The official poverty data that the Census Bureau will release on September 13 will provide useful information concerning developments from 2014 to 2015, but will not provide the best assessment of longer-term trends.

Analysts across the political spectrum agree that comparing the current official poverty rates to those of several decades ago produces limited and often misleading conclusions because the official rate fails to consider the benefits from non-cash benefits such as SNAP (formerly known as food stamps) and refundable tax credits. These non-cash benefits and tax credits provide far more assistance than they did when the official poverty rate was established in the 1960s, and have led to a substantial reduction in economic hardship. To see this, it’s necessary to use the Supplemental Poverty Measure (SPM), which the Census Bureau will also release September 13; the SPM counts the value of many non-cash benefits as well as refundable tax credits. (The SPM data will also show the anti-poverty impact that major safety net programs had last year.)

In addition, those using the poverty data to assess progress in the economy since the end of the recession should keep in mind the shifting role of the safety net. While still much stronger than it was several decades ago, the safety net provides less support than it did during the recession and the early years of the recovery. This factor, as well as changes in the survey questions it asks that Census adopted in 2013, may somewhat obscure recent progress.

The SPM data released next week will allow us to determine the degree to which safety net programs reduced poverty in 2015. Unlike the official poverty measure, which counts only a family’s cash income, the SPM counts non-cash benefits such as food assistance and rental subsidies as well as tax-based assistance such as the Earned Income Tax Credit (EITC).

Our analysis of SPM figures released last year showed that the safety net cut the poverty rate nearly in half in 2014, from 27.3 percent (in the absence of government assistance) to 15.3 percent (after such assistance is taken into account). We’ll update this analysis next week with the 2015 numbers.[1]

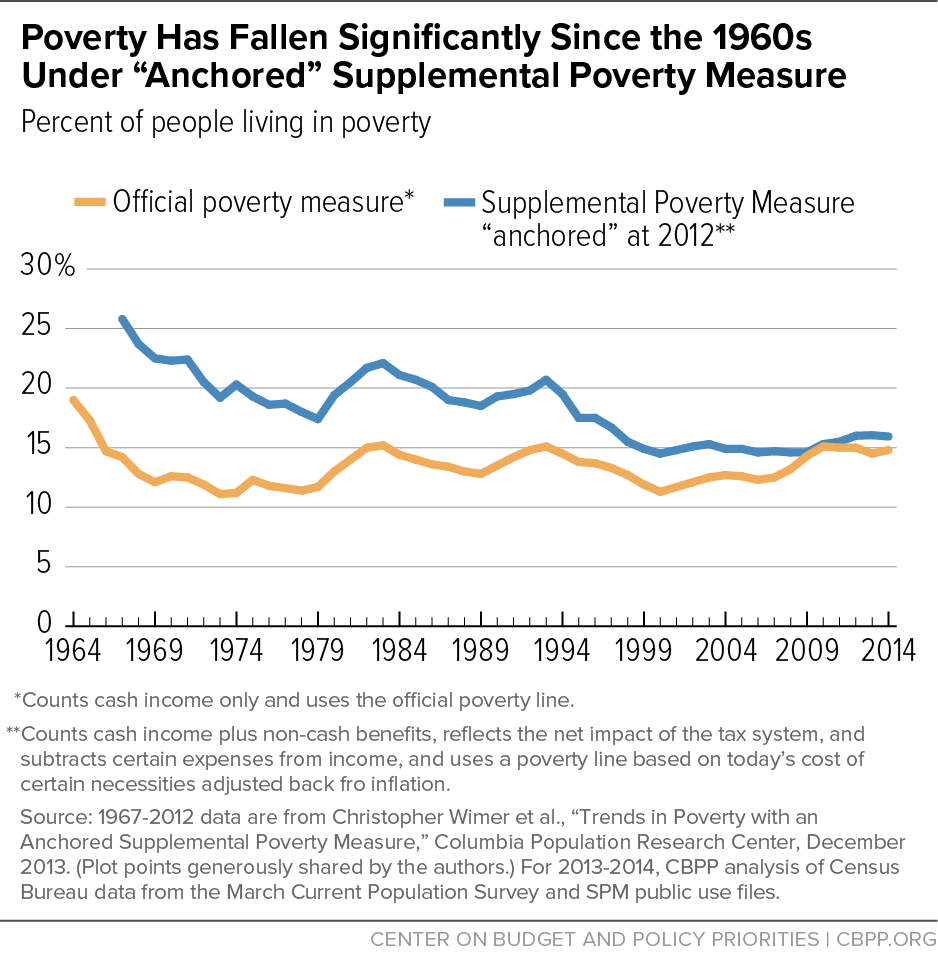

In addition, the SPM permits a more accurate assessment of poverty trends over the decades. Because non-cash and tax-based benefits constitute a much larger part of the safety net than they did 50 years ago, the exclusion of these benefits in the official poverty measure masks progress in reducing poverty in recent decades. Trying to compare poverty in the 1960s to poverty today using the official poverty measure implies that programs like SNAP, the EITC, and rental vouchers — all of which were either much smaller in the 1960s or didn’t yet exist — have no anti-poverty impact, which clearly isn’t the case.

