- Home

- Income Security

- To Strengthen Economic Security And Adva...

Policy Brief: To Strengthen Economic Security and Advance Equity, States Should Invest More TANF Dollars in Basic Assistance

States only spend a little over one-fifth of their combined federal and state Temporary Assistance for Needy Families (TANF) dollars on basic assistance for families with children, our analysis of the latest data from fiscal year 2021 shows. (See Table 1.) States continue to use their considerable flexibility under TANF to divert funds away from income support for families and toward other, often unrelated state budget areas. By redirecting the funds back toward cash assistance, however, states could do more to strengthen economic security and promote racial equity and child well-being.

Cash assistance to families struggling to make ends meet can improve children’s long-term outcomes while also providing parents with the cash they need to afford necessities such as rent, utilities, personal hygiene products, and school supplies. Over time, however, TANF has significantly declined in performing this core task. Fewer families in need have access to the program (in 2020, for every 100 families living in poverty, only 21 received TANF cash assistance, down from 68 families when TANF was created)[2]; benefits leave those who do have access far below the poverty line; and as this report explains, states are spending a shrinking portion of their TANF funds on basic assistance.

| TABLE 1 | ||

|---|---|---|

| Total TANF Spending by Category, Fiscal Year 2021 | ||

| Category | Amount Spent (rounded in billions) | Share of Total Spending |

| Basic Assistance | $6.9 | 22.6% |

| Work, Education, and Training Activities | $2.3 | 7.6% |

| Work Supports and Supportive Services | $0.7 | 2.4% |

| Child Care | $4.9 | 16.2% |

| Refundable Tax Credits | $2.6 | 8.5% |

| Pre-kindergarten/Head Start | $2.9 | 9.7% |

| Child Welfare | $2.7 | 9.0% |

| Program Management | $3.2 | 10.5% |

| Other | $4.1 | 13.5% |

| Total | $30.3 | 100% |

Note: TANF = Temporary Assistance for Needy Families.

Funds in “Other” go toward a range of areas such as non-recurrent, short-term benefits, which are used to help low-income families in crisis situations; transfers to the Social Services Block Grant; services for youth and children, including after-school programs; pregnancy prevention and two-parent family programs; and juvenile justice and emergency payments and services “authorized under prior law,” meaning they are not within the four TANF purposes but were in the state’s Aid to Families with Dependent Children (AFDC) Emergency Assistance plan when TANF replaced AFDC.

Source: CBPP analysis of Department of Health and Human Services 2021 TANF financial data

