Trump Budget Continues Multi-Year Assault on IRS Funding Despite Mnuchin’s Call for More Resources

End Notes

[1] C-SPAN, “Treasury Secretary Confirmation Hearing,” January 19, 2017, https://www.c-span.org/video/?421858-1/treasury-secretary-nominee-steven-mnuchin-testifies-confirmation-hearing.

[2] Office of Management and Budget, “America First: A Budget Blueprint to Make America Great Again,” March 16, 2017, https://www.whitehouse.gov/sites/whitehouse.gov/files/omb/budget/fy2018/2018_blueprint.pdf.

[3] These additional cuts are part of a $54 billion proposed reduction in overall funding for non-defense discretionary programs, which is already set to decline to record lows under current law. See David Reich and Chloe Cho, “Will Congress Ease the Continuing Pressure on Non-Defense Discretionary Programs or Worsen It?” Center on Budget and Policy Priorities, March 13, 2017, https://www.cbpp.org/research/federal-budget/will-congress-ease-the-continuing-pressure-on-non-defense-discretionary.

[4] Chuck Marr et al., “Will New Trump Tax Plan Include Pass-Through Tax Break for Wealthiest?,” Center on Budget and Policy Priorities, February 27, 2017, https://www.cbpp.org/research/federal-tax/will-new-trump-tax-plan-include-pass-through-tax-break-for-wealthiest.

