The debt ceiling agreement, which includes almost all of the Supplemental Nutrition Assistance Program (SNAP) changes from the House-passed debt-ceiling-and-cuts bill, would put almost 750,000 older adults aged 50-54 at risk of losing food assistance through an expansion of the existing, failed SNAP work-reporting requirement.[1] The expansion of this requirement would take food assistance away from large numbers of people, including many who have serious barriers to employment as well as others who are working or should be exempt but are caught up in red tape.

The agreement also includes some improvements to both existing SNAP policy and the SNAP provisions in the House-passed version: veterans, people experiencing homelessness, and former foster youth would be exempted from the work-reporting requirement if states properly identify that they meet these criteria.

Strong research evidence on SNAP’s existing work-reporting requirement shows that it does not increase employment or earnings but does cause many people to lose food assistance. Those who would be newly at risk of losing food assistance have very low incomes, typically well below the poverty line, and would be pushed even deeper into poverty if they lose SNAP. The new exemptions are positive, but improvements for some do not justify expanding a failed policy to others.

It is uncertain how many people the new exemptions would help because the data for assessing the impact are imperfect and the impact of both policy changes would depend on federal and state implementation decisions.

In its analysis of the debt limit agreement, the Congressional Budget Office (CBO) estimates that modestly more people would be protected by the new exemptions, including those subject to the work-reporting requirement under current law, than those who would lose assistance from the expansion of the time limit, though as noted above, these estimates are uncertain. That so many people experiencing homelessness, veterans, and former foster youth ― many of whom should be exempt under current law because of their significant health conditions and other circumstances ― would be newly protected by these exemptions is evidence that the current exemption system is badly broken.

It is important to note that the overwhelming majority of people aged 50-54 who would be newly subject to the requirement are not veterans or people experiencing homelessness.

The agreement would also restrict states’ discretion to mitigate the impact of the work-reporting requirement by reducing the cap on individual hardship exemptions and limiting carryover of unused exemptions. Under current law, each state receives individual hardship exemptions they can use at their discretion to exempt individuals from the work-reporting requirement based on a percentage of the number of people in their state who are subject to SNAP’s work-reporting requirement. Currently, unused exemptions can accrue over time.

SNAP’s existing work-reporting requirement has proven to be a failure. Under current law, most adults aged 18-49 without children in their homes can only receive benefits for three months in a three-year period unless they can document that they are working or participating in a job training program for 20 hours per week or can prove they qualify for an exemption, such as having a work-limiting disability.

Numerous studies have shown that this requirement does not improve employment or earnings, but it does take away SNAP’s food assistance from a substantial share of people who are subject to it. For example, a recent study found that the work-reporting requirement cut SNAP participation among those subject to it by more than half (53 percent).[2] Those subject to the requirement often have very low incomes, and the loss of SNAP benefits significantly harms their ability to meet their basic needs.

This requirement is also based on the false premise that low-income people receiving benefits do not work and must be compelled to do so, an assumption rooted in unfounded stereotypes based on race, gender, disability status, and class. Most working-age, non-disabled adults who participate in SNAP are already working for pay or are temporarily between jobs. Among the 18- to 49-year-olds without disability income or children in their homes who are subject to SNAP’s existing work-reporting requirement, 51 percent worked in a given month while receiving SNAP and 74 percent worked within a year of that month.[3] But the complexity of this bureaucratic work-reporting requirement means that significant numbers of people ― including many who are meeting the requirement and those who should be exempt from it ― end up losing their benefits.

While the law provides that the work-reporting requirement applies only to people who are “fit for work,” this has not borne out in practice. There is evidence that, under the existing policy, many of those whose SNAP benefits are taken away should have been exempt but were not properly screened for work-limiting health conditions or other exemptions.[4]

The agreement would expand SNAP’s existing harsh work-reporting requirement to apply to older adults aged 50-54 over time. Starting 90 days after enactment, 50-year-olds would be newly subject to this work-reporting requirement.[5] Beginning October 1, 2023, almost immediately after the first change would take effect, the work-reporting requirement would expand further to also apply to 51- and 52-year-olds; it would then expand to apply to 53- and 54-year-olds beginning October 1, 2024. Once fully phased in, this requirement would remain in place until October 1, 2030.