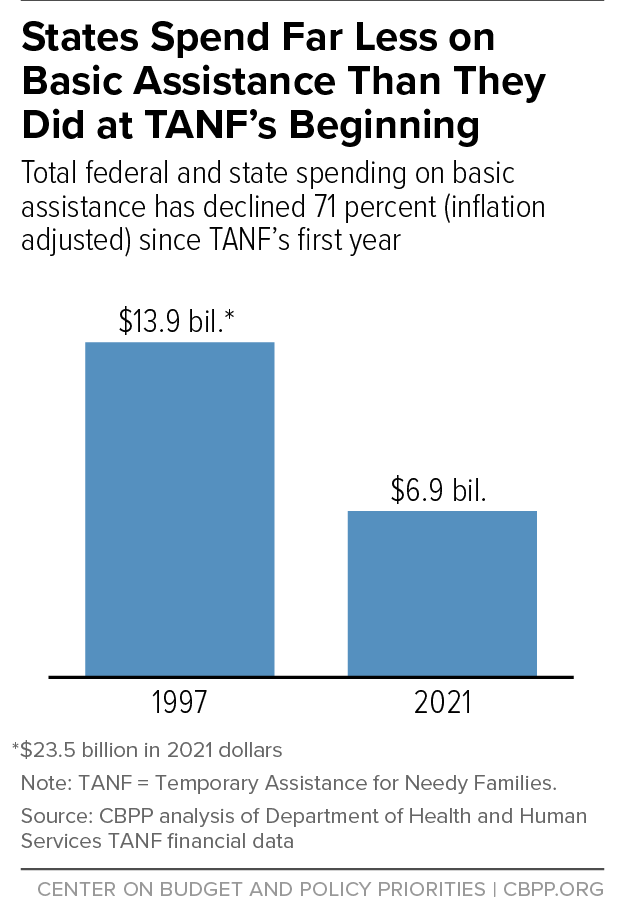

State Spending on Basic Assistance Has Plummeted Since TANF’s Creation

TANF provides a vital support to families with the lowest incomes in the form of cash assistance. Families with little or no cash income don’t have the funds they need to pay their bills or to buy essential items such as diapers, personal hygiene products, and household cleaning supplies. Cash assistance is crucial for stabilizing families who are facing crises, such as those fleeing domestic violence, and can promote racial equity and improve child well-being. However, cash assistance has weakened significantly under TANF, with potentially devastating long-term consequences for children growing up in families with little or no cash income to meet basic needs.

States only spend a little more than one-fifth of their federal and state TANF funds on basic cash assistance. When TANF began, basic assistance was the single biggest use of TANF funds in all states. In 2021, states spent just $6.9 billion, or 22.6 percent, of their total funds on basic assistance. This is down from $14 billion in 1997, which would be $23.5 billion in 2021 dollars. (See Figure 1.) This amounts to a 71 percent drop in basic assistance spending when adjusting for inflation.

The share of federal and state TANF funds spent on basic assistance varies across states, ranging from 4 percent to 75 percent in 2021. Fourteen states spent 10 percent or less on basic assistance, while 13 spent more than 30 percent.

Underinvestment in TANF cash assistance is worse where Black children are likelier to live. In 2020, 41 percent of Black children lived in states that spend 10 percent or less of TANF funds on basic assistance, compared to 34 percent for both Latinx and white children.[3] When controlling for other factors, states with higher concentrations of Black residents dedicate less of their TANF funds to cash assistance, a 2019 study found.[4] This is just one example of the long-standing racism in U.S. cash assistance policy that continues to result in racial disparities.[5]

A closer look at Texas, the state with the largest Black child population,[6]illustrates many of the issues with TANF spending. In 2021, Texas spent only 4 percent of its TANF funds on basic assistance, one of the smallest percentages of any state. In Texas, TANF now reaches just 4 out of every 100 families experiencing poverty, down from 47 in 1996. Today, benefits are just $312 a month for a family of three, or about 16 percent of the poverty line.[7]

How States Spend the Rest of Their TANF Funds

Instead of investing in helping families meet their basic needs, states use a large share of TANF funds in other areas. In 2021, state spending on work activities ranged from less than 1 percent to 34 percent of total TANF spending, with eight states spending less than 1 percent and 22 states spending between 1 and 10 percent. Similarly, states in 2020 spent just $727 million (2.4 percent) of their federal and state TANF funds on direct work supports, such as transportation, or on supportive services, such as mental health or domestic violence services. Eleven states spent less than 5 percent of their funds on work activities and supports combined.

In 2021, states spent 16 percent of their federal and state TANF funds on child care. The share varies tremendously across states, from 0 to 47 percent. Eleven states spent more than 30 percent of their TANF funds on child care, while 14 states spent less than 5 percent.

Refundable tax credits for working families with low incomes are another important support and a permissible use of federal and state TANF funds, although this approach typically keeps families with the lowest incomes from receiving assistance in this form. In 2021, 22 states and Washington, D.C. spent $2.6 billion of TANF funds on refundable tax credits, most commonly a state earned income tax credit (EITC) — amounting to 8.5 percent of federal and state TANF spending nationwide.

