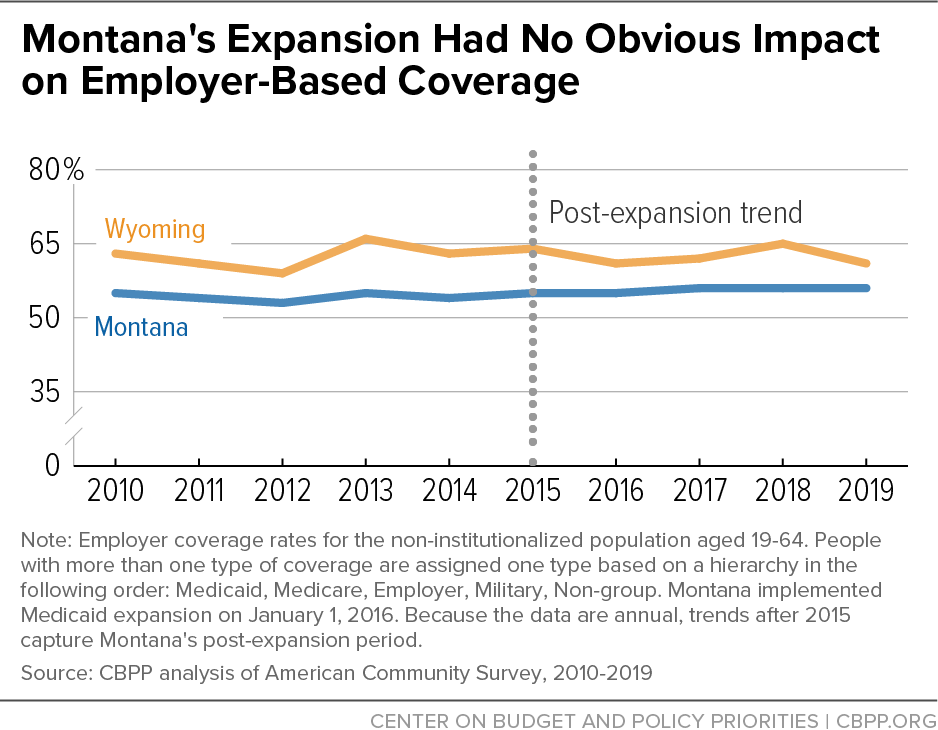

[10] Molly Frean, Jonathan Gruber, and Benjamin Sommers, “Premium subsidies, the mandate, and Medicaid expansion: Coverage effects of the Affordable Care Act,” Journal of Health Economics, Vol. 53, May 2017, https://www.sciencedirect.com/science/article/abs/pii/S0167629616302272. Michael Dworsky and Christine Eibner, “The Effect of the 2014 Medicaid Expansion on Insurance Coverage for Newly Eligible Childless Adults,” Rand Corporation, 2016, https://www.rand.org/pubs/research_reports/RR1736.html.

[11] Kaiser Family Foundation, Federal Medical Assistance Percentage (FMAP) for Medicaid and Multiplier, https://www.kff.org/medicaid/state-indicator/federal-matching-rate-and-multiplier. Federal match rates cited here are for 2023. The federal match is calculated by a formula such that the match is higher for states with relatively lower per-capita income. The minimum federal match is set to 50 percent, and Wyoming receives this minimum because it has high per-capita income relative to most other states. As part of pandemic relief legislation, all states receive a temporary 6.2 percentage point increase in their federal match rate, which brings the median state’s match rate up to 66.2 percent and Wyoming’s match rate up to 56.2 percent. This increase is temporary and will expire when the public health emergency ends.

[12] Bryce Ward, “The Impact of Medicaid Expansion on States’ Budgets,” Commonwealth Fund, May 5, 2020, https://www.commonwealthfund.org/publications/issue-briefs/2020/may/impact-medicaid-expansion-states-budgets. Buettgens and Ramchandani, op. cit. For a cross-state comparison study, see Benjamin Sommers and Jonathan Gruber, “Federal Funding Insulated State Budgets from Increased Spending Related to Medicaid Expansion,” Health Affairs, Vol. 36, No. 5, May 2017, https://www.healthaffairs.org/doi/10.1377/hlthaff.2016.1666.

