- Home

- State Budget And Tax

- States Can Learn From Great Recession, A...

Policy Brief: States Can Learn From Great Recession, Adopt Forward-Looking, Antiracist Policies

So far in the current, pandemic-driven economic downturn, some states are following their playbook from the Great Recession of 2007-09 when they often closed large budget shortfalls with cuts to schools, higher education, and economic supports rather than protecting families and communities from the worst of the economic fallout. Those measures of roughly a decade ago ramped up layoffs that slowed the recovery, increased hardship, and worsened long-standing structural inequities that hold back Black, brown, and Indigenous people as well as women and workers struggling on low pay. In the coming year, states can take a different approach that raises the resources needed to stave off cuts, limits economic hardship, and advances equity-oriented, antiracist policies.[1]

States Can Create Thriving Communities and Economies

State economies and communities thrive when public investment in the foundations of broad prosperity unlocks the potential of every person and when structural barriers erected by racism and discrimination are knocked down. Good schools in every community offer children from lower-income families a chance at a better future. Family economic supports help parents provide their children with stable housing, nutritious food, and less stressful home lives. Health coverage protects families from bankruptcy due to a health emergency or chronic illness and ensures that businesses have healthy, productive workers. High-quality infrastructure — roads, bridges, ports, and waterways — helps businesses get their goods to market, and building it creates good jobs in the short term when the economy is not at full employment.

And, to ensure all communities thrive, states and localities must help undo the destructive legacies of past racism and the damage caused by continuing racial bias and discrimination. They can better design policies to address these harms and create more opportunities for people of color, which will make state economies more equitable and stronger, benefiting people of all backgrounds. They can also make their state a better place for people to live, work, and prosper regardless of their immigration status by enacting policies that take an inclusive approach to immigrants.