Additionally, TANF-funded work programs and supports are often poorly targeted and often serve families with incomes above the poverty line, instead of those with the most need. For instance, several states spend most of their work activity funds on college scholarship programs that are available to families with incomes up to 350 percent of the poverty line — not on programs to prepare TANF participants for or connect them to work opportunities.

The greatest funding areas in categories beyond those mentioned above are child welfare services and pre-kindergarten/Head Start. While these are worthy and important investments, states should use funding sources other than federal and state TANF funds for them — particularly when states spend so little on providing cash assistance and supporting work for the families with the lowest incomes.

In 2021, states spent $5.6 billion on the following:

- Child welfare. Forty-two states used $2.7 billion in federal and state TANF funds for child welfare services. This represents 9 percent of total national TANF spending. Twelve states spent more than 20 percent, and three states spent more than 50 percent of their TANF funds for child welfare services.

- Pre-K/Head Start. Twenty-seven states used $2.9 billion in federal and state TANF funds for pre-K/Head Start in 2021. This represents 9.7 percent of total national TANF spending and 12 percent of spending for those states. Seven states spent more than 20 percent of their TANF funds in this category.

The rest of TANF spending ($4.1 billion) goes to a range of areas such as non-recurrent short-term benefits, which are used to help low-income families in crisis situations (2 percent of total TANF spending); transfers to the Social Services Block Grant (4 percent); services for youth and children, including after-school programs (3 percent); pregnancy prevention and two-parent family programs (1 percent); and juvenile justice and emergency payments and services “authorized under prior law” (1 percent), meaning they are not within the four TANF purposes but were in the state’s Aid to Families with Dependent Children (AFDC) Emergency Assistance plan when TANF replaced AFDC.[8] The share of spending going to other areas varies greatly across states, ranging from less than 1 percent to 45 percent.

Many States Have Unspent Funds, Some Exceeding Their Annual Block Grant

States are not required to spend all their annual federal TANF block grant allocation each year. In 2021, 19 states spent less than 90 percent of their annual allocation of federal funds. States can carry over unspent funds for use in future years. As TANF caseloads have continued to shrink, many states have accumulated carry-over or “reserve” funds by not spending their full block grant allocation over multiple years. There is no limit under federal law on how much states can carry over or when states must spend these carry-over funds, and states can continue to use them in the same way as any TANF funds in future years.

In 2021, states had $8 billion in unspent TANF funds, equaling 49 percent of the total annual block grant allocation. Five states had no unspent TANF funds, while 16 states had unspent funds equal to or exceeding 100 percent of their annual block grant. The majority of these funds ($6 billion or 85 percent of the funds) are unobligated, meaning that the state has not committed to use them for any specific purpose.

| TABLE 2 | ||

|---|---|---|

| 16 States Have TANF Reserves That Equal or Exceed Their Annual Block Grant | ||

| State | Total Unspent Funds, 2021 (rounded in millions) | Total Unspent Funds as a Share of Block Grant, 2021 |

| Tennessee | $798 | 418% |

| Hawai’i | $405 | 411% |

| Oklahoma | $334 | 242% |

| Nebraska | $121 | 214% |

| Arkansas | $113 | 199% |

| Delaware | $45 | 139% |

| Wyoming | $25 | 138% |

| New Hampshire | $53 | 137% |

| Alabama | $113 | 122% |

| Maine | $92 | 118% |

| Mississippi | $98 | 113% |

| Pennsylvania | $797 | 111% |

| Montana | $42 | 110% |

| South Dakota | $23 | 110% |

| Utah | $77 | 102% |

| West Virginia | $110 | 100% |

Note: TANF = Temporary Assistance for Needy Families.

Source: CBPP analysis of Department of Health and Human Services TANF financial data

Changes Needed to Redirect TANF Funds to Families

Cash assistance to low-income families with children is a good investment. The National Academies of Science, Engineering, and Medicine’s 2019 report on reducing child poverty concluded that income support to families experiencing poverty can improve children’s health and academic achievement, which in turn can lead to better health and higher earnings in adulthood.[9] If states maintain their current TANF spending practices, millions of children experiencing poverty — disproportionately Black children — will continue to be left without critical cash assistance. But if they instead reinvest in basic assistance, they can provide opportunities for all children and their families to thrive.