We estimate that almost 750,000 older adults aged 50-54 would be newly subject to SNAP’s work-reporting requirement and at risk of losing benefits under this bill. Nearly half (48 percent) of those who would be newly at risk of losing SNAP are women. See Table 1 for state-level estimates of the number of older adults who would be at risk of losing benefits in each state based on data from 2019.

Not everyone who would be at risk of losing benefits under this bill would lose access to SNAP. Some would consistently work 20 hours per week and successfully document and report that work effort each month. Others would be determined to be exempt from the work-reporting requirement, either because they would be successfully screened for an existing exemption, such as having a disability, or they would be determined to be eligible for one of the new exemptions discussed below. Still others would live in an area where the state has secured a waiver of the work-reporting requirement due to a lack of sufficient jobs.

But a significant number of people would lose benefits because of this change. CBO previously estimated 275,000 people would be cut from SNAP on average each month under the House-passed bill, under which 55-year-olds also would have been subject to the requirement.[6] CBO’s new estimate of the final agreement did not provide the estimate of the number of 50-54-year-olds who would be cut from SNAP, but, absent the new exemptions for individuals experiencing homelessness and veterans, it’s likely about 225,000 people given the age distribution among SNAP participants.[7] A small share of these individuals are likely to be eligible for the new exemptions included in the bill.

Some of the people who would lose SNAP would be working but could struggle to consistently meet the 20-hour requirement or to provide documentation of their hours. It will likely be challenging for participants to understand whether they are subject to the requirement or not, particularly as the rules change as the age expansion phases in over time. Others would lose benefits if they should have been exempt from the requirement but were not correctly screened, or if they have a work-limiting health condition that the state does not view as serious enough for an exemption.

The older adults who lose access to SNAP would lose about $8 per person per day in benefits. These individuals often have very low incomes, and the loss of SNAP will push most of those affected into or deeper into poverty.

