BEYOND THE NUMBERS

Veterans and the Safety Net

November 11, Veterans’ Day, is an appropriate time to highlight some ways that the safety net helps many low-income veterans and active duty service members make ends meet. It’s important to note that policymakers’ actions in areas like health coverage and tax credits for working families have a big impact on veterans and their families.

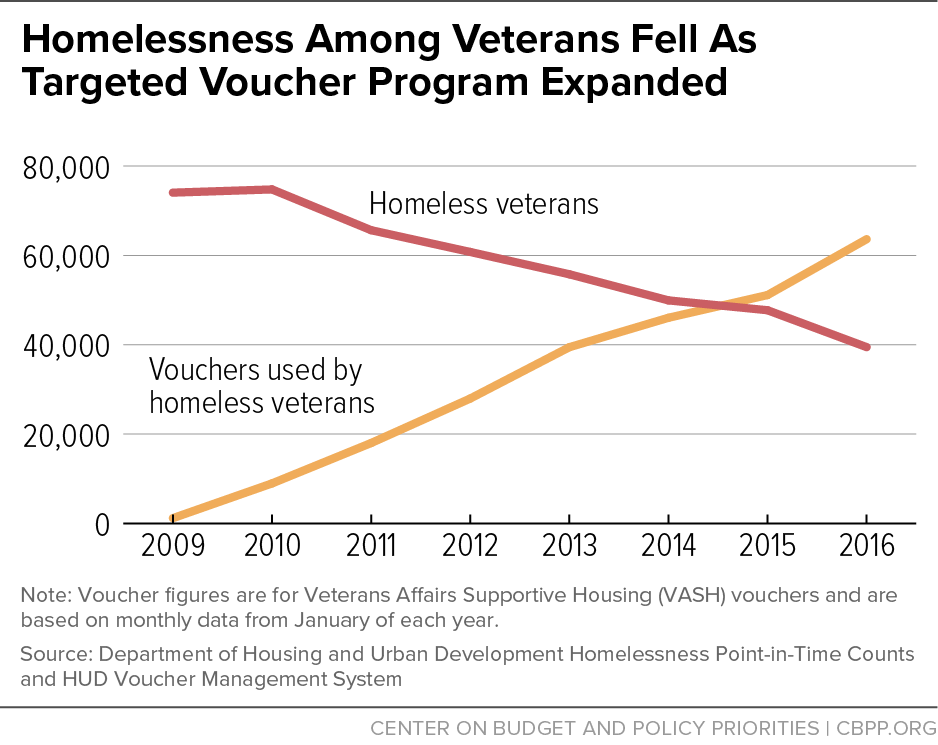

Housing assistance: The number of homeless veterans has dropped by 47 percent since 2010, recent Department of Housing and Urban Development (HUD) data show. While several factors contributed to this striking progress, one key one is the tens of thousands of new Housing Choice Vouchers for homeless veterans that policymakers have funded since 2008 through the HUD-Veterans Affairs Supportive Housing (HUD-VASH) program. Click here for more.

Health coverage: Veterans are enjoying large gains in health coverage since health reform’s major coverage provisions took effect, as their uninsured rate dropped from 11.9 percent in 2013 to 6.8 percent in 2015, an Urban Institute analysis of the Centers for Disease Control and Prevention’s National Health Interview Survey (NHIS) finds. The biggest gains have come in states that adopted health reform’s Medicaid expansion, so further state take-up of the expansion will be key to future gains in veterans’ coverage. Click here for more.

Working-family tax credits: The Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) — pro-work tax credits for low- and moderate-income working households — boost the economic security of millions of veteran and military households. Roughly 2 million veteran and military households earn the EITC, the low-income component of the CTC, or both, an analysis of Census and IRS data shows. Congress could strengthen the EITC for more than 600,000 veterans and active duty service members by closing the large gap in the credit for adults not raising children and non-custodial parents. Click here for more.