- Home

- Federal Budget

- Failed Reopenings Highlight Urgent Need ...

Policy Brief: Failed Reopenings Highlight Urgent Need to Build on Federal Fiscal Support for Households and States

Federal policymakers face a major decision at the end of this month when the CARES Act’s significant boost in unemployment insurance (UI) benefits, which has provided a lifeline for millions of families, is scheduled to expire. To reduce hardship for families and pressures for states to reopen their economies prematurely, which would cost lives and likely delay an economic recovery, policymakers should provide robust assistance to individuals and state and local governments and continue it as long as it is needed.[1]

Confronted by a pandemic-induced economic free-fall early this spring, the President and Congress quickly enacted several pieces of relief legislation with provisions to shore up household incomes. Those measures generally worked well, preventing poverty from spiking even as millions of workers lost their jobs and keeping household consumption — and hence the economy — from sinking even further. Yet the downturn has inflicted severe, widespread hardship, as data on rising food insecurity, housing insecurity, and other hardships and the miles-long lines of cars outside food banks attest.

"COVID-19’s recent resurgence in states that reopened prematurely shows the economy will almost certainly remain weak for many months."The President has repeatedly signaled that his preferred path forward starts with aggressive reopenings of local economies. Senate Majority Leader Mitch McConnell, anticipating a strong economic rebound, said at the end of May that he preferred the next relief package be “narrowly crafted, designed to help us where we are a month from now, not where we were three months ago.”[2] Senator McConnell has now called for significantly limiting the package in size and scope. Yet this approach makes a fundamental error by assuming that the public health restrictions imposed in response to the pandemic are at the root of the downturn and that the economy will recover strongly once they are lifted.

To the contrary, COVID-19’s recent resurgence in states that reopened prematurely shows the economy will almost certainly remain weak for many months and that a full recovery cannot occur until the virus is under control and people feel safe resuming economic activity. These reopenings have failed as a strategy to bolster household and state finances, and this strategy cannot justify a federal retreat on robust fiscal help for families and states. Instead, policymakers should act now to build on the success of efforts to date to alleviate hardship and bolster the economy.

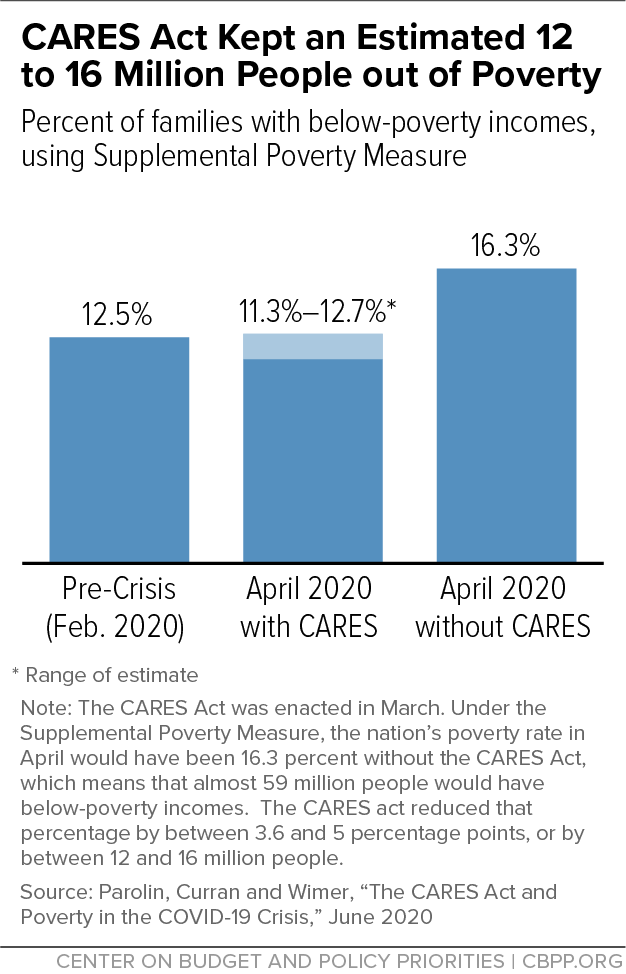

Legislation responding to the pandemic has softened the recession’s blow to low- and moderate-income households and the economy, research shows. UI benefit and eligibility expansions and one-time stimulus payments enabled low- and moderate-income families to maintain their spending, cushioning the blow to overall spending and the economy. Personal incomes were actually higher in April and May than in February, and poverty rates fell by about 2 percentage points over that period, although this partly reflected the one-time infusion from the stimulus payments. The assistance also prevented the income and poverty gaps between Black and Latino households and white households from growing. Overall, by getting resources to households that spent them, federal assistance prevented even deeper job losses and an even sharper decline in the economy. But the federal supplement to weekly unemployment benefits, which has played a large role in keeping things from getting worse, is slated to expire in just a few weeks.