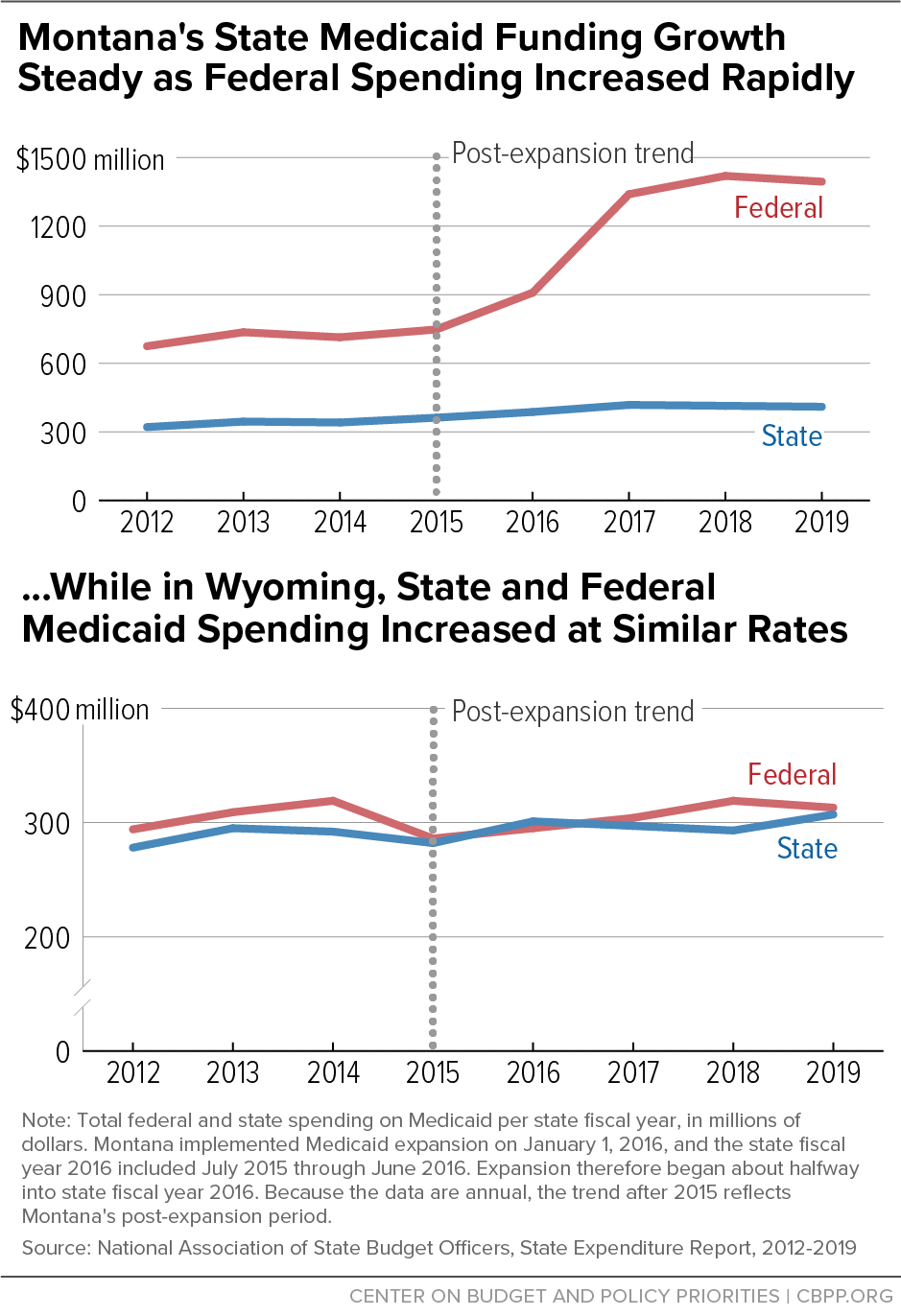

[13] Calculations in this paragraph and the accompanying figure reflect nominal dollars, that is, they are not adjusted for inflation.

