In 1996, federal lawmakers created the Temporary Assistance for Needy Families (TANF) program as the nation’s primary source of cash assistance to low-income families with children. TANF, which replaced Aid to Families with Dependent Children (AFDC), imposed stringent time limits on receiving assistance and rules that take benefits away from families for failing to meet work and other program requirements (known as a “sanction”). Twenty-six years later, policy analysts and policymakers continue to debate whether TANF is a policy success or failure. A June 2021 study by Zachary Parolin[2] provides strong evidence that TANF is not the success that some claim, and that it could be substantially improved to reduce poverty and economic hardship.

Using data from the U.S. Census Bureau, Parolin estimated that the real (inflation-adjusted) value of cash assistance provided by TANF and AFDC fell 78 percent between 1993 and 2016, from $34.3 billion annually to $7.4 billion.[3] Parolin notes that TANF’s critics and defenders have proposed different explanations for this decline. Critics point to low benefit levels and policies that exclude families in need from receiving assistance. TANF’s defenders argue that increased employment among single mothers and a reduced incidence of single motherhood led to a decline in families in need of assistance.

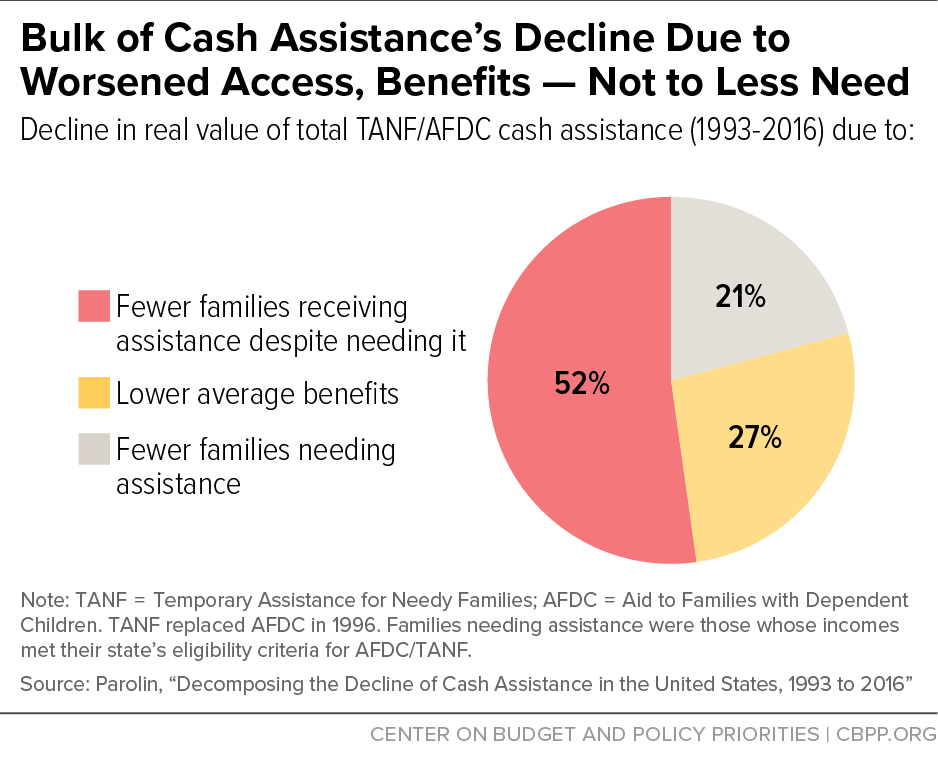

Parolin provides some of the strongest evidence so far that TANF’s decline was primarily driven by less participation among families meeting the eligibility criteria and by lower benefits ― factors within states’ control ―and not less need for assistance.

Changes in Access and Benefits Drove Decline in Cash Assistance

Using decomposition analysis — which allows researchers to investigate the main causes of observed changes over time — Parolin analyzed three potential drivers of the decline in cash assistance between 1993 and 2016:

- Need: the share of families with children who meet states’ income eligibility requirements for AFDC and TANF. The estimated share of families needing assistance fell by 32 percent between 1993 and 2016.

