Thank you for the opportunity to testify on this extremely welcome update to an essential labor standard.

I begin my testimony with two historical perspectives, one from the past and one from the future.

Over 75 years ago, policymakers recognized the importance of labor standards in making sure that the benefits of economic growth were more fairly shared and that workers with less bargaining clout were not exploited by those who controlled their economic fates. The result was the Fair Labor Standards Act (FLSA), which established the national minimum wage and the subject of today’s hearing, time-and-a-half pay after 40 hours of weekly work for workers covered by the legislation.

Today, these standards are more important than ever. Income inequality is actually higher than it was in 1938. Back then, the top 1 percent held 16 percent of national income; today, they hold 21 percent, a transfer to the wealthiest families of over half-a-trillion dollars (3 percent of GDP), or an average of about $3,200 for each household in the bottom 99 percent.[1]

This trend in income inequality, which has in turn contributed to middle-class income and wage stagnation, is partially a function of the weak bargaining position of many working class households. These households are the precise targets of the FLSA, which recognized that, absent adequate protections, some workers’ wages are set at privation levels not because of “market forces,” but because of these workers’ relative powerlessness. Before this legislation, more workers had no choice but to work long hours of overtime for no extra pay, as not doing so could potentially result in a job loss or pay cut. Their unprotected status thus cut deeply into their leisure time and challenged their ability to balance work and family.

The FLSA overtime rules took direct aim at this problem by “internalizing” the negative externality of overwork. That is, by raising the cost to employers of working their employees beyond 40 hours, the law played a key role in helping to create what we recognize today as the middle class.

The law was also intended to draw a bright line between workers with and without substantial bargaining power. Workers exempt from the overtime rule are expected, because of their role, education, work experience, and other options available to them, to be able to negotiate their working conditions. Workers without those same attributes, who lack the leverage to prevent employers from forcing them to work unpaid overtime, are supposed to be covered by the rule’s protections.

I urge the committee to recognize these realities as underscoring the need for labor standards in place since the 1930s to be fully updated and operational in today’s labor market. They are just as important, if not more so, than when they were first introduced; without an update, there will continue to be perverse incentives to overwork low-wage employees without compensating them for their time.

I predict that this overtime rule change, implemented by the Obama administration and its Labor Department and broadly supported by congressional Democrats and the general public – 60 percent of Americans backed the proposal in a recent poll[2] — will come to be viewed as an important and positive intervention on behalf of middle-class families.

The above rationale for the labor protections of the FLSA is vitiated if the OT threshold is allowed to be eroded by inflation and nominal salary increases. This threshold is the amount of weekly or annual earnings beneath which a broad group of salaried workers are automatically eligible for OT coverage. The new rule raises the weekly threshold from $455 to $913, and, importantly, indexes it to future salary movements so it will not erode in the future as it has in the past.

