BEYOND THE NUMBERS

The Senate Finance Committee will consider bipartisan legislation tomorrow that would give the IRS the authority to require all paid tax preparers to demonstrate basic competence. Congress should pass this legislation and the President should sign it into law.

While some paid preparers (such as attorneys and certified public accountants) are subject to Treasury Department regulation and must meet professional competency requirements, many others — known as “unenrolled preparers” — aren’t.

The Government Accountability Office (GAO) has found that “in most states, anyone can be an unenrolled preparer regardless of education, experience, or other standards.” And even hairdressers generally must receive training and certification, as IRS National Taxpayer Advocate Nina Olson has pointed out.

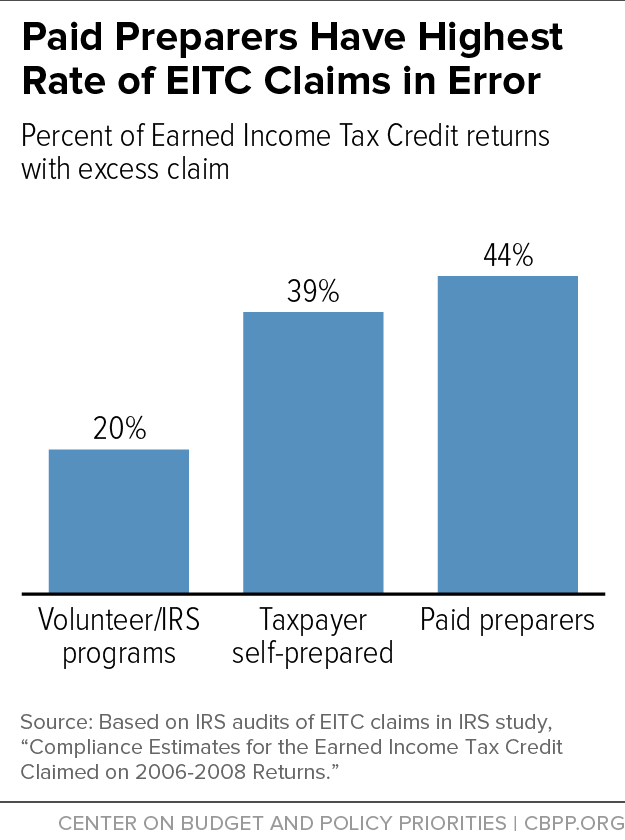

IRS studies show that the rate of error on EITC claims filed by paid preparers is 44 percent (see chart). Unenrolled preparers account for the majority of Earned Income Tax Credit (EITC) returns completed by a paid preparer, IRS research shows. And unenrolled preparers who aren’t affiliated with a national tax preparation firm — those most likely to be working alone without supervision — are most prone to error: 49 percent of their EITC returns contain overclaims, or errors that result in overly large refunds.

Many of these errors are unintentional — the unenrolled preparers simply don’t understand the rules because they aren’t required to learn them. Requiring unenrolled preparers to pass a competency examination will reduce these unintentional errors and allow the IRS to focus greater attention on fraudulent preparers.

The IRS launched a major compliance initiative in 2010 to require preparers who lack professional credentials to pass a competency examination in order to be certified to prepare tax returns. Many preparers supported the initiative to improve accuracy, but a small number brought a lawsuit to block the measure. The courts found that Congress must give the IRS legal authority to implement these important safeguards. Since then, the President, National Taxpayer Advocate, and GAO have all urged Congress to grant the IRS this authority.

Heeding these calls will likely reduce errors, promote high-quality services from paid preparers, improve voluntary compliance, and foster taxpayer confidence in the tax system’s fairness.