BEYOND THE NUMBERS

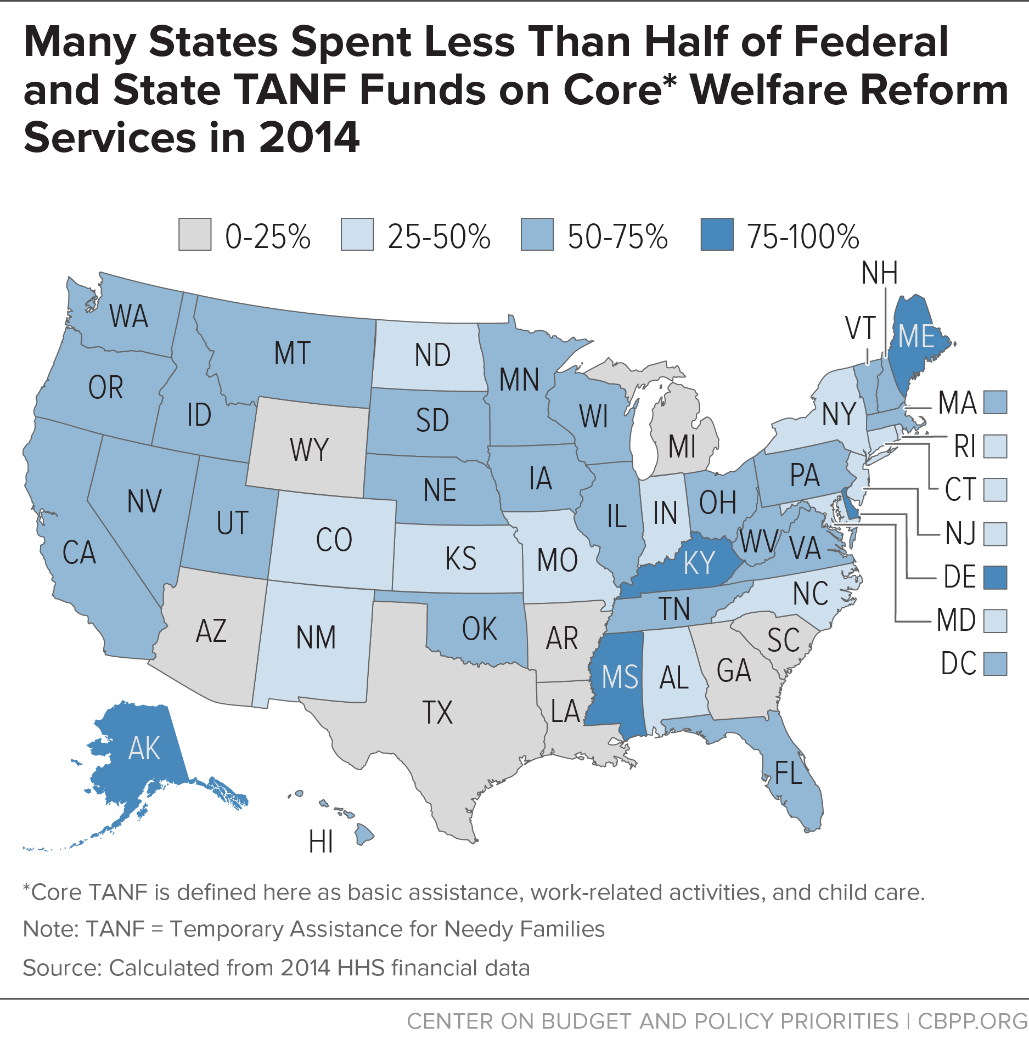

States spend only half of their funds under the Temporary Assistance for Needy Families (TANF) block grant on core welfare reform activities, our updated analysis (with state-by-state fact sheets) shows. Child care, work activities, and basic cash assistance totaled 50 percent of federal and state TANF spending nationally in 2014, and many states spent far less. In eight states, these core categories accounted for one-quarter or less of TANF spending (see map).

A key argument for TANF’s block-grant design was that states needed more flexibility over federal funds than TANF’s predecessor, Aid to Families with Dependent Children, provided. Under a block grant, proponents argued, states could apply the funds that were freed up when families left welfare for work to child care or other work supports, where need would rise. States also could invest more in work programs to reflect the increased emphasis that welfare should be temporary and work-focused. Thus, one could reasonably consider the trio of basic assistance, child care, and work activities as the core areas of welfare reform spending.

In the late 1990s, with the economy strong and caseloads declining, most states did invest more in work programs and child care. But over time, states redirected much of the funds to other purposes. And when need increased during the Great Recession, states often didn’t direct the funds back to core welfare reform services but instead cut basic assistance, child care, and work programs.

Our examination of state spending for 2014 found:

-

The share of spending used for basic assistance (cash welfare) has fallen significantly under TANF. At TANF’s onset, 70 percent of combined federal and state TANF funds went for basic assistance for poor families. By 2014, that figure had plummeted to 26 percent. Ten states spent less than 10 percent of the funds on basic assistance in 2014.

-

States spend only about a quarter of their state and federal TANF dollars on child care and work activities combined. In 2014, states used only 8 percent of the funds for work activities and 16 percent for child care.

-

States use a large and growing share of state and federal TANF funds that formerly helped poor families meet their basic needs for other state services. In some cases, states used the funds to expand programs, such as state Earned Income Tax Credits (EITCs) or pre-K, or to cover the growing costs of existing services, such as child welfare. In other cases, they used the funds to replace existing state funds, thereby freeing the latter for purposes unrelated to a safety net or work opportunities for low-income families.

While some continue to cite TANF as a model for other safety net programs, our analysis provides a cautionary tale about the dangers of block-granting these programs and giving states extensive flexibility over them. The cash assistance safety net for the nation’s poorest families with children has weakened significantly under the TANF block grant.