Black children have less access to these positive outcomes because they disproportionately live in the states where TANF reaches the fewest families in poverty and where benefits are the lowest.[10] Consistent with the Black Women Best framework,[11] redesigning TANF to center the needs of Black women and families and to adequately help families struggling to afford necessities would better serve families of all races and ethnicities. Such a redesign would require significant changes to TANF spending.

While states have the flexibility to ensure families have enough to afford necessities, they have a long history of providing inadequate assistance — especially states with higher shares of Black residents. To ensure that no family falls below a certain income level, federal policymakers must:

- Direct states to spend a majority of existing federal TANF and state MOE dollars on basic assistance.

- Require states to target their TANF funds toward families with the lowest incomes. Under current law, states must generally spend funds on “needy families,” but there is no national definition of “needy” or income eligibility limit for TANF-funded programs. As a result, TANF funds often go to families with incomes well above the federal poverty line even though poverty and deep poverty remain widespread, especially in states where TANF benefits are low and reach few families.

- Reshape TANF’s allocation formula to promote equity. Congress should allocate TANF funds in proportion to each state’s share of the nation’s children in poverty. TANF’s original block grant allocation structure was based on state AFDC spending amounts; the states where Black children disproportionately live generally had lower AFDC benefits, so the TANF block grant formula locked in those lower TANF funding levels. The amount of federal TANF funds states received per poor child was unequal from the program’s outset and has grown only more unequal with time.[11] To address this problem, states with more families in need should receive more resources.

Appendix 1: Background on Methodology and Funds Available to States

Federal TANF Funding

Each state receives a fixed annual amount of federal TANF funding, technically known as the State Family Assistance Grant but generally referred to as the TANF block grant. The total amount of federal block grant funds available to all states each year is $16.5 billion. The TANF block grant allocations for each state are set in accordance with the 1996 law that created TANF, based on the amount of federal funding that the state had received in AFDC and related programs before 1996. Each state’s annual block grant allocation has generally remained unchanged since TANF’s creation (see Appendix 3) and thus has declined in value by 47 percent due to inflation. (In 2021, each state’s allocation was reduced by 0.33 percent as a set-aside for research funding.) Because states can carry over unspent TANF funds to use in future years, the amount of federal TANF funds that a state spends in a given year may vary.

In 19 states, the annual block grant is further reduced by a certain amount as a set-aside for Tribal TANF programs. The set-aside for Tribal TANF programs varies by state. In 2021, set-asides for Tribal TANF programs ranged from just under $70,000 in Nevada to $87 million in California. (See Appendix 3.) In total, $208 million in federal TANF funding was set aside for Tribal TANF programs in 2021 — about 1 percent of total federal funding. In Appendix 3, “Block Grant Received” refers to how much federal funding states received after the research funding and Tribal TANF (in states with such programs) set-asides as well as any fiscal penalties were subtracted out.

A state can transfer up to 30 percent of its block grant funds per year to the Child Care and Development Fund and up to 10 percent to the Social Services Block Grant (SSBG), as long as the total amount transferred doesn’t exceed 30 percent. Transferred funds are subject to the rules of the program to which they are transferred, not to TANF rules. Funds transferred to SSBG must be spent on programs and services for children or families with incomes below 200 percent of the poverty line.