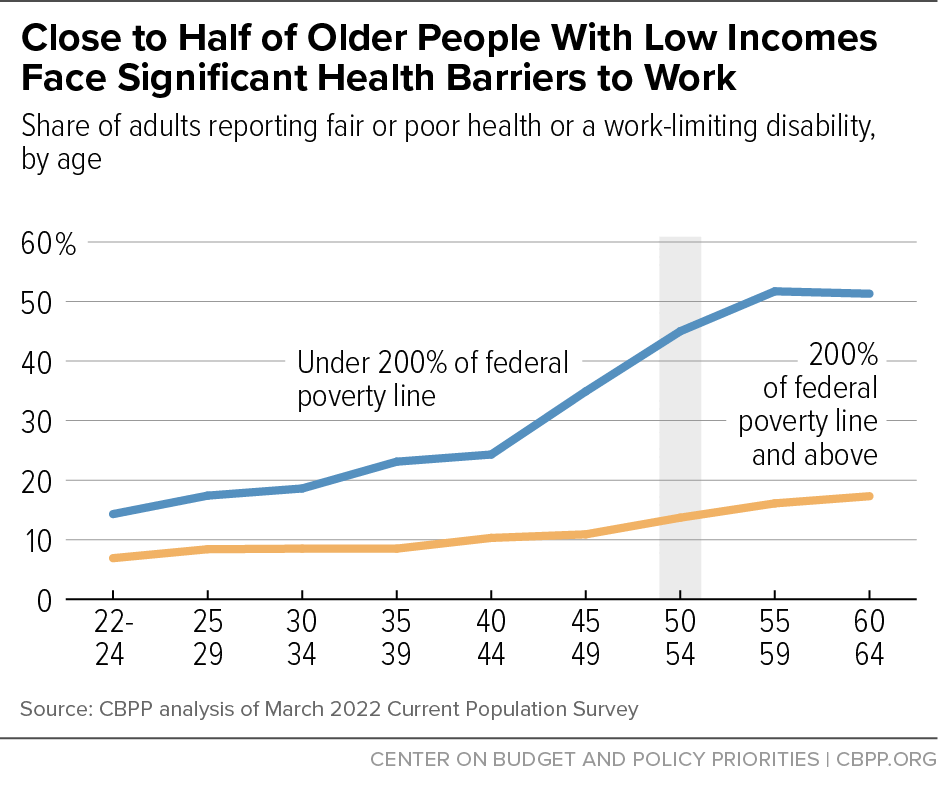

The older adults who would be newly subject to this work-reporting requirement may be particularly vulnerable to losing benefits due to age-related employment challenges. Older adults are more likely to face age-related discrimination in the labor market, to no longer be able to perform the types of jobs they did when they were younger, or to have health conditions that may limit their ability to work, the types of jobs they can do, or their ability to consistently work enough hours. The prevalence of health conditions rapidly increases for low-income adults starting in their 40s, and nearly half of low-income adults aged 50-54 report a health barrier to work. (See Figure 1.) The share of older adults with incomes below twice the poverty line who have health conditions is three times higher than the share of those with incomes above this level.

Receipt of disability benefits is one of the most common reasons that someone is exempt from the work-reporting requirement, but high denial rates and long wait times have made those benefits increasingly difficult to access. SNAP has been an important lifeline for low-income older adults with significant health barriers to employment who have struggled to access disability benefits or who may be waiting for an eligibility determination, but these adults may soon lose access to SNAP as well, if they are not determined to be otherwise exempt from the expanded work-reporting requirement.[8]

While the agreement would expand SNAP’s work-reporting requirement to apply to older adults, it also creates new exemptions from the requirement that would reduce the number of people aged 18-54 who are subject to it. The agreement creates three new exemptions for people experiencing homelessness, veterans, and individuals under age 25 who were previously in foster care.[9] These exemptions would be temporary and would expire on October 1, 2030, as would the expanded work-reporting requirements.

Because SNAP’s work-reporting requirement does not improve employment outcomes but does remove substantial numbers of people from SNAP, these new exemptions could be a meaningful step toward mitigating the harm of this requirement for people in these groups. The universe of people who may qualify for one of these new exemptions, particularly the exemption for people experiencing homelessness, is potentially significant.

CBO has estimated that once the provisions in the agreement are fully phased in, 78,000 more people would gain SNAP as a result of the new exemptions than would lose eligibility due to the expansion of the work-reporting requirement to older adults, though the data available to CBO to make this estimate are imperfect. The Department of Agriculture (USDA) would need to ensure that states implement the exemptions to maximize their effectiveness and minimize the burdens on individuals and state agencies to collect documentation.

It appears that many states already collect information about whether SNAP applicants are experiencing homelessness because SNAP’s shelter deduction includes a special allowance for individuals who are homeless but incur some expenses for shelter. This may make it relatively easy for many states to implement the new exemption for individuals experiencing homelessness. However, there is substantial variation across the states in the share of households identified as experiencing homelessness. These differences no doubt reflect differences in the prevalence of homelessness across the states, but they may also reflect differences in how states are screening applicants.

For example, some states’ SNAP applications ask for the applicant’s address and shelter costs, while others ask more detailed questions about the applicant’s living situation, such as whether they are living in an emergency shelter, motel, or with family or friends due to economic hardship. It is less clear the extent to which states collect information regarding an individual’s status as a veteran or former foster youth, as these factors do not currently directly impact the SNAP eligibility determination or benefit calculation.

While the new exemptions for veterans and former foster youth would be relatively straightforward once established for any given individual, it may be challenging for states to track whether and for how long someone meets the definition of a “homeless individual,” as very low-income people often have unstable housing situations that may change frequently. Depending on how it is implemented, this exemption could also create perverse no-win situations for people struggling with housing insecurity, who may find more stable housing only to lose their SNAP benefits once they no longer qualify for this exemption.

Many of the people who would be covered by the new exemptions may qualify for an exemption under existing rules. For example, many individuals experiencing homelessness have work-limiting disabilities but have not been determined eligible for a disability benefit, and any veteran who receives disability compensation from the Department of Veterans Affairs, regardless of their disability rating, should be exempt under existing policy.[10] Moreover, states have discretionary individual exemptions that they can use for people facing significant hardship — states should have been using those exemptions for at least some people experiencing homelessness but it isn’t clear how many have been doing so.