Yet many households are suffering hardship, highlighting the shortcomings in measures enacted to date and the need to do more rather than to retrench prematurely. Real-time data on food insecurity and adverse mental health conditions from weekly Census Bureau surveys show tremendous unmet need. Roughly 1 in 5 renters are behind in their rent payments, potentially setting up a wave of evictions once various moratoriums on evictions end, and food insecurity has risen sharply. The CARES Act excluded important types of assistance that could have helped address food insecurity while also aiding the economy, such as an increase in the maximum SNAP (food stamp) benefit akin to that enacted during the Great Recession.

Efforts to reopen states before the virus is under control have proven dangerous and ineffective. Infections and hospitalizations have surged in various states that pushed ahead before meeting the basic federal criteria for reopening. Prematurely reopening also has failed in strictly economic terms, by assuming incorrectly that people would resume their normal spending patterns when their state reopened even if the pandemic remained uncontrolled. Research shows that economic activity collapsed earlier this year primarily because people curbed their activities to avoid getting sick or infecting others, not because of state stay-at-home restrictions, and lifting those restrictions reversed only a modest part of the pandemic-induced decline in economic activity. Premature reopening will not encourage enough activity to restore the economy, but apparently it does encourage enough activity to spread the virus. This means that pushing states to reopen their economies prematurely is no substitute for assisting individuals and cash-strapped state and local governments.

An inadequate federal response would hinder efforts to control the pandemic and hurt households and the economy. Despite some positive economic news, the path of the recession remains very uncertain, driven by a public health crisis that is not close to being under control. Mainstream forecasts suggest that without further fiscal stimulus, the economy will remain weak for an extended period. Indeed, allowing the CARES Act’s expansion of UI benefits to expire without a replacement would cost an estimated 2 million jobs over the next year, according to former Council of Economic Advisers (CEA) Chair Jason Furman.[3] Further, state budgets have yet to feel the recession’s full impact; states’ massive shortfalls will force deep cuts and layoffs to comply with states’ balanced-budget requirements.

Federal Reserve Chair Jerome Powell has emphasized that the costs of failing to enact further fiscal stimulus would be large and long-lasting: “If we let people be out of work for long periods of time, if we let businesses fail unnecessarily, waves of them, there’ll be longer-term damage to the economy.”[4] Failure to protect families and the economy would also widen the nation’s glaring racial inequities, as the pandemic’s health and economic impacts are disproportionately affecting people of color.

Strong fiscal stimulus thus is urgently needed. Federal policymakers should enact further, strong stimulus measures, including income supports for struggling individuals and families and robust fiscal relief for states, as well as stronger public health measures to contain the spread of the virus. The House took a strong step in this direction when it passed the Heroes Act in May.

As policymakers negotiate the next fiscal package, specific policies that merit adoption include:

- Extending the current UI eligibility expansions, providing a substantial federally funded benefit increase above pre-pandemic levels (without the CARES Act, benefits would have averaged only about $320 per week in May), and providing additional weeks of benefits to give unemployed workers more time to find a job while unemployment remains high.

- Helping those struggling the most by: boosting SNAP benefits for all participants by increasing the maximum benefit amount, which serves as the program’s benefit standard; increasing funding for rental assistance and homelessness services and prevention; providing emergency grants to states to provide targeted help to families falling through the cracks; and expanding (for tax year 2020) the Earned Income Tax Credit for workers without minor children at home and the Child Tax Credit for children in families with little or no income.

- Providing robust fiscal relief that meets rising needs for Medicaid and helps states and localities avert deep cuts in education, transportation, and services for struggling residents.

- Reversing the CARES Act provision that excluded many families from relief measures because they include one or more immigrant members who lack a Social Security number.

- Providing further resources for public health measures to arrest the relentless spread of the virus.

End Notes

[1] For the full version of this report, see https://www.cbpp.org/research/federal-budget/failed-reopenings-highlight-urgent-need-to-build-on-federal-fiscal-support.

[2] Jacob Pramuk, “Next coronavirus stimulus bill will be the ‘final’ one, Mitch McConnell says,” CNBC, May 29, 2020, https://www.cnbc.com/2020/05/29/coronavirus-stimulus-mitch-mcconnell-says-relief-bill-will-be-final-one.html.

[3] Jason Furman, “Prepared Testimony on ‘The Unemployment Pandemic: Addressing America’s Jobs Crisis,’” Before the Select Subcommittee on the Coronavirus Crisis, June 18, 2020, https://docs.house.gov/meetings/VC/VC00/20200618/110811/HHRG-116-VC00-Wstate-FurmanJ-20200618.pdf.

[4] CBS News, “Full Transcript: Fed Chair Jerome Powell's 60 Minutes interview on economic recovery from the coronavirus pandemic,” May 17, 2020, https://www.cbsnews.com/news/full-transcript-fed-chair-jerome-powell-60-minutes-interview-economic-recovery-from-coronavirus-pandemic/.

More from the Authors

Areas of Expertise