In addition to the basic block grant, some states can receive additional TANF federal funds from the TANF Contingency Fund. A state can access the TANF Contingency Fund if it meets a monthly economic hardship (or “needy state”) trigger and spends more MOE funds than is otherwise required. (See below for more on MOE.) Congress created this $2 billion fund when it created TANF to provide additional help to states in hard economic times. States made little use of it until the Great Recession, but they began to draw on it in 2008, and nearly half of the states have done so since then. Since the original $2 billion provided was depleted early in fiscal year 2010, Congress has added limited funds ($608 million) for each year; qualifying states have received less than half of the amount for which they qualified each year since 2010.

State Maintenance of Effort Funding

Each year, states are required to meet a MOE obligation under the TANF block grant or face a fiscal penalty. (The statute refers to this spending as “qualified state expenditures,” but the common usage is “state MOE.”) Each state’s MOE amount is based on its historical spending, defined as its 1994 financial contribution to AFDC and related work programs. To meet its MOE obligation, a state must report spending at least 80 percent of this historical spending level; this minimum share falls to 75 percent for any year in which a state meets its TANF work participation rate requirement.

The fact that the MOE requirement is only 75 percent or 80 percent of a state’s historical spending, rather than 100 percent, allowed states to withdraw part of the funds they had spent on AFDC and related programs. Moreover, a state’s MOE requirement is based on its 1994 expenditure level, with no adjustment for inflation over the years since then.

Since the Deficit Reduction Act of 2005 made it harder for states to meet their TANF work participation rate requirements — threatening states with the loss of some federal TANF funds due to penalties — a number of states have found it advantageous to claim as MOE certain existing expenditures they hadn’t previously claimed. States with MOE spending exceeding their minimum MOE requirement can obtain a “caseload reduction credit” that lowers their work participation rate requirement. Claiming excess MOE also helps a state qualify for additional federal money from the TANF Contingency Fund.

Thus, since 2006, total MOE spending across states has risen above the minimum required levels. In 2021, 32 states reported spending over 80 percent MOE, with 21 of these reporting spending of more than 100 percent. This increase does not necessarily represent an increase either in underlying state spending or in benefits or services for families with low incomes. Some of the reported MOE may represent existing state spending or existing third-party spending that the state hadn’t previously counted as MOE. In analyzing a state’s TANF and MOE expenditures, it is important to understand the extent to which there may be part of an “excess MOE” strategy in effect. Also, when a state has a particularly high MOE, percentages of total spending in various categories can be skewed.

Expenditures that qualify as MOE include state and local government spending or third-party spending that benefits members of “needy families” and meets one of TANF’s four purposes. Examples of qualifying third-party expenditures include spending by food banks or domestic violence shelters on TANF-eligible families. Third-party MOE also can include in-kind contributions, such as volunteer hours or employer-provided supervision and training for people in subsidized jobs. While a number of states have reported third-party MOE in order to boost MOE to obtain caseload reduction credits or a portion of the TANF Contingency Fund, not all third-party spending is excess MOE spending; some states claim third-party expenditures toward their minimum MOE obligations. The financial data that states report to HHS do not identify what reported spending arises from third-party MOE.

MOE expenditures must occur during the year for which the state claims them; states cannot carry them over to a future year. MOE expenditures can come from any area of the state budget and are not limited to spending by the TANF agency. MOE spending, however, must be an actual expenditure, not simply forgone revenue; thus, a state can count the refundable portion of a state EITC as MOE but not the portion that simply reduces the amount of income tax owed to the state.

Methodology

Throughout the analysis, percentages are used to describe portions of total TANF funding spent in a particular year. Because federal funding can be carried over into future years and due to variation in state MOE from year to year, percentages across years use different denominators and may not always be comparable.

