The tax law enacted in December 2017 weakens federal revenues at a time when the nation needs to raise more revenue. Federal spending will necessarily increase as a share of gross domestic product (GDP) in coming years due to several factors, particularly the retirement of more baby boomers, health care cost growth, and rising interest rates. These factors will drive up spending for Medicare, Social Security, interest on the federal debt, and some other programs. The budgetary savings that can be achieved through slowing the growth of health care costs, eliminating duplicative, outdated, or ineffective programs, and reducing errors and overpayments will not come close to offsetting the upward pressures on spending.

Complicating the picture, the federal debt is already high by historical standards. The response by some policymakers has been to call for cutting various social programs deeply while proposing another round of costly tax cuts. To avoid damaging program cuts that likely would increase poverty, hardship, and inequality, restoring the federal revenue base should be a primary goal of fiscal policy in the next few years, not digging the revenue hole even deeper.

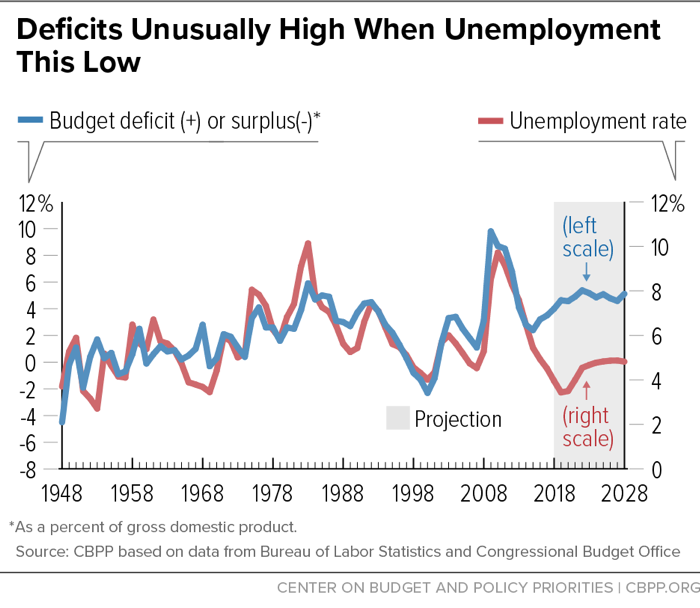

The federal budget deficit is unusually high for this point in the business cycle. Since World War II, in years when unemployment has been below 5 percent, the average deficit-to-GDP ratio has been close to zero. This year, in contrast, although the jobless rate is less than 4 percent, the deficit will exceed 4 percent of GDP. Over the coming decade the deficit will average nearly 5 percent of GDP, the Congressional Budget Office (CBO) projects. (See Figure 1.) These deficits will increase the federal debt from 78 percent of GDP this year to 96 percent of GDP by 2028, according to CBO’s baseline budget projections.[1]

This fiscal picture is cause for concern. When the economy is operating at or near its potential, as it is now, policymakers should generally aim to keep the debt from growing faster than the economy or possibly to reduce it gradually. Stabilizing the debt would require holding deficits to no more than about 3 percent of GDP. Deficits that lead to a perpetually rising debt-to-GDP ratio are ultimately unsustainable. Deficits may be problematic well before that, however, because they reduce national saving (total saving by households, businesses, and governments) and domestic investment, depressing future national income. The amount of the reduction in investment depends on the extent of any resulting increases in private saving (stemming from higher incomes or interest rates) and net inflows of foreign capital. CBO finds that increases in private saving only partly make up for the decline in national saving due to the budget deficits. Domestic investment does not fall by as much as national saving, due to inflows of investment funds from abroad, but most of the future income generated by these foreign capital inflows goes to foreign investors rather than to future U.S. national income.[2]

Generally, the debt-to-GDP ratio should rise during periods of economic slack or major emergencies and then decline during good times. When the economy slows, federal tax revenues automatically decline or grow more slowly, and spending on unemployment insurance, the Supplemental Nutrition Assistance Program (SNAP, formerly food stamps), and other social programs automatically increases, keeping the downturn from becoming longer and deeper, but causing deficits to rise. When the economy recovers, revenues rise, and spending on transfer programs slows.

In addition to reducing growth in national income, rising debt levels during a period of economic growth use up “fiscal space” — the leeway to employ discretionary fiscal policy to fight another recession if the automatic stabilizers prove inadequate. To be sure, researchers have not found any particular threshold above which debt dramatically slows economic growth.[3] Nonetheless, there is a political dimension: high levels of debt may make policymakers overly cautious in providing needed fiscal stimulus to combat an economic downturn.[4] This is particularly problematic at times when interest rates are relatively low and there is limited room for countercyclical monetary policy.

