BEYOND THE NUMBERS

An article by George Mason University’s David Armor and Sonia Sousa claims that a fifth of SNAP (food stamp) recipients in 2010 had incomes above twice the poverty line. The Washington Post’s Robert Samuelson cited the study in a recent column as an indication of unchecked growth in safety-net programs.

But Armor and Sousa’s finding is almost certainly inaccurate, as is the conclusion Samuelson apparently drew that a large expansion of SNAP to people with higher incomes has occurred and is a major driver of recent SNAP cost growth.

Let’s first look at what’s actually been driving SNAP costs; in a separate post, we’ll examine the claim that large numbers of higher-income people are taking advantage of the program.

The number of SNAP recipients has indeed grown markedly in recent years, but this is mostly because of the recession. As the Congressional Budget Office (CBO) reported, “the primary reason for the increase in the number of participants was the deep recession from December 2007 to June 2009 and the subsequent slow recovery.”

Another key factor behind the large increase in SNAP costs of recent years is a temporary but substantial increase in SNAP benefit levels, enacted in the 2009 Recovery Act to help stimulate the economy. (Analyses by CBO, Moody’s Analytics, and others have shown that increasing SNAP benefits is one of the most cost-effective ways to stimulate a weak economy.)

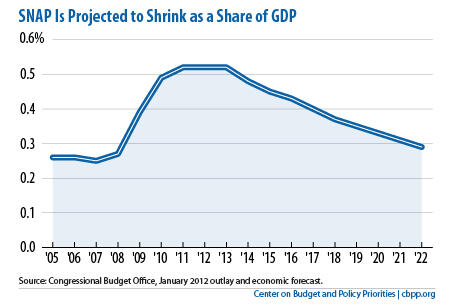

SNAP spending has now begun to level off, and CBO predicts that it will fall sharply as a share of gross domestic product (GDP) as the economy recovers and as the Recovery Act’s benefit increase expires (see graph). CBO estimates that by the end of the decade, SNAP will return nearly to pre-recession levels as a share of GDP.

Moreover , SNAP is projected to grow no faster than the economy over the long term. Thus, costs for SNAP, unlike those for programs whose spending is driven by health care costs or the aging of the population, do not contribute to the nation’s long-term fiscal problems.