Appendix 2: CBPP Groupings of Federal TANF Reporting Categories

| CBPP Category | Federal Reporting Categories |

| Basic Assistance | Basic Assistance (excluding Relative Foster Care Maintenance Payments and Adoption/Guardianship Subsidies) Relative Foster Care Maintenance Payments and Adoption/Guardianship Subsidies |

| Work, Education, and Training Activities | Subsidized Employment Education and Training Additional Work Activities |

| Work Supports and Supportive Services | Work Supports Supportive Services |

| Child Care | Child Care – Assistance and Non-Assistance Transferred to Child Care and Development Fund |

| Program Management | Administrative Costs Assessment/Service Provision Systems |

| Refundable Tax Credits | Refundable Earned Income Tax Credit (EITC) Non-EITC Refundable State Tax Credits |

| Child Welfare | Family Support/Family Preservation/Reunification Adoption Services Additional Child Welfare Services Authorized Under Prior Law (AUPL): Child Welfare or Foster Care (Assistance and Non-Assistance) |

| Pre-K/Head Start | Pre-kindergarten/Head Start |

| Other Areas | Non-Recurrent Short-Term Benefits Transferred to Social Services Block Grant Services for Children and Youth Home Visiting Programs Financial Education and Asset Development Prevention of “Out-of-Wedlock” Pregnancies Fatherhood and 2-Parent Family Formation & Maintenance Programs AUPL: Juvenile Justice Payments (Assistance and Non-Assistance) AUPL: Emergency Assistance (Assistance and Non-Assistance)Other |

Appendix 3: Federal TANF Funds Allocated to Each State in 2021 (millions)

| State | Block Grant Allocation | Block Grant Received* | Contingency Fund | Tribal TANF |

