BEYOND THE NUMBERS

In many states, recent tax collections are higher than last year, exceeding the states’ own projections. The higher-than-expected revenues are welcome — but states should proceed cautiously as they consider what to do with the new funds, as we explain in a new paper.

A closer look into the tax spurt reveals that:

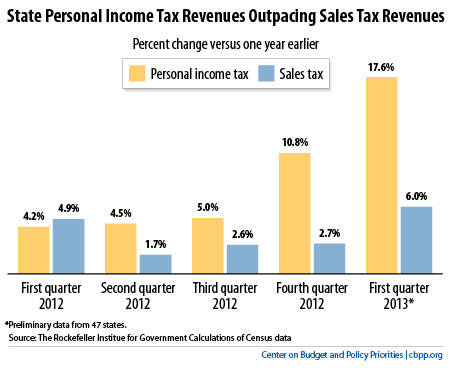

- Income taxes fueled much of the recent growth. With two months left in the fiscal year, the typical state has collected 8.9 percent more personal income taxes than it did in the same period last year. Sales taxes have grown more slowly (see chart).

- Some of the income tax growth reflects the economic recovery, but a portion reflects wealthy taxpayers moving income forward into 2012 in anticipation of 2013 federal tax rate increases.

- Even with this recent growth, state tax revenues have not recovered from the Great Recession. Revenues likely still remain more than 3 percent below pre-recession levels, after adjusting for inflation. And because of the one-time nature of much of the recent revenue growth, revenue growth will likely slow again.

These findings, echoed today by the National Association of State Budget Officers and the National Governors Association in their Fiscal Survey of States, have three important policy implications for states.

First, states without income taxes are missing out on revenue. Part of the recent revenue boost reflects the fact that income taxes grow better with the economy than sales or other taxes. States that are considering repealing or shrinking their income tax would lose out on this advantage now that the economy appears to be in a sustained recovery.

Second, national factors, not state actions, are driving this revenue growth. Income tax revenues are up across much of the country, regardless of whether a state has cut tax rates. So, claims that these revenue gains reflect positive “supply-side” impacts of tax cuts appear unfounded.

Third, states should proceed with caution in using these funds. While both the improving economy and the temporary tax shift clearly have contributed to revenue growth, it remains unclear how much of the increased growth comes from each of those causes. A sound strategy — applicable this year as in other years — is that states should use the higher-than-anticipated year-end balances that often result from revenue surges like these to address one-time spending needs such as paying down debt, boosting reserves, or addressing neglected infrastructure needs, rather than enacting permanent tax cuts or creating new programs.

Click here to read the full paper.