BEYOND THE NUMBERS

The Trump Administration has declared this week “Infrastructure Week,” and today the President is expected to portray his agenda as a major new investment in revamping the nation’s roads, bridges, tunnels, and railways. Yet despite calling for a $1 trillion infrastructure plan, the President hasn’t explained how the $200 billion in new, undefined spending in his budget would achieve that goal. And a closer look at that budget reveals that it would actually weaken federal support for infrastructure by reducing Highway Trust Fund spending, cutting other infrastructure such as mass transit, prioritizing private investment, and shifting costs to states and localities.

In essence, the President’s infrastructure agenda reflects a “bait-and-switch”: rhetoric that suggests a commitment to rebuilding, but policies that would undermine our ability to do so.

- Over time, the budget would reduce federal infrastructure spending. The Administration has tried to focus attention on a $200 billion placeholder in its budget that it says will support $1 trillion in infrastructure spending. But hidden in the budget is a major policy change that would — even when combined with that investment — reduce annual federal funding for surface transportation over time.

In recent years, the dedicated revenues for the Highway Trust Fund (mostly from the gasoline tax) were insufficient to cover ongoing “baseline” spending from year to year, largely because the gas tax has eroded in value. On a bipartisan basis, lawmakers have repeatedly transferred money into the trust fund to keep infrastructure spending from falling.

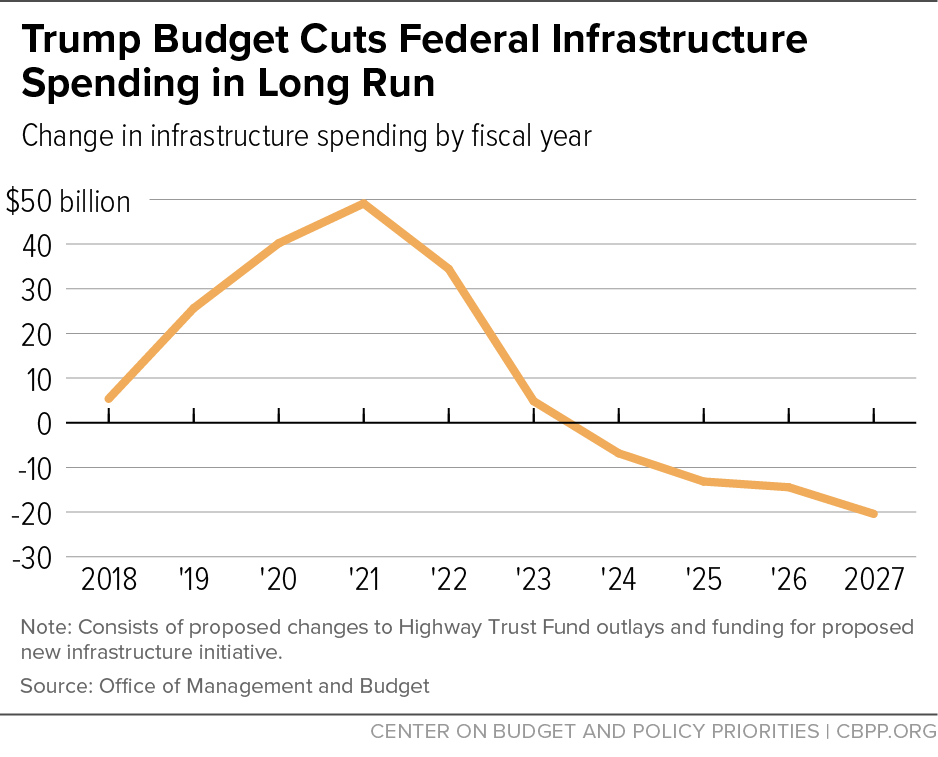

The budget, however, proposes that beginning in 2021, the Highway Trust Fund will spend no more in a given year than the dedicated revenues it receives. In practice, that means significant cuts in Highway Trust Fund spending that would grow over time, reaching $20 billion a year by the end of ten years and extending indefinitely. Within a few years, the net impact of these two major proposals – upfront investment in infrastructure followed by this permanent policy shift – would be large and growing cuts in infrastructure spending (see graph).

- The budget would also spur other infrastructure cuts. On top of the long-term spending cut described above, the budget proposes $3 billion in immediate cuts to discretionary funding for the Transportation Department from 2017 to 2018, including large cuts to Amtrak, a 49 percent cut to the “New Starts” program that supports transit construction, and elimination of the TIGER program, which has supported some of the most innovative local infrastructure projects over the last eight years. While the budget does not specify funding levels for these programs beyond 2018, the cuts would likely grow for the rest of the decade, as the budget proposes growing cuts in overall non-defense appropriations – the budget category that includes a substantial share of transportation funding. If funding for the Departments of Veterans Affairs and Homeland Security (both of which the budget would increase in 2018) were to grow with inflation between now and 2027, other domestic programs (including infrastructure) would be cut by half, on average. With the total cuts growing steadily, the Transportation Department cuts almost certainly will grow after 2018 as well.

- The budget prioritizes private investment in infrastructure at the expense of programs that don’t generate fees or other revenue. The federal government provides direct funding for transportation because infrastructure is a public good that supports the economy, businesses, and families and wouldn’t receive enough support through private investment alone. The Administration argues that a major share of its $200 billion investment will go to spur private investment in infrastructure. This could be a worthy goal if coupled with much greater support for direct public spending but, on the whole, the Administration’s approach appears to shift infrastructure investment towards projects that provide a return to investors. That approach means that more projects would require tolls or other revenue sources that impose costs on families. And when combined with the budget’s other cuts, it would inevitably lead to underfunding of projects that offer substantial public benefits but no opportunity for profit.

- More broadly, the budget shifts responsibility for infrastructure spending to states and cities, without explaining how they could shoulder that burden. As a budget fact sheet states, the Administration seeks to “encourage self-help” and “support more communities moving toward a model of independence” in infrastructure funding. In practice, states and cities would either have to go without needed infrastructure repairs or raise new revenues or cut spending elsewhere to fund them. Given states’ current fiscal constraints, which other funding shifts across the Trump budget would significantly worsen, the burden likely would ultimately fall on working families and the most vulnerable.

That outcome reflects the fiscal priorities at the core of the budget. To present lower deficits while cutting taxes for the wealthy and corporations, the budget must cut domestic spending across the board – including in infrastructure. How roads, bridges, and railways get funded becomes a problem for states and cities to solve. Despite the rhetoric of “Infrastructure Week,” the end result would be a major step backwards in rebuilding the infrastructure we need.