The 2017 tax law has contributed to the challenging budget outlook by eroding the nation’s revenue base, which was already inadequate. It will add $1.9 trillion to the debt over the next ten years, CBO estimates, and it will add even more if lawmakers make its temporary tax cuts permanent. Making the individual tax provisions permanent would cost $631 billion from 2019 through 2028 and over $250 billion annually by the end of the period, amounting to more than 0.8 percent of GDP.[5]

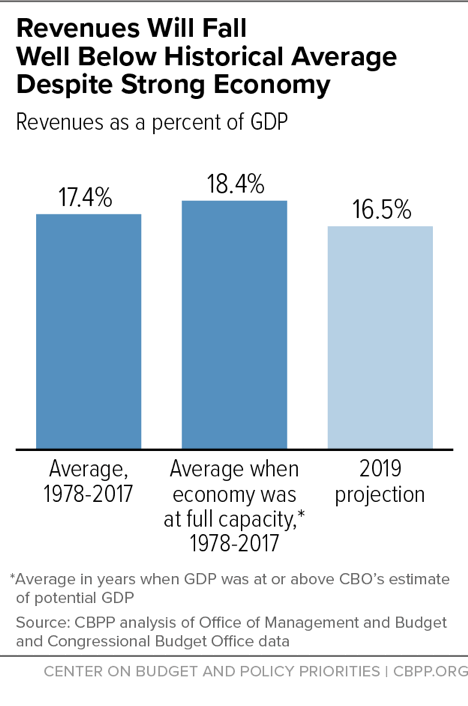

Federal revenues will total just 16.5 percent of GDP in 2019, CBO projects, well below the 17.4 percent average over the last 40 years. Further, that historical average includes years when the economy was weak and revenues were depressed. In 2019, CBO assumes the economy will be operating at its full potential (that is, at the maximum level of GDP that’s sustainable in the long term). Looking only at years over the past four decades when GDP was at or above potential, revenues averaged 18.4 percent of GDP. CBO’s projection for 2019 is 10 percent below that level. (See Figure 2.)

Simply returning to past revenue levels, however, will not be sufficient. An aging population will significantly raise government retirement and health costs, making clear the need for revenues in the coming years to rise well above the historical average. Over the next two decades, the share of the population age 65 or older will grow from 15 to 21 percent, and the share of the population over age 85 — who have much higher health care costs than other elderly individuals — will grow even faster. That will increase spending on Social Security, Medicare, and Medicaid, as discussed further below.[6]

Compounding the effect of these demographic realities, both public- and private-sector health care costs have long grown faster than the economy and will likely continue doing so, partly due to new procedures, drugs, and treatments that improve health and save lives but add to costs. The pace of health care cost growth has slowed over the past decade, though the extent to which the slowdown will persist is unknown.

In addition, Congress will face considerable pressure to relax the statutory caps on defense and non-defense discretionary spending, which have borne the brunt of deficit reduction since 2010. Discretionary funding is limited by the 2011 Budget Control Act (BCA) caps, as further reduced starting in 2013 by sequestration, which was triggered by Congress’ failure to enact the additional deficit reduction that the BCA called for. Policymakers provided partial relief from sequestration from 2014-2017. In 2018, Congress passed a two-year budget deal permitting higher discretionary funding for 2018 and 2019 than in the previous years, although still below the 2010 level adjusted for inflation. Unless Congress provides relief from sequestration again in 2020 and 2021, discretionary spending will fall to historically low levels.[7] Accordingly, Congress is likely to approve another deal in 2019 to ease these austere funding caps.

Finally, net interest payments are projected to nearly double as a percentage of GDP over the next ten years — from 1.6 percent to 3.1 percent in CBO’s baseline. Some two-thirds of this increase reflects CBO’s assumption that Treasury interest rates will rise to more normal levels as the Federal Reserve continues to tighten. The rest of the increase stems from a rising debt-to-GDP ratio, reflecting the significant mismatch between revenues and spending.

Faced with criticism that the 2017 tax law will swell budget deficits, some Republican lawmakers and advisers have renewed calls for cutting entitlement programs, including Medicare, Medicaid, and SNAP, while at the same time proposing additional tax cuts. Some savings from slowing health care cost growth, especially in areas like drug prices, may be achievable. But cutting programs that are critical for low- and modest-income American families, in combination with the tax cuts, would widen inequality, increase poverty, and likely raise the number of Americans who lack health insurance.[8]

Less than two months after signing the tax law, for example, President Trump submitted a 2019 budget that would cut deeply into programs that provide basic assistance for many Americans of modest means. The Trump budget would cut mandatory (or entitlement) programs by $1.3 trillion over the next decade (2019 through 2028), according to CBO, with very large cuts in programs like Medicaid and SNAP. The Trump budget would also cut spending on non-defense discretionary programs by $2.1 trillion[9] and take non-defense discretionary spending to its lowest level (as a percentage of GDP) since the Hoover Administration, greatly underfunding investments in such areas as infrastructure, education, research, and the environment.[10]

