As House Republicans develop their forthcoming budget resolution, they are discussing radically restructuring Medicaid. One of the changes under consideration is changing Medicaid financing to a per capita cap.[1] This highly technical approach is designed to cut federal funding and would come at the expense of millions of people who access health care through Medicaid, jeopardizing coverage and shifting costs to states and health care providers. Congress should soundly reject such a plan, as it has done in the past.

Per capita cap proposals establish a limit on how much the federal government will spend on Medicaid on a per-person basis and create savings for the federal government by setting that cap to fall short of costs over time. Below, using illustrative examples, we describe how various populations in different states could be impacted differently under only a few years of a cap. The long-term impact would be even deeper than we describe here. Moreover, a per capita cap provides a ready mechanism for future Congresses to make cuts to federal Medicaid funding.

Today, the federal government picks up a fixed percentage of states’ Medicaid costs, which gives them the certainty they need to run their programs because the amount they receive is pegged to their actual spending.[2] In contrast, under a per capita cap, states would receive a fixed amount of federal funding on a per-enrollee basis.

A per capita cap would achieve federal savings by reducing the amount of federal Medicaid funding states would otherwise receive; it would set spending limits at levels well below what the current financing system would provide. That typically would be accomplished by basing a state’s initial per capita cap amount on its current or historical spending and then increasing it annually at a considerably slower rate — such as general inflation — than the currently projected annual growth in federal Medicaid spending. While in any particular year general inflation could be higher than health care inflation, over time general inflation averages well below growth in per capita health care spending.

Because the per capita cap growth rate would be set lower than expected Medicaid spending growth, over time average per capita costs would exceed the capped amount and the state would have to pay the full amount of those additional costs. In the face of rising state costs, states would be forced to raise taxes to finance those higher costs, make cuts to other parts of their budgets, or make cuts to Medicaid that could leave more people uninsured or without access to services they need.

If costs rise by more than anticipated, due to, for example, higher-than-expected spending on a new drug or new therapies, then the amount by which federal funding would fall short of states’ needs would be greater, exacerbating state funding shortfalls and the need for cuts.

To stay within the caps, states could cut coverage of eligibility groups that they are not required to cover under Medicaid, such as some people with disabilities and adults over age 65 who states cover but are not required to; reduce optional benefits such as home- and community-based services; lower payments to health care providers; or all of these things. Lowering provider payments can restrict access to care, particularly because Medicaid provider payments are already well below Medicare payments and private insurance payments for the same services. Because people of color disproportionately use Medicaid for their health coverage, a per capita cap and resulting cuts would be certain to deepen health inequities.

A per-enrollee cap tied to the consumer price index (CPI-U) beginning in October 2025 would cut federal funding by $879 billion over fiscal years 2026 through 2032, the Congressional Budget Office estimates. Even a cap tied to the CPI-U plus 1 percentage point would cut federal funding by $545 billion over fiscal years 2026-2032.[3]

Even an inflation factor like the medical consumer price index (CPI-M), which typically exceeds a general inflation measure such as the CPI-U, would likely underestimate the growth rate of Medicaid spending in most states. The CPI-M is meant to capture consumer prices for medical services, but Medicaid per-enrollee spending reflects both prices and per-enrollee utilization, and health care utilization has generally increased over time.