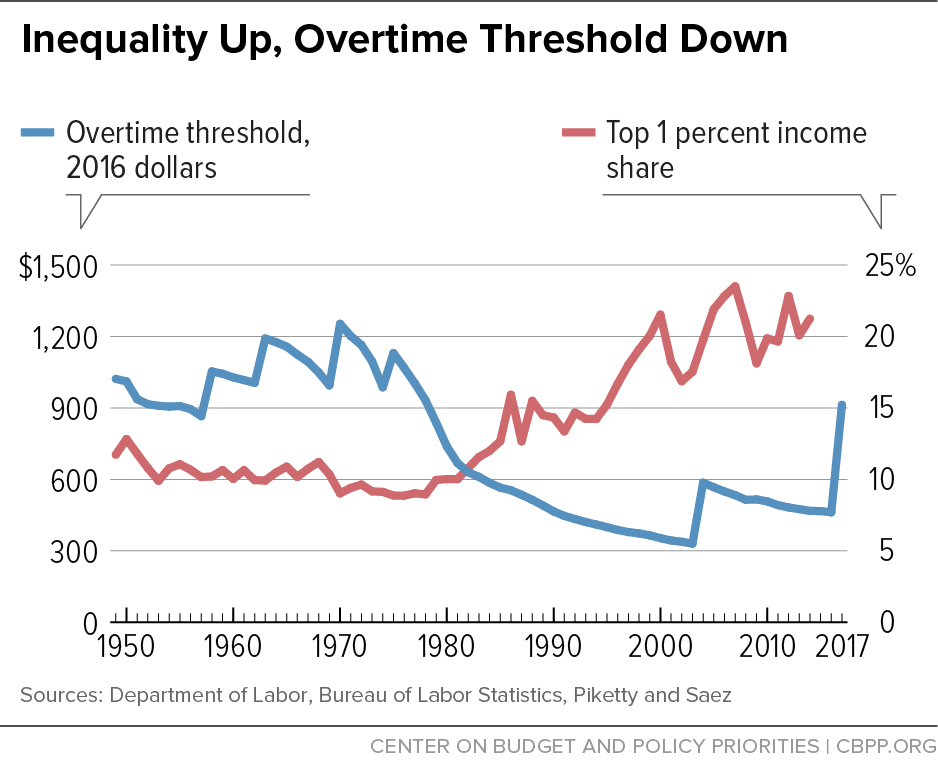

The figure below makes an important point in this regard. While much ink has been spilled over the complexities of the new rule, what’s actually happening here is extremely simple. The salary threshold was ignored for decades, other than a notch up in 2004. The new increase, while historically large, does not even bring the threshold back up to its historical peaks (see left y-axis); it only partially restores its inflation-adjusted historical value.

The other line in the figure shows the percent of national income going to the top 1 percent of households. For decades, this measure hovered around 10 percent, while the OT threshold was regularly maintained at a real level of at or above $1,000 in today’s dollars. But beginning in the early 1980s, as inequality trends began to push up income concentration, labor standards like overtime and the minimum wage were allowed to erode.

To be clear, I am not claiming a direct, causal linkage between these two trends. My point is that both were driven by, among other things, an abandoning of labor standards and a rejection of the FLSA-era appreciation of the role of worker bargaining power in the distribution of growth.

Back in 1975, over 60 percent of full-time salaried workers earned salary levels that qualified them for overtime pay. Today, only 7 percent of salaried workers are under the $455 cap. Under the new rule, this share rises to 35 percent of full-time salaried workers.

As Ross Eisenbrey and I pointed out a few years ago in a white paper for the Department of Labor (DoL), the last time the threshold was consistent with the intent of the FLSA was also in 1975, when it was a bit more than twice the current threshold.[3] The 1975 level, adjusted for inflation, corresponds to about the 40th percentile of full-time, salaried earnings today.

However, during the rule’s comment period, as the DoL did its due diligence and listened to thousands of stakeholders on all sides of the rule, it was suggested that the threshold should reflect regional wage and price differences. Instead of going with numerous different thresholds, the department decided on the 40th percentile of the lowest-wage region: the South. Though this level fails to get the threshold all the way back to its real 1975 value of $1,130 a week in today’s dollars ($58,760 annually), it is a reasonable, conservative choice.

As alluded to above, every three years, the threshold will be reset to the benchmark of the 40th percentile full-time salary in the region where it is lowest. This practice provides another example of the DoL responding to concerns raised during the public comment period, this time about the difficulty of implementing annual adjustments. The three-year cycle is based on publicly available data that will come out 150 days or more in advance of the changes, thus giving employers plenty of time to adjust to threshold increases.

The Economic Policy Institute estimates that there are 12.5 million salaried workers earning between the old and new threshold who will now be covered by overtime protections. The DoL further estimates that about one-third of that number (4.2 million) will directly benefit in that they were likely exempt prior to the new rule. As regards the rest of the salaried workforce in the affected range, recall that, because of tests establishing certain duties as non-exempt, some salaried workers above the threshold were or at least should have been covered prior to the change. These workers will now be covered. The balance of the affected group, about 9 million according to DoL, should have been getting OT already based on their duties but, as EPI believes, may well not have been.[4] For those workers, the new rule ensures their eligibility, doing away with any ambiguity based on their duties.

