BEYOND THE NUMBERS

Ahead of tomorrow’s Senate Finance Committee hearing on reducing payment errors in federal benefit programs, here are three ways Congress can reduce errors in the Earned Income Tax Credit (EITC):

-

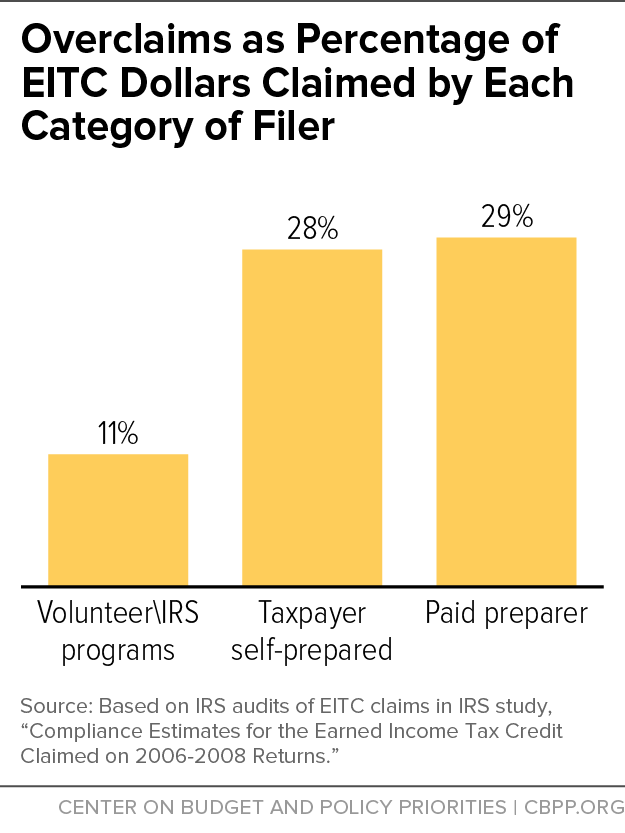

Give the IRS the needed authority to reduce EITC errors by commercial tax preparers. Some 29 percent of EITC dollars claimed by paid preparers in 2006-2008 were overclaims, a major IRS study on EITC compliance issued last year found. That’s a slightly higher share than among people who prepared their own returns (see first chart).

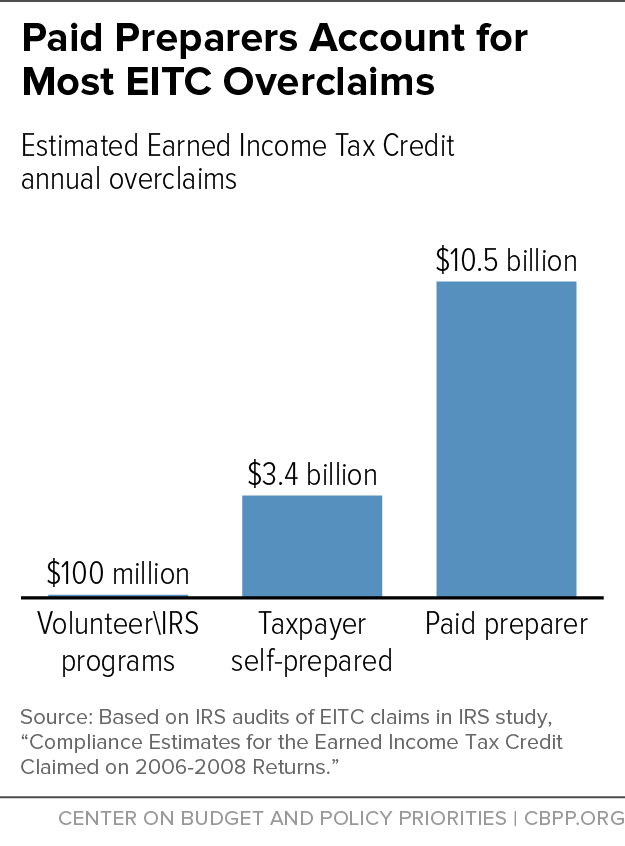

And, since paid-preparer returns made up the large majority (68 percent) of all EITC returns in the IRS study, they accounted for three-quarters of the dollar value of all EITC overclaims (see second chart). That fraction is likely somewhat lower today, since paid-preparer returns now make up around 60 percent of EITC returns. Still, paid-preparer returns continue to account for the substantial majority of the dollar value of all EITC overclaims.

The IRS study also found that the preparers most likely to have EITC overclaims were “unenrolled” preparers. Unlike other paid preparers, such as attorneys and certified public accountants, unenrolled preparers don’t have to meet professional competency requirements.

“[I]n most states, anyone can be an unenrolled preparer regardless of education, experience, or other standards,” the Government Accountability Office (GAO) has found. Accordingly, the IRS launched a major initiative in 2010 to require preparers who lack professional credentials to pass a competency examination in order to be certified to prepare tax returns. Many preparers supported the initiative to improve accuracy, but a small number sued to block the measure. The courts found that the IRS needs legal authority from Congress to implement these safeguards.

By giving the IRS that authority, as both GAO and the President have recommended, Congress can help the IRS reduce EITC errors, promote high-quality services from paid preparers, improve voluntary compliance, and foster taxpayer confidence in the tax system’s fairness.

-

Provide adequate IRS funding. Congress has cut IRS funding by 18 percent since 2010, adjusted for inflation. These cuts have occurred even as the IRS’s responsibilities have grown due to its role in implementing new laws (such as health reform), a significant increase in the number of tax returns filed, and growing threats such as tax-related identity theft. IRS budget cuts can raise budget deficits by making it harder for the IRS to enforce compliance with the EITC rules and other areas of the tax code.

For example, the IRS now identifies a number of questionable EITC returns through data-matching with various databases, but it follows up on only some of them due to lack of resources, so it must pay the claims. The IRS could lower EITC errors if it had more staff to follow up on more of these claims. In another example, the IRS last year identified 18,000 preparers with high error rates in the EITC claims they filed and carried out “real time” interventions with them before and during the 2014 filing season. This strategy averted an estimated $550 million in erroneous claims, according to the IRS. The IRS would like to expand this effort to identify more suspect tax preparers, but that requires adequate funding.

- Enact EITC error-reduction proposals. The President’s 2016 budget includes a number of proposals, such as requiring employers and other third parties to supply information such as W-2s and 1099s earlier in the year to help the IRS detect erroneous or fraudulent refund claims. In addition, Congress can consider several EITC simplification measures that the Bush Administration proposed in the mid-2000s, after a first round of EITC simplifications in 2001 led to a 13 percent drop in overpayments. Various senators and House members have introduced bills with these and other simplifications.

Studies show that the EITC promotes work, reduces poverty, lowers welfare receipt, and improves children’s educational achievement. By reducing EITC errors, policymakers could make this successful program even better.