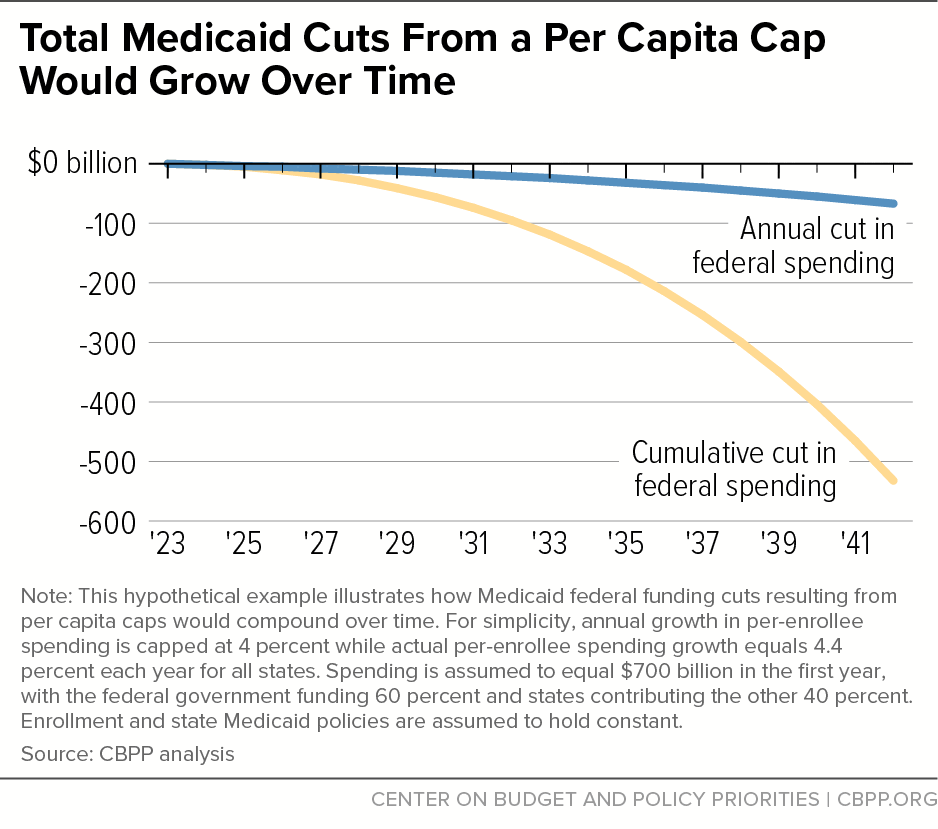

The federal cuts from a Medicaid per capita cap would be heavily backloaded, meaning cuts in the tenth year would be much larger than cuts in the second, and cuts 15 years out would be larger still. Even a proposal that produced modest federal cuts in the initial years would produce large and growing cuts in later years due to the compounding effects of growth rates.

Figure 1 illustrates a hypothetical example in which annual growth in per-enrollee spending is capped at 4 percent while actual per-enrollee spending growth equals 4.4 percent each year across all states.[4] As annual cuts to federal funding grow each year, the cumulative cut to federal funding grows increasingly rapidly. In this example, while federal funding is cut $95 billion during the first ten years, it is cut more than four times as much — an additional $438 billion — during the second decade.

States Stand to Lose Under Any Per Capita Cap Design

Federal law gives states significant flexibility to design and run their Medicaid programs, though with some minimum federal requirements that all states must meet. As a result of this flexibility, states cover different populations, offer different benefit packages, and use distinct delivery systems. This variation means that funding caps will affect states in different ways, depending on how the policy is designed.[5]

In addition, factors beyond states’ control — such as health conditions, provider practice patterns, and adoption of new medical technologies and drugs — can impact cost growth in unpredictable ways. For example, a small subset of patients with expensive conditions are typically responsible for the bulk of the costs within each eligibility group, and fluctuations in the share of these high-cost patients could have outsized impacts on cost growth.[6]

The unpredictable and variable nature of health care cost growth means that federal spending cuts would vary dramatically across states (and across years) and, if caps were applied individually across eligibility categories as opposed to being aggregated into an overall cap, different states would experience deeper cuts to some eligibility categories than to others.

The following examples illustrate how different states could be impacted differently by a per capita cap; while the growth rates of the caps and eligibility group delineations are similar to previous per capita cap proposals, the examples do not estimate the effects of a particular proposal.

Past proposals have sometimes applied separate per capita caps to enrollees with disabilities, adults aged 65 or older, children, adults eligible through the Affordable Care Act (ACA) Medicaid expansion, and other adults not eligible through ACA expansions. If the federal government’s per-enrollee Medicaid spending for each of these five eligibility categories had been capped at the growth rate of the CPI-M beginning in 2018,[7] in 2020 most states would have had to either make cuts or spend more to fill in federal funding gaps.[8]

- For enrollees with disabilities, 37 states would have exceeded the cap.

- Idaho’s per capita spending would have exceeded the cap by 8 percent.

- Kentucky’s per capita spending would have exceeded the cap by 13 percent.

- Pennsylvania’s per capita spending would have exceeded the cap by 12 percent.

- For adults aged 65 or older, 21 states would have exceeded the cap.

- California’s per capita spending would have exceeded the cap by 17 percent.

- Colorado’s per capita spending would have exceeded the cap by 9 percent.

- West Virginia’s per capita spending would have exceeded the cap by 12 percent.

- For children, 28 states would have exceeded the cap.

- Idaho’s per capita spending would have exceeded the cap by 16 percent.

- Ohio’s per capita spending would have exceeded the cap by 8 percent.

- For expansion adults, 23 states would have exceeded the cap.