[14] Under the ACA, the federal match rate for the expansion group was 100 percent until 2017, when it fell to 95 percent and gradually phased down to 90 percent for 2020 and thereafter. Despite the declining federal match ― and rising state share ― for the expansion group that began in 2017, Montana’s state Medicaid spending grew at a lower average annual rate from 2016-2019 than during any other three-year period since at least 2010.

[15] Ward, op. cit. Estimates vary depending on the methodology used as well as the characteristics of the Medicaid program and federal match rates in the state that is being studied.

[16] Stan Dorn et al., “The Effects of the Medicaid Expansion on State Budgets: An Early Look in Select States,” Kaiser Family Foundation, March 2015, https://www.kff.org/report-section/the-effects-of-the-medicaid-expansion-on-state-budgets-an-early-look-in-select-states-issue-brief/.

[17] Bryce Ward, “Economic Effects of Medicaid Expansion in Montana,” ABMJ Consulting, January 2021, https://mthcf.org/wp-content/uploads/ABMJ-Medicaid-Report_2.2.21-FINAL-1.pdf. Manatt Health, “Medicaid in Montana: How Medicaid Affects Montana’s State Budget, Economy, and Health,” February 2021, https://mthcf.org/resource/medicaid-in-montana-how-medicaid-affects-montanas-state-budget-economy-and-health/. Cost savings and revenue calculations assume Montana pays 10 percent of expansion costs as required currently and in future years. Pre-pandemic estimates and data are used to avoid the impact of the COVID-19 pandemic and temporary policy changes that altered enrollment and expenditures patterns.

[18] Manatt Health, February 2021, op. cit.

[19] Ward, 2021, op cit. This method of estimation, known as difference-in-differences, was also used by Sommers and Gruber (2017), cited above, in their cross-state study of the fiscal impacts of Medicaid expansion.

[20] One study found that Medicaid expansion led to fewer people enrolling in the Supplemental Security Income (SSI) program. SSI participation typically qualifies non-elderly adults for Medicaid but imposes income and asset limits; when states expand, low-income childless adults can qualify for Medicaid without SSI, giving them the freedom to increase their earning and assets beyond the SSI limits without losing Medicaid coverage. As a result, some people who otherwise would choose to qualify for Medicaid based on SSI instead opt for enrollment in the expansion group. See Aparna Soni et al., “Medicaid Expansion and State Trends in Supplemental Security Income Program Participation,” Health Affairs, February 2018, https://www.healthaffairs.org/doi/10.1377/hlthaff.2016.1632.

[21] Whether states use these savings to reduce expenditures in these programs or instead to reach more people in need may depend on the programs and state policy decisions.

[22] Dorn et al., op. cit. Medicaid does not cover care for services provided in prisons or jails, but it can cover inpatient care outside of the prison or jail, for example, when an incarcerated person requires inpatient hospitalization.

[23] Ward, 2020, op. cit.

[24] Manatt Health, February 2021, op. cit. Ward, 2021, op. cit.

[25] Kathleen Gifford et al., “State Medicaid Programs Respond to Meet COVID-19 Challenges: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2020 and 2021,” Kaiser Family Foundation, October 2020, https://www.kff.org/medicaid/report/state-medicaid-programs-respond-to-meet-covid-19-challenges/.

[26] Kaiser Family Foundation Annual Medicaid Budget surveys, States With a Hospital Provider Tax in Place, https://www.kff.org/medicaid/state-indicator/states-with-a-hospital-provider-tax-in-place/, and States With a Nursing Facility Provider Tax in Place, https://www.kff.org/medicaid/state-indicator/states-with-a-nursing-facility-provider-tax-in-place/.

[27] Ward, 2020, op. cit.