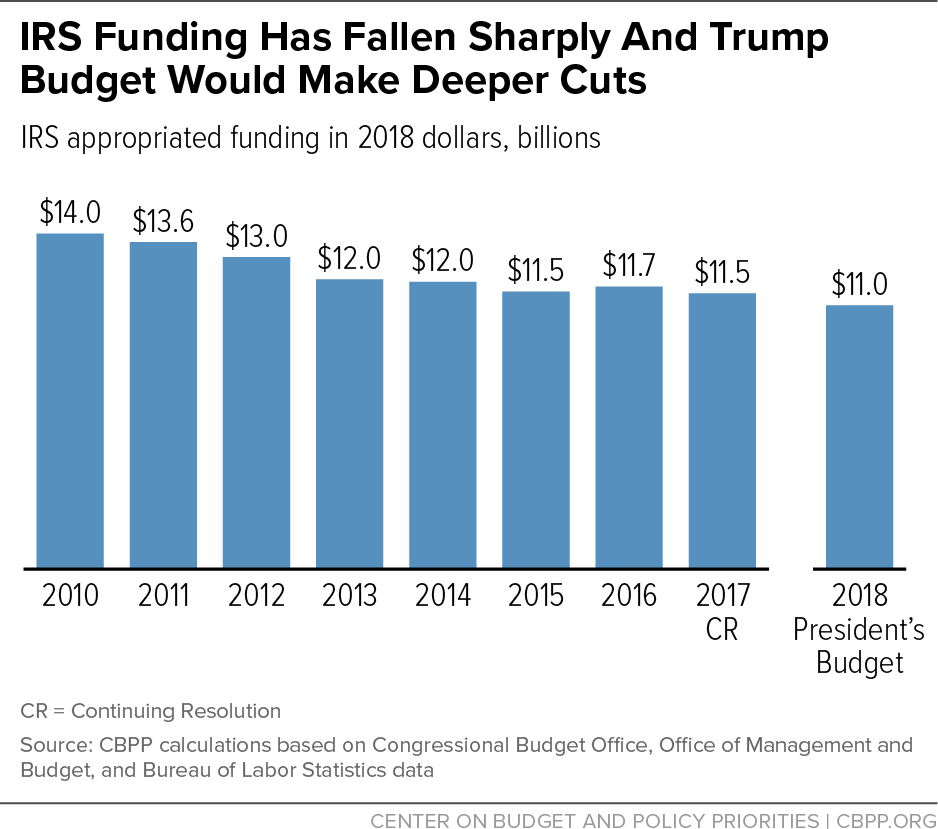

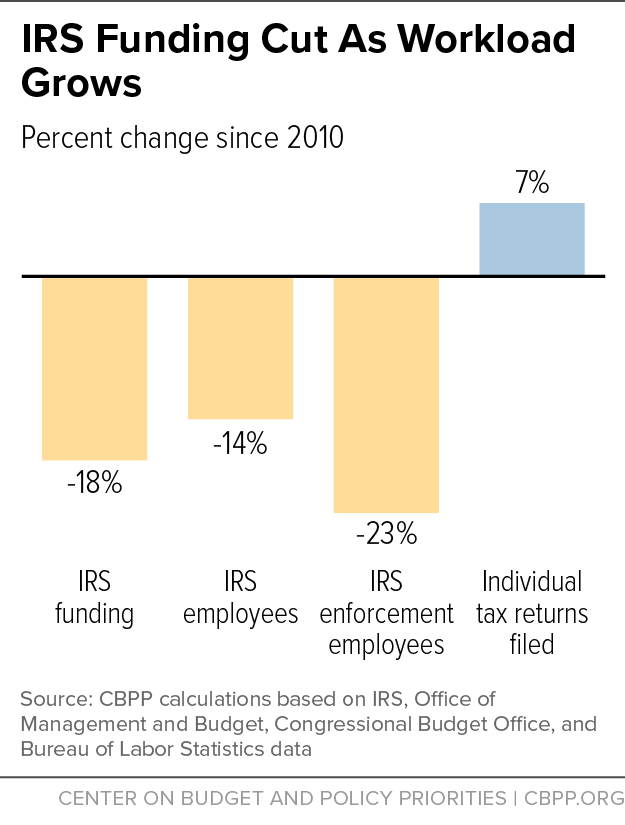

[5] In fiscal year 2016, IRS funding was $11.2 billion, 16 percent below its 2010 level after adjusting for inflation. The IRS is currently funded through April 28, 2017 with a continuing resolution that extends its 2016 funding level into 2017 with a small across-the-board cut. If that funding level were continued through the entirety of 2017, IRS funding would be 18 percent below its 2010 level after adjusting for inflation.

[6] Government Accountability Office, “Internal Revenue Service: Observations on IRS’s Operations, Planning, and Resources,” February 27, 2015, http://www.gao.gov/assets/670/668769.pdf, p. 35; Government Accountability Office, “Internal Revenue Service: Preliminary Observations on the Fiscal Year 2017 Budget Request and 2016 Filing Season Performance,” March 8, 2016, http://www.gao.gov/assets/680/675668.pdf, p. 9.

[7] Former IRS Commissioners Mortimer M. Caplan, Sheldon S. Cohen, Lawrence B. Gibbs, Fred T. Goldberg, Jr., Shirley D. Peterson, Margaret M. Richardson, and Charles O. Rossotti, “Letter to the Honorable Thad Cochran, the Honorable Barbara A. Mikulski, the Honorable Harold Rogers, and the Honorable Nita M. Lowey: IRS Appropriations for Fiscal Year 2016,” November 9, 2015, http://taxprof.typepad.com/files/former-irs-commissioners-letter-on-agency-budget.pdf.

[8] For further details on the impact of IRS funding cuts, see Chuck Marr and Cecile Murray, “IRS Funding Cuts Compromise Service and Weaken Enforcement,” Center on Budget and Policy Priorities, updated April 4, 2016, https://www.cbpp.org/research/federal-tax/irs-funding-cuts-compromise-taxpayer-service-and-weaken-enforcement.

[9] Government Accountability Office, “2015 Tax Filing Season: Deteriorating Taxpayer Service Underscores Need for a Comprehensive Strategy and Process Efficiencies,” December 16, 2015, https://www.gao.gov/products/GAO-16-151 and National Taxpayer Advocate, “Annual Report to Congress 2016: Executive Summary,” Internal Revenue Service, 2017, https://taxpayeradvocate.irs.gov/2016AnnualReport.

[10] John Koskinen, “Koskinen Discusses Challenges Facing IRS, Tax Industry,” Tax Notes, October 31, 2014.

[11] Internal Revenue Service, “2017 and Prior Year Filing Season Statistics,” https://www.irs.gov/uac/2017-and-prior-year-filing-season-statistics.

[12] John Koskinen, “Koskinen Discusses Challenges Facing IRS,” Tax Notes, July 12, 2016 and John Darlymple, “Written Testimony of John M. Darlymple, Deputy Commissioner for Services and Enforcement, Internal Revenue Service, Before the House Oversight and Government Reform Committee, Subcommittee on Government Operations and Subcommittee on Health Care, Benefits, and Administrative Rules, On IRS Taxpayer Service,” March 8, 2017, https://oversight.house.gov/wp-content/uploads/2017/03/Dalrymple_IRS_Testimony.pdf.

[13] National Taxpayer Advocate.

[14] Internal Revenue Service, “Budget-In-Brief FY 2017,” https://www.irs.gov/PUP/newsroom/IRS%20FY%202017%20BIB.pdf.

[15] Government Accountability Office, February 7, 2015; Government Accountability Office, March 8, 2016.

[16] C-SPAN.

[17] Tax Policy Center, “What is the Tax Gap?,” http://www.taxpolicycenter.org/briefing-book/what-tax-gap.