- Arizona’s per capita spending would have exceeded the cap by 9 percent.

- Maine’s per capita spending would have exceeded the cap by 7 percent.

- For non-expansion adults, 33 states would have exceeded the cap.

- Georgia’s per capita spending would have exceeded the cap by 15 percent.

- Michigan’s per capita spending would have exceeded the cap by 13 percent.[9]

We highlight here how states would have fared if a per capita cap had been in place starting in 2018; for any new proposal that starts in a future year, both the level of cuts and which states might see larger cuts likely would change. The point of the examples above is to help illustrate how large the cuts could be and that the magnitude of the cuts would likely differ by state.

State variation and large cuts would also occur if Congress designed a per capita cap formula with different growth rates for different populations. For example, if in 2018 Congress had enacted a per capita cap of CPI-M for parents and children and a growth rate of CPI-M + 1 (i.e., 1 percentage point higher than the CPI-M) for adults aged 65 or older and people with disabilities, similar variation would have occurred in 2020:

- For enrollees with disabilities, 36 states would have exceeded the cap.

- Idaho’s per capita spending would have exceeded the cap by 6 percent.

- Kentucky’s per capita spending would have exceeded the cap by 11 percent.

- Pennsylvania’s per capita spending would have exceeded the cap by 9 percent.

- For adults aged 65 or older, 20 states would have exceeded the cap.

- California’s per capita spending would have exceeded the cap by 15 percent.

- Colorado’s per capita spending would have exceeded the cap by 7 percent.

- West Virginia’s per capita spending would have exceeded the cap by 10 percent.

A per capita cap presents a one-sided arrangement under which states can only lose.[10] States would experience cuts in federal funding in years when spending per enrollee exceeded the cap, but states would not be able to make up for these cuts by getting extra federal funding in years when spending per enrollee fell below the cap. Even if a state’s per-enrollee spending equaled its cap on average over several years, it would lose federal funding when spending exceeded the cap in some years.

A policy that creates incentives for states to cut optional benefits, eligibility, and provider rates will weaken Medicaid, especially if it eliminates important federal protections. As the federal Medicaid cuts grew larger each year, states would be forced to decide where to make increasingly draconian cuts.

They might cut off children in families with incomes above mandatory eligibility group levels (including children with disabilities), pregnant women with incomes over statutory minimums, or parents above a certain income level in non-expansion states. States could also limit the number of people who qualify for Medicaid long-term care services.[11] In 2018, all but one state had elected to provide Medicaid to at least one optional eligibility category based on old age or disability;[12] a per capita cap could dramatically alter this landscape.

Following the Supreme Court’s decision in National Federation of Independent Business (NFIB) v. Sebelius, the ACA Medicaid expansion is also optional; while 40 states (including the District of Columbia) have adopted the expansion, a per capita cap could lead some states to reconsider.

States could also cut important benefits that many states provide even though they are not required to do so, such as vision, dental, and home- and community-based services. Or states could cut reimbursement rates, which would diminish access to care if more providers refuse to accept Medicaid patients or shift costs to those providers who continue to be willing to care for them.

Most likely, states would make cuts in all three areas: eligibility, benefits, and payment rates. These cuts would put the tens of millions of older adults, people with disabilities, children, and families who use Medicaid coverage in serious jeopardy of becoming uninsured or losing access to the care they need.

To take just one example, although only 11 percent of Medicaid enrollees are eligible based on a disability,[13]they account for 34 percent of Medicaid spending,[14] making their care or even their eligibility a potential target for budget cuts. This is particularly likely because states are not required to provide many of the home- and community-based services that people with disabilities often use, like personal care services or adult day care. Similarly, per capita spending on adults over age 65 could outpace projections and fall short by more than anticipated as the population of people over the age of 80 becomes a larger portion of older adults overall; this would create pressure to cut spending on this group or on other parts of a state’s program to make up the difference.

And in stark contrast to the current, responsive Medicaid financing structure, a per capita cap would result in larger funding shortfalls during a downturn, when demand for Medicaid tends to increase. Under a per capita cap structure, states would get additional funding as the number of enrollees increased during a downturn, but insufficient per-enrollee funding caps would mean that when more people enroll, the funding shortfall the state would have to make up would grow.

Restructuring Medicaid’s financing would make the program highly vulnerable to future cuts as it provides a formula that could be easily ratcheted down further — by setting the cap or its growth rate lower — to provide even deeper savings when Congress seeks federal budget cuts. Policymakers should reject this path and retain the current federal-state financial partnership.