[28] Ward, 2021, op. cit. This estimate uses fiscal year 2020 data to capture the increase in Montana’s hospital utilization fee in 2019, in part to help finance expansion.

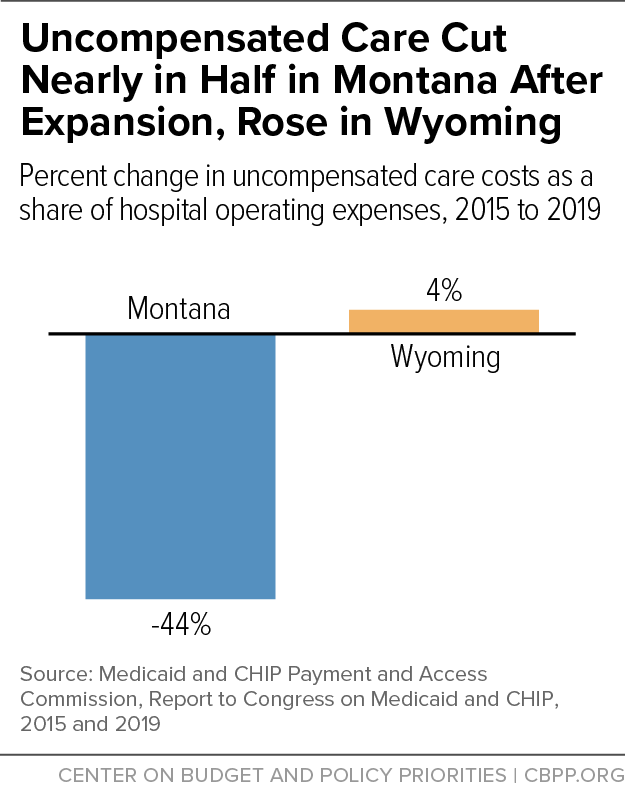

[29] Gideon Lukens, “Medicaid Expansion Cuts Hospitals’ Uncompensated Care Costs,” CBPP, April 20, 2021, https://www.cbpp.org/blog/medicaid-expansion-cuts-hospitals-uncompensated-care-costs.

[30] Medicaid and CHIP Payment and Access Commission, “March 2018 Report to Congress on Medicaid and CHIP,” March 2018, https://www.macpac.gov/publication/march-2018-report-to-congress-on-medicaid-and-chip/.

[31] Buettgens and Ramchandani, op. cit.

[32] Guth, Garfield, and Rudowitz, op. cit.

[33] See Wyoming Medical Society’s position statement at https://www.wyomed.org/wyoming-medicaid/, and “Medicaid expansion revived despite flood of misinformation,” Oil City News, May 15, 2021, https://oilcity.news/wyoming/legislature/2021/05/15/medicaid-expansion-revived-despite-flood-of-misinformation/.

[34] Montana Hospital Association President and CEO Rich Rasmussen’s Weekly Update, April 22, 2022, https://mtha.org/mha-president-ceo-rich-rasmussens-weekly-update-04-22-22/.

[35] Medicaid and CHIP Payment and Access Commission, “March 2022 Report to Congress on Medicaid and CHIP,” March 2022, https://www.macpac.gov/publication/march-2018-report-to-congress-on-medicaid-and-chip/. Medicaid and CHIP Payment and Access Commission, “March 2018 Report to Congress on Medicaid and CHIP,” March 2018, https://www.macpac.gov/publication/march-2018-report-to-congress-on-medicaid-and-chip/.

[36] Robin Rudowitz, Bradley Corallo, and Rachel Garfield, “New Incentive for States to Adopt the ACA Medicaid Expansion: Implications for State Spending,” February 2021, https://www.kff.org/medicaid/issue-brief/new-incentive-for-states-to-adopt-the-aca-medicaid-expansion-implications-for-state-spending/. Manatt Health, April 2021, op. cit.

[37] These calculations do not constitute an estimate of the fiscal impact of Medicaid expansion on Wyoming, but rather are a way to consolidate the estimates for Montana and understand what they would mean for Wyoming if its fiscal impacts were similar.