[18] “The Budget of the United States Government, Fiscal Year 2017,” Department of the Treasury, p. 1051, https://obamawhitehouse.archives.gov/sites/default/files/omb/budget/fy2017/assets/tre.pdf.

[19] John Koskinen, “Koskinen Discusses Challenges Facing IRS, Tax Industry,” Tax Notes, October 31, 2014.

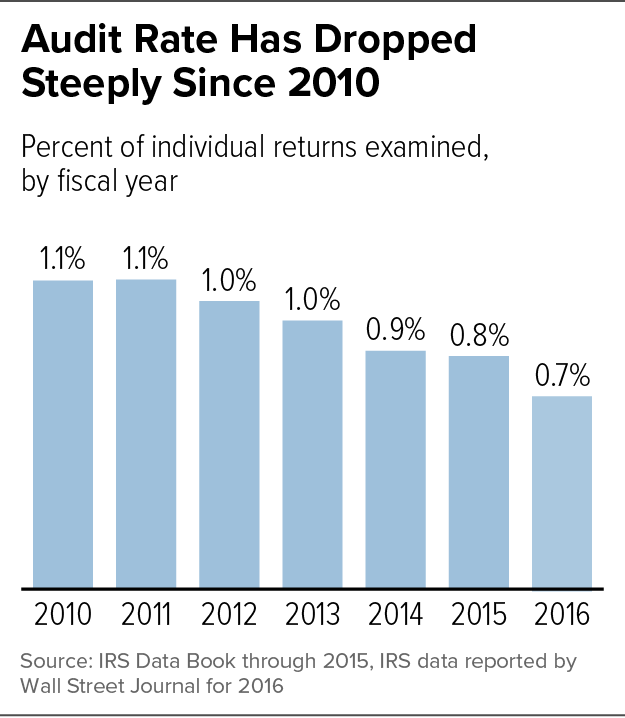

[20] Richard Rubin, “IRS Audits of Individuals Drop for Fifth Straight Year,” Wall Street Journal, February 22, 2017, https://www.wsj.com/articles/irs-audits-of-individuals-drop-for-5th-straight-year-1487794717 and Internal Revenue Service, “2010 Data Book,” https://www.irs.gov/pub/irs-soi/10databk.pdf.

[21] IRS defines high-income returns as those with total positive income (TPI) over $200,000. Among returns with TPI over $1 million that it audited in 2014, IRS identified over $2,000 in additional tax liability per audit hour. Among the highest-income returns audited — those with TPI over $5 million — IRS identified more than $4,500 in additional liability per audit hour. Treasury Inspector General for Tax Administration, “Improvements Are Needed in Resource Allocation and Management Controls for Audits of High-Income Taxpayers,” September 18, 2015, https://www.treasury.gov/tigta/auditreports/2015reports/201530078fr.pdf.

[22] Rubin.

[23] Luca Gattoni-Celli, “IRS CI Chief Hopes Mnuchin Will Help Fill Workforce Gaps,” Tax Notes, February 28, 2017.

[24] Internal Revenue Service, “Enforcement Statistics,” https://www.irs.gov/uac/enforcement-statistics-criminal-investigation-ci-enforcement-strategy.

[25] The House Republican plan would also restructure the IRS, but that part of the proposal is not included in this analysis.

[26] As TPC’s analysis of the Trump tax plan noted, “Establishing a top rate on pass-through business income that is 10 percentage points below the top rate on wages would create a very strong incentive for wage earners to become independent contractors, who would be taxed at the preferential pass-through business rates. Congress could impose strict rules in an attempt to limit such changes in worker status, but the boundary is quite difficult to enforce under current law and would be even harder to police if the Trump proposal were enacted.” James R. Nunns et al., “Analysis of Donald Trump’s Tax Plan,” Tax Policy Center, December 22, 2015, http://www.taxpolicycenter.org/publications/analysis-donald-trumps-tax-plan/full.

[27] Marr et al.

[28] Many countries have destination-based value-added tax systems that use a “credit-invoice” system, but the House GOP plan would implement the border adjustment by altering the corporate income/profits calculation in the corporate income tax, which is unprecedented.

[29] As TPC Director Mark Mazur stated, “when you do a tax change this large you have to be very, very concerned about unintended consequences and opening up different dimensions of behavior and tax planning that may not be an issue in the current system.” Jonathan Curry, “Conversations: Mark Mazur,” Tax Notes, February 9, 2017.

[30] Chye-Ching Huang and Chloe Cho, “Ten Facts You Should Know About the Federal Estate Tax,” Center on Budget and Policy Priorities, September 8, 2016, https://www.cbpp.org/research/federal-tax/ten-facts-you-should-know-about-the-federal-estate-tax.