BEYOND THE NUMBERS

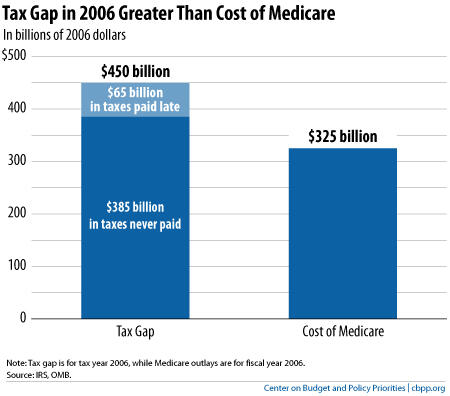

The IRS’s new estimate of the “tax gap,” its first in six years, shows that taxpayers failed to pay $450 billion in federal taxes on time in 2006, $385 billion of which they never paid. That’s real money (more than Medicare cost that year, as the graph shows), particularly for a country facing wrenching choices on how much to raise taxes on honest taxpayers and to cut Medicare, health and science research, education, and other vital priorities in order to rein in long-term deficits.

What is most frustrating about the new figures is that they restate a simple message that isn’t new but that the current Congress has chosen to ignore. In the areas of the tax code with substantial information reporting and withholding requirements — most notably workers’ wages, which employers report to the IRS and on which they withhold income and payroll taxes — compliance is extremely high. But where there is no third-party information reporting or withholding, tax collections are abysmal. Sole proprietors, a major class of small businesses, report less than half of their income to the IRS.

In fact, under-reported business income is the single largest source of the tax gap, amounting to fully $122 billion in 2006 alone.

Eliminating the tax gap would be impossible. Nor can any single measure substantially reduce it. But Congress can — and should — take a number of steps that would boost collection of taxes that are already owed by many billions of dollars.

Not too long ago, there were signs that policymakers of both parties recognized this. The Bush Administration pushed successfully for new withholding requirements on government contractors on the heels of troubling Government Accountability Office investigations showing widespread tax abuse. Then, in the 2010 health reform law, the Obama Administration teamed up with congressional Democrats to tighten reporting requirements on certain business transactions. These were two modest but real steps forward.

The current Congress, however, repealed both measures. To make matters worse, in last year’s deficit-reduction legislation (the Budget Control Act), House Republicans blocked Senate Majority Leader Reid’s effort to ensure sufficient funding for IRS tax compliance activities, even though the Congressional Budget Office concluded that it would have generated net budget savings of $30 billion over a decade.

The new IRS figures are a stark reminder to policymakers that some taxpayers are not paying substantial sums of legally owed taxes and that we know how to address this problem: by expanding information reporting and withholding.