BEYOND THE NUMBERS

With the 1996 welfare law in the news this week on its 20th anniversary, our new report finds that the poorest children in single-mother families grew poorer between 1995 and 2005 — the best period to examine the law’s impact, as the economy was similar in both years. This group’s income loss reflected a large drop in cash assistance through the Temporary Assistance for Needy Families (TANF) block grant, which the law created.

Moreover, since the welfare law, the overall poverty rate for single-parent families has fallen, though many other factors besides TANF influenced this trend. But the poorest families and children have become worse off.

Our analysis found:

-

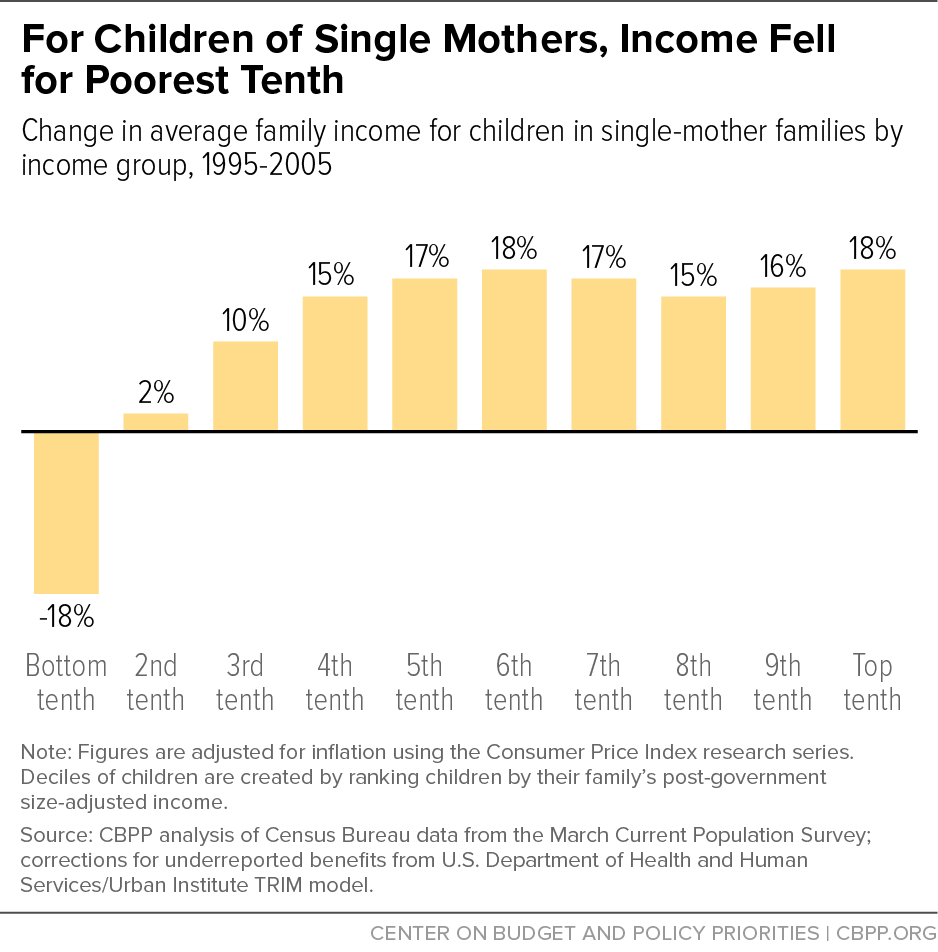

Incomes fell by 18 percent for the poorest tenth of children of single mothers between 1995 and 2005. Using a comprehensive measure of family income, the average family income of the poorest tenth of children in single-mother families fell by nearly $2,400 (18 percent) over this period. The losses among this group — about 2 million of the nation’s most disadvantaged children — were driven by a $2,800 fall in TANF cash assistance. Incomes rose for every other income group of children of single mothers (see chart). (All figures are adjusted for inflation and family size.)

-

The poorest single-mother families recouped some of these losses after 2005. From 2005 to 2012 (the last year for which we have data), the bottom tenth of children in single-mother families gained an average of about $700, due in part to temporary increases in SNAP (food stamps). Even so, this group lost ground between 1995 and 2012.

-

The loss of TANF also affected other single-mother families. Among the second tenth of children in single-mother families, average annual TANF income fell nearly $3,600 from 1995 to 2005. Their overall family income rose only because some families turned to other safety-net benefits.

-

The income declines for the poorest children reflect a shift toward a work-based safety net that helps those somewhat higher on the income scale. The safety net has shifted away from helping the very poorest children (particularly through TANF) and toward helping those modestly higher on the income ladder (particularly with tax credits for working families, such as the Earned Income Tax Credit and Child Tax Credit).

From 1995 to 2005, government support fell for children with no other identifiable source of family income, as well as for those with $1 to $10,000 in non-government income, and those earning $10,000 to $20,000. In contrast, government support rose for those earning $20,000 to $30,000 and those making $30,000 to $40,000.

The figures illustrate why TANF — with its rigid work requirements, time limits, and block grant structure — isn’t an effective model for supporting families, particularly during periods of joblessness.