It is worth noting here that while some FLSA advocates argued that the new rule should update the “duties test,” particularly in light of the fact that these tests were loosened (meaning it was made easier to arbitrarily exempt workers) in the changes under President Bush in 2004, DoL decided not to do so. This decision once again reflects the department’s responsiveness to arguments employers made during the comment period.

According to EPI, this rule change will disproportionately help black and Hispanic workers, who make up a combined 21 percent of the salaried workforce but 28 percent of workers who will directly benefit from the new threshold.[5] Millennials — those between the ages of 16 and 34 — will also disproportionately benefit, as they comprise 36 percent of the affected group (they are 28 percent of the total workforce). More than a third of all workers with less than a college degree will be directly affected, and the rule will also help over 7 million children. Slightly more than half of all beneficiaries (51 percent) are women.

DoL estimates that about 1.6 million of the 4.2 million workers noted above regularly or occasionally work overtime and will now be paid time-and-a-half. Now that OT is more expensive for newly covered (or “correctly” covered — those who should have been getting OT but were not) workers, some may work fewer overtime hours. Contrary to the claims of critics, this change will make these workers better off. Remember, workers in this group weren’t getting overtime pay before the rule change. Now that their weekly earnings are unchanged but they’re working fewer weekly hours, they’re clearly better off in terms of earning a higher average hourly wage rate (the same salary is being divided by fewer hours) and having more time to spend with their families.

Some adjustments may come through lower base pay rates, such that an employer’s total wage bill, including OT, will be only slightly higher as they partially offset the impact of the increase through the lower base wage. Some employers will decide to bump some workers up to the new threshold so they will remain exempt, another clear gain for these workers. Others may distribute more hours to workers who are currently part-time, which would again be a clear benefit at a time when the number of part-time workers who would rather be full-timers remains elevated. A final desirable impact is more hiring of straight-time workers by employers who want to avoid higher OT costs. Researchers at Goldman Sachs predict that this aspect of the change could lead to 100,000 new full-time jobs in 2017.

DoL estimates that the new rule will cost employers $1.5 billion a year: $1.2 billion in new OT pay and $300 million in administrative expenses to implement the change. That amounts to about 0.03 percent of our $8 trillion total, national wage bill. Goldman Sachs’ analysts also find that “the new rules should have little effect on wages in the aggregate,” arguing that the rule change is likely to raise average hourly earnings less than 0.1 percent.

This tiny impact on the aggregate wage bill should not undermine our expectations that the rule will improve the well-being of millions of workers and push back to some degree on inequality. First, some of the higher pay for beneficiaries of the new rule will come from redistribution within the wage bill (from high- to middle- and lower-paid workers). Second, in cases where workers are no longer tapped to work unpaid overtime hours, they are clearly better off in terms of balancing work and family life. Though such a welfare-enhancing change does not show up in the national accounts, it is one of the very important benefits of the new rule.

As the blog ThinkProgress points out, “the usual cast of opponents to boosting wages for workers has come out swinging, saying the [OT] rule is an ‘absolute disaster’ and a ‘job killer’ or ‘career killer.’”[6] Such rhetoric is highly inconsistent with a rule change that a) only partially updates a critical labor standard and b) is estimated to cost a rounding error (0.03 percent) of the national wage bill. Thus, policymakers should write off much of the criticism as knee-jerk responses from business lobbyists doing what they’re paid to do: fight the rule regardless of the substantive arguments that support it.

There are, however, two objections that deserve a response: compliance costs and costs to non-profits.

