BEYOND THE NUMBERS

House and Senate committees have begun considering next year’s Internal Revenue Service (IRS) budget, and while policy issues like the IRS’s examination of tax-exempt organizations are getting much of the attention, policymakers shouldn’t ignore the damaging effects of the big cuts in IRS funding in recent years, our new paper explains.

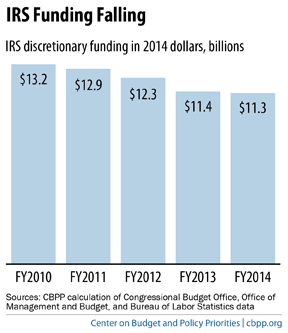

Since 2010, when Congress began cutting discretionary programs, IRS funding has fallen by 14 percent, after adjusting for inflation (see graph). The 2015 funding bills before the House and Senate wouldn’t restore the lost funding — in fact, the House bill would cut deeper. The cuts of recent years have led the IRS to reduce its workforce, severely scale back employee training, and delay much-needed upgrades to information technology systems. These steps, in turn, have weakened the IRS’s ability to enforce the nation’s tax laws and serve taxpayers efficiently, as the National Taxpayer Advocate, the Treasury Inspector General for Tax Administration, the Internal Revenue Service Oversight Board, and the Government Accountability Office all have documented. To cite a few examples:

- The IRS has about 10,400 (11 percent) fewer employees than in 2010, even as its workload has grown. For instance, the number of individual income tax returns has grown by an average of 1.5 million each year over the past decade.

- The number of IRS staff devoted to enforcing tax laws has dropped by 15 percent since 2010. As a result, the IRS is conducting fewer audits. The annual audit rate for individual taxpayers is now below 1 percent, the lowest since 2006, and revenue collected through IRS enforcement actions has fallen by more than $4 billion over the past four years. Weakening IRS enforcement ultimately hurts the entire budget: every additional dollar invested in IRS tax enforcement activities from current levels yields $6 in increased revenue, the Treasury Department reports.

- Taxpayer services have worsened. For example, in 2013, a typical caller to the IRS waited about 18 minutes for an IRS representative to get on the line, and about 40 percent of calls were never answered.

The IRS needs more adequate funding not only to address these problems but also to handle its new and expanding responsibilities. Under health reform, for example, the IRS administers the premium tax credits for millions of near-poor and middle-income taxpayers to help them afford private coverage. Also, the 2010 Foreign Account Tax Compliance Act, which seeks to reduce illegal tax evasion by requiring filers and financial institutions to report more information to the IRS about assets held in offshore accounts, will add to the agency’s workload. The President’s budget would begin to address these challenges by raising IRS funding by $1.2 billion, enough to restore the funding lost since 2010 in nominal — though not inflation-adjusted — dollars. But a bill that a House appropriations subcommittee has approved would cut IRS funding by $340 million below the 2014 level in nominal terms, worsening the IRS’s funding squeeze. The bill’s Senate counterpart provides a modest increase of roughly $240 million, barely enough to keep up with inflation. Both bills would leave the IRS funding far below its 2010 level, after adjusting for inflation. In many ways, the IRS exemplifies the problems caused by the low overall funding levels for non-defense discretionary programs resulting from the tight funding caps and sequestration cuts mandated by the 2011 Budget Control Act. To avoid underfunding important programs — like the IRS, which provides a core government function of collecting revenue — policymakers should reach a budget agreement that provides more adequate overall discretionary funding levels starting no later than fiscal year 2016, much as last December’s Murray-Ryan deal did for fiscal years 2014 and 2015.