BEYOND THE NUMBERS

The President’s new proposal for corporate tax reform and infrastructure investments provides a creative way to address both the urgent need for job creation and the risk that corporate tax reform will contain timing gimmicks that expand long-term deficits. But the proposal would be better if its corporate tax reform contributed to long-term deficit reduction.

Let’s consider each point in turn.

First, the need for jobs: today’s main economic challenge is that millions of Americans who want desperately to work and support their families can’t find jobs. The share of the adult population with a job is still stuck at levels when the Great Recession hit bottom. With many construction workers out of work while our infrastructure continues to decay, this is the obvious time to rebuild and repair roads, bridges, and airports. The President deserves credit for pushing this idea.

Second, the risks of timing gimmicks in corporate tax reform: as our recent report explains, corporate tax reform — whether designed to be revenue neutral or to raise revenue over the first decade — could easily end up expanding deficits in later decades.

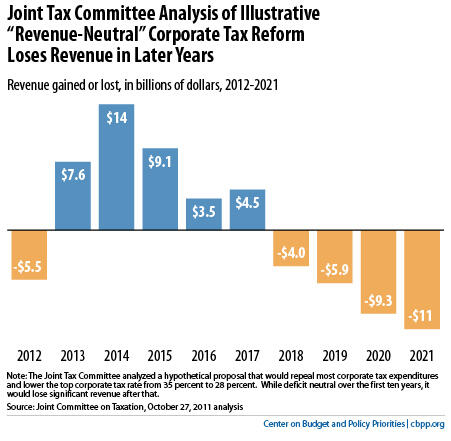

That’s because many of the corporate tax subsidies that policymakers might scale back to pay for lowering the corporate tax rate are structured in such a way that cutting them would generate much larger savings in the first ten years than over the long run.

For example, a 2011 Joint Tax Committee analysis of a potential corporate tax-reform package that was revenue neutral over the first decade found that it would produce annual revenue losses before the end of the decade, which would then grow over time (see graph).

The President would address this timing problem and ensure that corporate tax reform doesn’t add to the deficit in the long run by devoting its temporary revenue gains to timely infrastructure investments, and using only permanent revenue gains for permanent rate cuts.

Third, the need to do more on long-term deficits: the President’s proposal meets a “do no harm” fiscal test, but corporate tax reform needs to contribute to deficit reduction over the long run. The risk is that revenue-neutral corporate tax reform now will “use up” the politically achievable savings from cutting corporate deductions, credits, and other preferences known collectively as “tax expenditures,” taking corporate taxes off the table for deficit reduction.

At a time when policymakers are cutting critical investments in areas like scientific research and Head Start, corporate revenues should contribute to deficit reduction, not be exempt from it.