BEYOND THE NUMBERS

In Case You Missed It...

This week at CBPP, we focused on federal taxes, state budgets and taxes, family income support, housing, health, and the economy.

- On federal taxes, we released an interactive graphic showing how many children in each state would get just a token increase from the Child Tax Credit proposal that press reports indicate will be included in the conference committee’s tax bill. Joel Friedman and Chad Stone updated their analysis pointing out that the Republican tax plans cost more – and add less to economic growth – than the plans’ proponents claim. Stone also noted that the Treasury Department’s so-called “analysis” of the tax bill assumes what it claims to prove.

- On state budgets and taxes, Michael Leachman lamented that Republican House members from California may settle for a bad “compromise” on the state and local tax (SALT) deduction in the emerging GOP tax bill. Leachman then updated the analysis to reflect the latest on the bill’s SALT deduction changes.

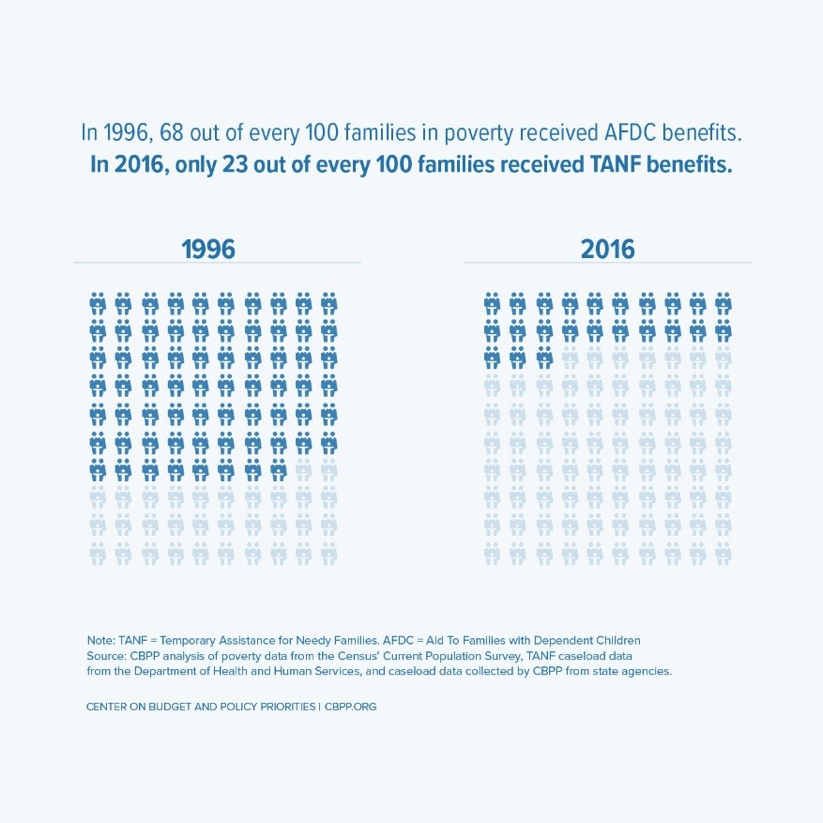

- On family income support, Ife Floyd, LaDonna Pavetti, and Liz Schott found that the Temporary Assistance for Needy Families (TANF) block grant is reaching few poor families who need it. Floyd also summarized the report. Floyd, Pavetti, and Schott issued a policy brief based on the report and related state-by-state fact sheets.

- On housing, Douglas Rice noted that the latest annual count of homeless people shows there’s still work to be done in getting homelessness down. Alicia Mazzara highlighted a report finding that many workers are struggling to pay rent, yet the GOP tax bill threatens housing assistance programs.

- On health, Shelby Gonzales warned that time is running out to get coverage next year through HealthCare.gov. Edwin Park criticized a House GOP spending bill for falling short on the Children’s Health Insurance Program, community health centers, and Puerto Rico. Hannah Katch cited some of the research showing that Medicaid improves access to health coverage and care. Aviva Aron-Dine pointed out that the market stabilization bill from Senators Lamar Alexander and Patty Murray wouldn’t reverse the cost increases from repealing the Affordable Care Act’s (ACA) individual mandate. Tara Straw rebutted arguments for shortening the ACA marketplace’s grace period for catching up on missed premium payments.

- On the economy, we updated our chart book on the legacy of the Great Recession.

Chart of the Week – Only 23 out of 100 Families in Poverty Receive TANF Benefits

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Marco Rubio got a last-minute tax deal — but the poorest Americans got left out

Vox

December 15, 2017

The Republican Tax Bill Provides Huge Benefits to People Who Don’t Work. But Only if They’re Rich.

Mother Jones

December 14, 2017

Susan Collins is enabling a bad tax bill

Washington Post

December 11, 2017

The Middle Class Might Not Even Notice If the GOP Cuts Their Taxes

Bloomberg

December 11, 2017

How many people pay the estate tax in each state

Axios

December 10, 2017

Don’t miss any of our posts, papers, or charts — follow us on Twitter, Facebook, and Instagram.