- Participation: the share of families with children who meet states’ income eligibility requirement that receive cash assistance. The estimated share of families needing assistance who received it fell by 70 percent.

- Benefits: the average monthly grant amount for families receiving cash assistance. The estimated average benefit fell by 31 percent.

After estimating the changes in the three variables over time, Parolin simulated how much cash assistance would have been provided to families had each variable not changed, to find how much each potential driver contributed to the decline in cash assistance. He found that the decline in cash assistance between 1993 and 2016 was fully explained by the three variables. More specifically, 52 percent of the decline was explained by fewer families receiving assistance despite meeting income eligibility requirements, 27 percent by lower average benefits, and only 21 percent by fewer families meeting income eligibility requirements.

TANF’s first years saw a sharp decline in the value of TANF cash assistance. Therefore, the causes of the decline in that period (1996-2000) are of particular interest ― and TANF’s defenders and critics have different interpretations. Its defenders claim that employment among single mothers increased and drove the decline in the TANF caseload.[4] TANF’s critics, on the other hand, point to the impact of work requirements and other policies that restricted access.

Parolin’s findings paint a mixed picture: between 1996 and 1998 the bulk of the decline in the total value of cash assistance was driven by fewer families receiving assistance despite needing it, while between 1998 and 2000 the primary driver was fewer families needing assistance. Since 2001, the primary drivers of decline fluctuated year-to-year but the declines in subsequent years were primarily driven by fewer families receiving assistance despite needing it.

TANF’s defenders claim that the decline in cash assistance was driven by changes in the prevalence and labor market participation of single mothers. To investigate this claim, Parolin conducted a second decomposition analysis. He found that only 22 percent of the decline in the total value of cash assistance between 1993 and 2016 could be explained by changes in the composition of the U.S. population.

He examined the potential contribution of three variables: (1) changes in the population – namely a decline in single motherhood, (2) rising educational attainment, and (3) changes in employment. He found that these three variables fully explained the decline in the number of families who met income eligibility requirements, but not the majority of the decline in either the share of eligible families receiving assistance or in average benefits.

Parolin then tested whether certain state TANF policy choices more fully explained the declines. States have always maintained control over cash assistance benefit levels, while TANF gave states significantly more control over eligibility than under AFDC, which since the 1960s had federal requirements to protect eligibility. Among other things, states can set their own, more stringent time limits than the federal 60-month time limit. States also have wide latitude to design and implement policies that take away benefits from families when a parent does not meet the work requirement. Some states have also adopted more severe policies that close a family’s case for not meeting work requirements, meaning they would have to reapply for assistance.

Parolin found that states with longer time limits had a higher share of eligible families receiving cash assistance. States that close a family’s case for not meeting work requirements had a lower share of eligible families receiving assistance. Parolin also found that states with lower maximum benefit levels, which nearly all states have allowed to lose value to inflation or deliberate cuts, provide lower average benefits.[5] The three associations were all statistically significant. These findings support the argument that state TANF policy decisions contributed to fewer eligible families receiving less generous assistance.

Parolin found that if states had not implemented policies that led to worsened access and lower benefits, the total annual value of TANF cash assistance would have never fallen below $20 billion and would have risen to $30 billion to meet greater need during the Great Recession (as opposed to the $9 billion that states provided). For example, in 2016 states would have provided $19.2 billion more in cash assistance to families with low incomes than they did.

These findings lend further support to what other researchers have documented: policies adopted under TANF have largely harmed, not helped, families with the lowest incomes. Deep poverty (income below 50 percent of the federal poverty line) among children rose during TANF’s first decade; millions of families lost access to cash assistance and Black children, Latino children, and children in single-mother families were most affected.[6]

Poverty scholars H. Luke Shaefer and Kathryn Edin found that TANF caseload declines were significantly associated with increases in food insecurity and homelessness among households with children.[7] Parolin built on this finding in a different 2021 study, which found that increasing access to TANF could reduce student homelessness, especially in school districts where a majority of students are Black or Native American.[8] And in a 2019 study, he found that states with larger shares of Black residents tend to spend less on TANF cash assistance, and that neutralizing racial bias in state TANF spending could help close the Black-white gap in child poverty and lift over a quarter-million Black children above the poverty line per year.[9]