The House Republican budget plan for 2019, which the House Budget Committee adopted on a party-line vote in June, would cut mandatory programs even more deeply than the Trump budget — nearly $5 trillion over ten years. It calls for $2.1 trillion in cuts to health programs, including $1.5 trillion in cuts to Medicaid and Affordable Care Act (ACA) premium tax credits, and would raise Medicare’s eligibility age from 65 to 67, increase deductibles overall, and replace Medicare’s guarantee of health coverage with a flat premium-support payment (or voucher). It also includes $923 billion in cuts to income security programs, such as SNAP, Temporary Assistance for Needy Families, and Supplemental Security Income (SSI) for low-income aged, blind, and disabled individuals.[11]

Total spending for entitlement programs outside of Social Security and Medicare is projected to remain steady over the coming decade as a percent of GDP, with declines in some programs offsetting increases elsewhere. This spending category includes Medicaid and health care subsidies provided under the ACA, military and civil service retirement, veterans’ compensation, refundable tax credits such as the Earned Income Tax Credit and Child Tax Credit, and key safety net programs such as SNAP. The costs of the three largest means-tested income-support programs — the refundable tax credits, SNAP, and SSI — are each projected to edge down over the next decade as a percent of GDP.[12]

The projected growth in entitlement spending overall, which is substantial, is concentrated in Social Security and Medicare and results from the aging of the population and, to a lesser extent, rising costs in the U.S. health care system.[13] This growth is not due to changes in the generosity of benefits, which are relatively modest. The average Social Security retired worker benefit is about $1,417 a month, or $17,000 a year, and Social Security benefits will replace a smaller portion of pre-retirement earnings in the future as Social Security’s full retirement age increases to 67. In Medicare, benefits are less comprehensive than those offered by a typical employer-sponsored health plan: traditional Medicare doesn’t cover most hearing, dental, and vision care and places no limit on the total amount of out-of-pocket expenditures that a beneficiary can incur each year. Medicare beneficiary households spend more than $5,000 a year on out-of-pocket health care costs, on average, which represents 14 percent of their budgets — over twice the average for non-Medicare households.[14]

Most of the growth in Social Security and Medicare stems from the aging of the population as the baby boomers continue to retire. Combined spending for these two programs averaged 6.4 percent of GDP over the past 40 years and is projected to rise from 7.9 percent of GDP in 2018 to 10.0 percent in 2028. At the same time, the share of the population aged 65 and over rose from 10.8 percent in 1978 to an estimated 15.5 percent in 2018, and will reach 19.3 percent of the U.S. population in 2028 as more baby boomers retire. The aging of the population alone accounts for all of the projected increase in Social Security spending, two-thirds of the increase in Medicare, and about five-sixths of the combined increase in spending for the two programs as a percent of GDP between 2018 and 2028.[15]

Although nothing can be done to halt the aging of the population, major steps can and should be taken to further slow the growth of health care costs (including pharmaceutical costs) in the private and public sectors alike. Medicare has been a leader in reforming the health care payment system to improve efficiency; it has outperformed private health insurance in holding down the growth of health costs. Since 1987, Medicare spending per enrollee has grown by 5.4 percent a year, on average, compared with 6.8 percent for private health insurance.[16] The ACA envisions that Medicare will continue to lead the way in efforts to slow health care costs while improving the quality of care. Although reforms to the health care delivery system will take time to test and implement, additional savings can be achieved over the next ten years while preserving Medicare’s guarantee of health coverage and without raising the eligibility age or otherwise shifting costs to vulnerable beneficiaries with limited means. Even with further efficiencies and other steps, however, Medicare spending almost certainly will still grow faster than GDP, adding to pressures on the budget and the need for adequate federal revenues.

Foreseeable increases in spending stemming from demographic changes and rising health care costs, combined with an already elevated debt-to-GDP ratio, mean that sooner or later, policymakers will need to raise significant new revenues. The 2017 tax law moves in the opposite direction, weakening the tax system’s ability to deliver on its core responsibility of raising sufficient revenue to finance critical national needs and avoid spiraling debt and interest burdens.

While the 2017 tax law’s changes to individual income taxes are mostly set to expire after 2025, a number of policymakers have called for making many or all of those tax cuts permanent. Doing so would exacerbate the budgetary challenges described here. Lawmakers should instead, as a first step, seek well-designed tax reforms that both make the tax code more efficient and equitable and, at a minimum, reverse the tax law’s imprudent revenue losses and the pressure those losses are placing on deficits and debt.