Many States Went in the Wrong Direction in the Great Recession

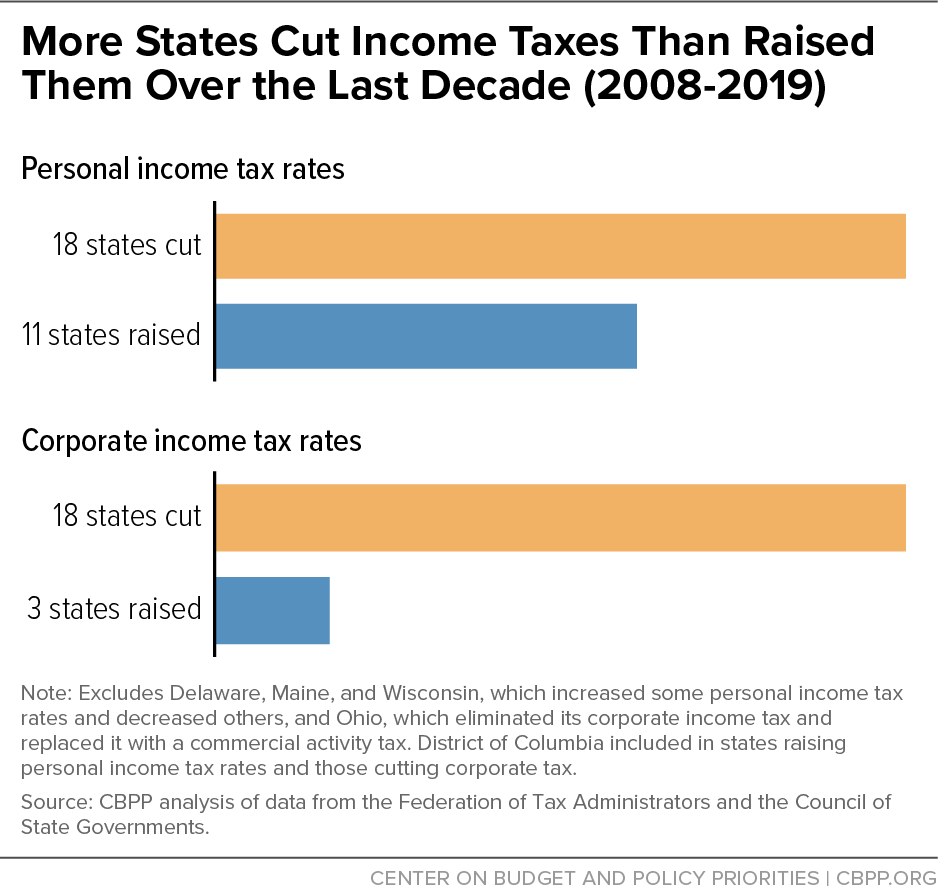

Forward-looking, antiracist, equitable tax policies and public investments are key to creating these conditions, but the Great Recession and many policies states adopted in its aftermath worsened longstanding inequities based on race, ethnicity, or income. Between 2005 and 2009, the period during which the housing bubble burst and the recession occurred, the median Black household lost more than half its meager wealth and the median Hispanic household lost two-thirds of its wealth.[2] Subsequent state actions that sharply increased college tuition, cut funding for schools, and weakened income supports like unemployment insurance and assistance through the Temporary Assistance for Needy Families (TANF) program added to the already extensive damage in Black and Latinx communities. And some states enacted policies that further constrained opportunities for immigrants. Further, some states cut taxes sharply for the wealthy and corporations, which primarily benefited white, affluent people, and some states and localities increased taxes and fees that fall hardest on those with the least ability to pay, which (along with cuts in public services) disproportionately harmed people of color. (See Figure 1.)

These steps also made the Great Recession deeper and longer than it otherwise would have been and weakened our economy over the long term by neglecting basic investments in our children, our health, and the public systems that help people and businesses thrive. Now we’re trying to fight a pandemic when many public health agencies are under-resourced, unemployment systems are outdated, and teachers are underpaid.

To be sure, some states made progress in these areas in the years between the beginning of the Great Recession and the start of the COVID-19 pandemic. Nearly three-quarters of the states expanded their Medicaid programs under the federal Affordable Care Act, and some states raised income taxes on the wealthy or corporations, strengthened earned income tax credits for families in poorly paid jobs, improved access to higher education for certain immigrants, or reformed criminal justice policies, among other things.

States Can Chart an Antiracist, Equitable Course

In the current downturn, states have already laid off or furloughed hundreds of thousands of workers and imposed harmful cuts, and some are proposing irresponsible income tax cuts including eliminating state income taxes.[3] But for most states the most consequential decisions will occur in the next few months as they hold their first full legislative sessions under COVID. To chart a better course, states can follow these three principles:

- Target aid to those most in need due to the COVID-19 and consequent economic crises. States’ immediate policy responses should prioritize supports for people and communities most in need due to the pandemic and accompanying economic crisis. They should target aid to essential workers and people who, due to lack of public investment, economic inequality, and historical and current discrimination and bias,[4] faced health and economic insecurity even before the pandemic. That includes people who have chronic health issues and people who are uninsured, experiencing homelessness, facing major barriers to work, or struggling on low pay, as well as immigrants who often have less access to supports.

- Adopt policies that address structural inequities. States can use this moment to address inequities due to historical racism and various forms of ongoing bias and discrimination. For example, they can make state unemployment rules more inclusive, boost income through state earned income tax credits, help tribal governments harmed by the pandemic, and eliminate criminal legal fees.

- Protect state finances to preserve the foundation of strong economies and widespread opportunity. Nearly every state’s tax system asks the least of the highest-income households, as a share of income. By raising taxes on high incomes and on various forms of wealth, much of which goes untaxed, states can build fairer tax systems while raising revenue for equity-enhancing public investments. States can also draw on their “rainy day” reserve funds, roll back ineffective corporate tax breaks, reform or repeal restrictions on revenue-raising by localities, and borrow (taking advantage of today’s low interest rates) for infrastructure projects that especially benefit neglected communities.

States Can Learn From Great Recession, Adopt Forward-Looking, Antiracist Policies

House Bill to Implement Biden COVID-Relief Plan Includes Much-Needed K-12 Funding

End Notes

[1] For the full version of this report, see https://www.cbpp.org/research/state-budget-and-tax/states-can-learn-from-great-recession-adopt-forward-looking.

[2] For both groups, median household wealth fell to only about $6,000. See Pew Research Center, “Wealth Gaps Rise to Record Highs Between Whites, Blacks, Hispanics,” July 26, 2011, https://www.pewsocialtrends.org/2011/07/26/wealth-gaps-rise-to-record-highs-between-whites-blacks-hispanics/.

[3] See, for example, Michael Leachman, “Mississippi Governor Irresponsibly Proposes to Repeal State’s Income Tax,” CBPP, November 30, 2020, https://www.cbpp.org/blog/mississippi-governor-irresponsibly-proposes-to-repeal-states-income-tax.

[4] LaDonna Pavetti and Peggy Bailey, ”Boost Safety Net to Help People With Fewest Resources Pay for Basics During Crisis,” CBPP, April 29, 2020, https://www.cbpp.org/research/poverty-and-inequality/boost-safety-net-to-help-people-with-fewest-resources-pay-for-basics.

More from the Authors

Areas of Expertise