off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

New Study from Treasury Analysts Highlights Risk of Corporate Tax Reform Trap

Receive the latest news and reports from the Center

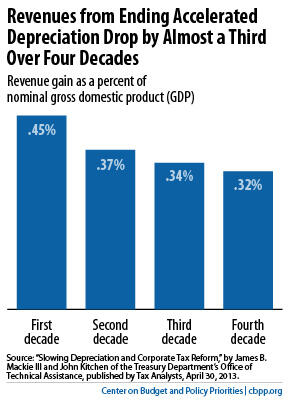

We explained recently that corporate tax reform could become a trap if policymakers start by setting a tax rate so low that they have trouble scaling back deductions and other preferences enough to offset the costs. If so, that reform not only could fail the key test of reducing long-term deficits, but it actually could expand them. A new paper by Treasury Department analysts on the biggest business subsidy in the tax code, “accelerated depreciation,” highlights the danger.

In other words, a corporate rate cut that policymakers could pay for in the first ten years by ending accelerated depreciation would add billions to deficits over the long run.

Policymakers should resist the temptation to rely on just such timing gimmicks to enact corporate tax reform that includes costly new cuts in tax rates. Like ending accelerated depreciation, many other corporate tax reforms would raise more revenue in the first ten years than they would continue to deliver in subsequent decades.

That’s why in corporate tax reform, as with tax reform generally, policymakers should prioritize fiscal responsibility and not make rash promises to slash rates that they can’t keep when faced with the political difficulty of cutting specific corporate tax breaks.