Compliance: The most complex part of the overtime determination, as Ross Eisenbrey has explained, is the application of the “duties test.”[7] The new rule does not change that and, as firms should already be in compliance with this part of the law, no new compliance costs are invoked in this area (especially when businesses use payroll processing software, which is quite common). It is notable that at a recent congressional hearing, the witness representing the National Restaurant Association conceded this point, admitting that compliance with the new rule “…would be an easy transition to make from a management and bookkeeping standpoint.”[8]

The higher threshold actually simplifies firms’ compliance burden. As more workers will be automatically covered, the need for the duties test on millions of salaried workers is now obviated. Though the new rule does not require them to do so, some employers complain that they will have to move salaried workers to hourly schedules and that this will mean a new tracking burden. But as evidenced by the testimony of the witness for the National Retail Federation at the October hearing referenced above, many businesses already track their employees’ hours.[9]

In addition, while employers argue that the new rule will reduce workers’ “flexibility,” presumably by moving salaried workers to hourly schedules, research by economist Lonnie Golden finds little difference in the existing amount of workplace flexibility between hourly and salaried workers with earnings below $50,000.[10]

Non-profits: Some non-profits, including social welfare and educational institutions, have argued that the rule will be especially burdensome on them. They contend that they are funded by budgets that may not adjust to meet the higher labor costs.

These concerns are understandable, but they miss a few key points.

First, the pay and work-family balance of workers at non-profits are no less important than the pay and work-family balance of workers at for-profit institutions. The whole point of this labor standard is to guarantee employees fair workplace conditions, a point recently amplified by a group of non-profits in favor of the proposed rule: “our own workers and the families they support also deserve fair compensation and greater economic security. . . . It is time to revisit the idea that working for the public good should somehow mean requiring the lowest-paid among us to support these efforts by working long hours, many of which are unpaid.”[11]

Second, the DoL has worked hard to accommodate specific non-profit concerns. For Medicaid-funded providers of services for individuals with intellectual or developmental disabilities in residential care facilities with 16 or more beds, for example, the new rule does not take effect for three years (i.e., it will not be enforced until December of 2019, providing time for outreach, technical assistance, and budget adjustments). In addition, higher education institutions worried about the effects on their post-docs, who are critical to the research mission of universities, will be comforted to know that future National Research Service Award grants from the NIH will be above the new salary threshold.

Finally, as the DoL guidance points out, based on the nature of their activities and whether they involve revenue-generating sales above $500,000, some non-profits and/or individual workers at non-profits may be exempt from the new rule.[12] It is important to stress once more, however, that even exempt non-profits, given their missions, should recognize the importance of fairly compensating their employees and strive to adhere to the principles outlined in the rule.

As time passes and the new overtime rule takes effect, I expect it to be recognized as a major policy win for middle-class families. It will boost some paychecks, help parents balance work and family, and produce new straight-time jobs. The fact that the threshold will be automatically adjusted will militate against the deteriorating trend observed in the figure above, a reminder to policymakers that labor standards must be vigilantly maintained, protected, and updated.

I’ve urged members of this committee to ignore knee-jerk antipathy to the new rule and instead to deal in substance, as the DoL did in reviews of tens of thousands of comments and listening carefully to stakeholders on all sides of this issue. We see the results of such compromise in the use of the lowest regional threshold, the three-year deferral for certain non-profits, and the leaving of the duties test unchanged.

Finally, as I know you realize, even with this important new rule in place, your work is far from done. While admirable policy work was done to shore up this labor standard, other standards continue to erode. Misclassification of regular employees as independent contractors is a growing area of concern as “arms-length” employer-employee relationships proliferate. Wage theft has been on the rise, with minority, immigrant, and women workers particularly vulnerable to non-payment of promised or guaranteed pay, including overtime and minimum wages. Senators Patty Murray and Sherrod Brown and Representative Rosa DeLauro have introduced The Wage Theft Prevention and Wage Recovery Act[13] and Representative Bobby Scott has introduced the Pay Stub Transparency Act; [14] both are important pieces of legislation designed to attack this serious problem. Ensuring that DoL’s Wage and Hour division is amply staffed with the number of inspectors needed to enforce labor standards is another key part of the solution to this and related problems.

In the age of inequality and middle-class wage stagnation, when it comes to labor standards, policymakers must “go on offense.” The new OT rule stands as a great example of this theme, wherein policymakers took a strong, positive action to help to reconnect the economic fates of working Americans to the growth that has too often failed to reach them. I look forward to working with you to continue moving forward with this opportunity-enhancing agenda.