The need to create exemptions for certain vulnerable populations from SNAP’s work-reporting requirement highlights the underlying harm of this requirement overall and the failings of the exemption process — the very process most 50–54-year-olds who are in poor health and newly subject to the work-reporting requirement would have to rely upon. Rather than putting the onus on participants and state agencies to navigate a bureaucratic process to determine whether and how long an individual meets the specific criteria to qualify for an exemption, policymakers should end this ineffective and punitive policy entirely.

The agreement also modifies existing options that states can use to temporarily exempt specific individuals.

Under current law, each state receives individual hardship exemptions based on a percentage of the number of people in their state who are subject to SNAP’s work-reporting requirement; states can accrue and carry over unused exemptions indefinitely. Each exemption can be used at the state’s discretion to convey one additional month of eligibility for SNAP benefits for an individual subject to the requirement. States have previously used these exemptions to extend eligibility for certain vulnerable populations, such as survivors of domestic violence; to extend eligibility for those with barriers to employment or who are working fewer than 20 hours per week; and to simplify administration of the work-reporting requirement.

Before fiscal year 2020, states received individual hardship exemptions equal to 15 percent of the number of individuals subject to the work-reporting requirement. Beginning in fiscal year 2020, this percentage was lowered to 12 percent due to a statutory change in the Agriculture Improvement Act of 2018. The debt ceiling agreement would further lower the number of exemptions states receive to 8 percent (a change that was not included in the House-passed bill) and would limit carryover of unused exemptions to the subsequent fiscal year. These changes would further limit states’ discretion to extend eligibility for individuals based on their specific circumstances.

The bill also includes a new requirement on USDA regarding the waivers that states may seek from the work-reporting requirement in areas with high unemployment or a lack of sufficient jobs. Thirty days after enactment, USDA would be required to make public all available state waiver requests and approvals, including supporting data from the state. This provision also was not included in the House-passed bill.

The agreement would also amend the statutory purpose of SNAP to include assisting “low-income adults in obtaining employment and increasing their earnings.” This modification ignores that a significant portion of adults who participate in SNAP are not expected to work because they are disabled or not working-age, and that most SNAP participants who are able to work for pay already do so. While this change would not have an immediate programmatic impact, it could be used in the future to press for further harmful work-reporting requirements. Further conditioning access to basic food assistance on employment runs contrary to SNAP’s long-standing, core purpose as an anti-hunger program that allows low-income households to obtain a more nutritious diet and strengthens the United States’ agricultural economy.

| TABLE 1 |

|---|

|

|

| State | Total number of SNAP participants aged 50-54 at risk of losing SNAP |

|---|

| Alabama | 13,000 |

| Alaska | 2,000 |

| Arizona | 14,000 |

| Arkansas | 6,000 |

| California | 118,000 |

| Colorado | 9,000 |

| Connecticut | 9,000 |

| Delaware | 3,000 |

| District of Columbia | 4,000 |

| Florida | 44,000 |

| Georgia | 19,000 |

| Guam | 1,000 |

| Hawai’i | 4,000 |

| Idaho | 2,000 |

| Illinois | 47,000 |

| Indiana | 9,000 |

| Iowa | 6,000 |

| Kansas | 3,000 |

| Kentucky | 13,000 |

| Louisiana | 13,000 |

| Maine | 2,000 |

| Maryland | 15,000 |

| Massachusetts | 13,000 |

| Michigan | 28,000 |

| Minnesota | 4,000 |

| Mississippi | 7,000 |

| Missouri | 11,000 |

| Montana | 2,000 |

| Nebraska | 2,000 |

| Nevada | 8,000 |

| New Hampshire | 1,000 |

| New Jersey | 8,000 |

| New Mexico | 13,000 |

| New York | 45,000 |

| North Carolina | 21,000 |

| North Dakota | 1,000 |

| Ohio | 28,000 |

| Oklahoma | 10,000 |

| Oregon | 19,000 |

| Pennsylvania | 30,000 |

| Rhode Island | 2,000 |

| South Carolina | 8,000 |

| South Dakota | 1,000 |

| Tennessee | 19,000 |

| Texas | 44,000 |

| Utah | 2,000 |

| Vermont | 1,000 |

| Virgin Islands | 500 |

| Virginia | 19,000 |

| Washington | 16,000 |

| West Virginia | 7,000 |

| Wisconsin | 12,000 |

| Wyoming | 500 |

| U.S. Total | Almost 750,000 |