|---|---|---|---|---|

| Alabama | $93.3 | $93.0 | $11.1 | |

| Alaska | $63.6 | $44.4 | $19.0 | |

| Arizona | $222.4 | $199.4 | $23.8 | $22.3 |

| Arkansas | $56.7 | $56.5 | $6.7 | |

| California | $3,733.8 | $3,634.3 | $87.2 | |

| Colorado | $136.1 | $135.6 | $16.2 | |

| Connecticut | $266.8 | $265.9 | ||

| Delaware | $32.3 | $32.2 | $3.8 | |

| District of Columbia | $92.6 | $92.3 | $10.9 | |

| Florida | $562.3 | $560.5 | ||

| Georgia | $330.7 | $329.7 | ||

| Hawai’i | $98.9 | $98.6 | ||

| Idaho | $31.9 | $30.3 | $1.5 | |

| Illinois | $585.1 | $583.1 | ||

| Indiana | $206.8 | $206.1 | ||

| Iowa | $131.5 | $130.6 | $0.5 | |

| Kansas | $101.9 | $101.5 | $0.1 | |

| Kentucky | $181.3 | $180.7 | ||

| Louisiana | $164.0 | $163.4 | ||

| Maine | $78.1 | $77.9 | ||

| Maryland | $229.1 | $228.3 | $27.2 | |

| Massachusetts | $459.4 | $457.9 | $54.5 | |

| Michigan | $775.4 | $772.8 | ||

| Minnesota | $268 | $259.6 | $7.5 | |

| Mississippi | $86.8 | $86.5 | ||

| Missouri | $217.1 | $216.3 | ||

| Montana | $45.5 | $37.9 | $7.5 | |

| Nebraska | $58.0 | $56.6 | $1.2 | |

| Nevada | $44.0 | $43.8 | $0.07 | |

| New Hampshire | $38.5 | $38.4 | ||

| New Jersey | $404.0 | $402.7 | ||

| New Mexico | $126.1 | $109.9 | $13.1 | $15.8 |

| New York | $2,442.9 | $2,434.9 | $290.1 | |

| North Carolina | $302.2 | $300.4 | $35.8 | $0.8 |

| North Dakota | $26.4 | $26.3 | ||

| Ohio | $728.0 | $725.6 | ||

| Oklahoma | $148.0 | $138.0 | $9.5 | |

| Oregon | $167.9 | $165.8 | $1.5 | |

| Pennsylvania | $719.5 | $717.1 | ||

| Rhode Island | $95.0 | $94.7 | ||

| South Carolina | $100.0 | $99.6 | $11.9 | |

| South Dakota | $21.9 | $21.2 | $0.6 | |

| Tennessee | $191.5 | $190.9 | ||

| Texas | $486.3 | $484.7 | $57.7 | |

| Utah | $76.8 | $75.4 | $1.2 | |

| Vermont | $47.4 | $47.2 | ||

| Virginia | $158.3 | $157.8 | ||

| Washington | $404.3 | $379.0 | $45.1 | $24.0 |

| West Virginia | $110.2 | $109.8 | ||

| Wisconsin | $318.2 | $312.8 | $4.3 | |

| Wyoming | $21.8 | $18.4 | $3.3 |

*Block grant allocation minus the 0.33 percent research set-aside, as well as any Tribal TANF set-asides or penalties.

Source: CBPP analysis of Department of Health and Human Services 2021 TANF financial data

To Promote Equity, States Should Invest More TANF Dollars in Basic Assistance

State Fact Sheets: How States Spend Funds Under the TANF Block Grant

Policy Basics

Income Security

End Notes

[1] Urvi Patel, an intern on the Housing and Income Security team, helped ensure the accuracy of the data and analyses in this report.

[2]Aditi Shrivastava and Gina Azito Thompson, “TANF Cash Assistance Should Reach Millions More Families to Lessen Hardship,” CBPP, updated February 18, 2022, https://www.cbpp.org/research/family-income-support/tanf-cash-assistance-should-reach-millions-more-families-to-lessen.

[3] CBPP analysis of 2020 U.S. Census population estimates collected from Kids Count Data Center, “Child population by race and ethnicity in the United States,” Annie E. Casey Foundation, September 2021, https://datacenter.kidscount.org/data/tables/103-child-population-by-race?loc=1&loct=2#detailed/2/2-52/false/574/68,69,67,12,70,66,71,72/423.

[4] Zachary Parolin, “Temporary Assistance for Needy Families and the Black-White child poverty gap in the United States,” Socio-Economic Review, May 14, 2019, https://doi.org/10.1093/ser/mwz025.

[5] Ife Floyd et al., “TANF Policies Reflect Racist Legacy of Cash Assistance,” CBPP, August 4, 2021, https://www.cbpp.org/research/family-income-support/tanf-policies-reflect-racist-legacy-of-cash-assistance.

[6] CBPP analysis of 2020 U.S. Census population estimates.

[7] Gina Azito Thompson, Diana Azevedo-McCaffrey, and Da’Shon Carr, “Increases in TANF Cash Benefit Levels Are Critical to Help Families Meet Rising Costs,” CBPP, updated February 3, 2023, https://www.cbpp.org/research/income-security/increases-in-tanf-cash-benefit-levels-are-critical-to-help-families-meet-0.

[8] States can also claim some foster care and child welfare services under “authorized under prior law” (AUPL). We have included those expenditures under child welfare rather than AUPL.

[9] National Academies of Science, Engineering, and Medicine, “Consequences of Child Poverty,” A Roadmap to Reducing Child Poverty, 2019, https://www.ncbi.nlm.nih.gov/books/NBK547371/.

[10] Shrivastava and Thompson, op. cit.; Thompson, McCaffrey, and Carr, op. cit.

[11] Kendra Bozarth, Grace Western, and Janelle Jones, “Black Women Best: The Framework We Need for An Equitable Economy,” Roosevelt Institute and Groundwork Collaborative, September 2020, https://rooseveltinstitute.org/wp-content/uploads/2020/09/RI_Black-Women-Best_IssueBrief-202009.pdf.

[12] Ife Floyd, LaDonna Pavetti, and Liz Schott, “Lessons from TANF: Initial Unequal State Block-Grant Funding Formula Grew More Unequal Over Time,” CBPP, revised July 20, 2017, https://www.cbpp.org/research/family-income-support/lessons-from-tanf-initial-unequal-state-block-grant-funding-formula.

More from the Authors