While the federal government has only calculated the SPM back to 2009, Columbia University researchers have estimated the SPM from 1967 to 2012. We have updated their estimates through 2014, and found the safety net is responsible for a decline in the poverty rate from 26 percent in 1967 to 16 percent in 2014, based on an “anchored” version of the SPM that uses a poverty line tied to what American families spend on basic necessities today, adjusted back for inflation. (See Figure 1.) Moreover, this measure shows that when government assistance is excluded, poverty rose modestly during this 47-year period, an indication of the strong and growing role of anti-poverty policies over this time.[2] These findings underscore the importance of using the SPM rather than the official poverty measure when evaluating long-term trends in poverty. (The SPM is not always the best measure for understanding short-term poverty changes, however, as the box explains.)

The new SPM figures, while useful for showing the effectiveness of safety net programs and facilitating long-term poverty comparisons, may be less suited to evaluating year-to-year changes in poverty between 2014 and 2015. This is because the SPM poverty line that Census will report is adjusted each year not for inflation but for changes in spending on basic needs, averaged over the past five years. As a result, the SPM poverty line (and therefore the SPM poverty rate) can sometimes change in confusing ways during and after times of major economic disruption that significantly alter spending patterns, as in the past decade when the Great Recession temporarily reduced many households’ spending on basic needs. In 2015, a return to higher basic-needs spending compared with 2010 means that the SPM poverty lines for 2015 will rise faster than inflation. We estimate that this shift by itself will add about 0.2 percentage points to the 2015 SPM poverty rate, relative to what it would have been otherwise.

We will adjust for this anomaly by providing a comparison on Tuesday between the 2014 and 2015 SPM figures that is anchored to 2015. This approach, as noted earlier, anchors the poverty line by adjusting the latest SPM poverty threshold back to earlier years only for inflation. That will provide a clearer picture of how changing family resources are affecting poverty by using the same poverty lines (in inflation-adjusted terms) in both 2014 and 2015. The Columbia researchers used this approach in creating the poverty series shown in Figure 1, anchored to 2012 (the last year of their analysis).

Whatever the new Census data show about changes in poverty from 2014 to 2015, the positive impact on poverty rates resulting from the improvement in the economy has been offset to a degree by a decline in safety net support. The improvement in poverty may also be obscured to some degree by changes in Census’s methodology.

-

The safety net provides less cash income support than in 2010. Although Census generally includes various government cash benefits when calculating income and poverty status, researchers often calculate alternative poverty rates that exclude those benefits. Between 2010, and 2014, we calculate that the poverty rate fell by 1.1 percentage points (from 24.1 percent to 23.0 percent) if cash benefits — which include unemployment insurance — are excluded, but fell by just 0.3 percentage points (from 15.1 percent to 14.8 percent) if they are included.

Similarly, the poverty rate using an anchored SPM fell by 0.8 percentage points over this period if safety net benefits are excluded but rose by 0.6 percentage points if they are included.

These figures indicate that the safety net does less to reduce poverty than it did in 2010. This decline reflects the expected decline in certain benefits, such as unemployment insurance, as the economy improved. The SPM data also reflect the expiration of temporary increases in certain safety net benefits that were adopted in response to the Great Recession, including a Making Work Pay tax credit created in 2009 and a temporary increase in SNAP benefits.[3]

- Survey changes that Census adopted in 2013 may further obscure recent progress. Census revised the income questions in one of its main surveys (the Current Population Survey or CPS) starting in 2013. Those changes, combined with simultaneous changes in the CPS survey sample, throw doubt on any poverty and income comparisons between 2013, 2014, or 2015 and earlier years if the comparisons are based on CPS data. It is instructive that while the CPS poverty and income figures were statistically unchanged in 2011, 2012, 2013, and 2014, a larger Census survey — the American Community Survey (ACS), which did not change its questions and therefore is probably more reliable for comparisons that include years before 2013 — found the official poverty rate fell and median income rose in 2014.[4] Census will release national, state, and local ACS results for 2015 on an embargoed basis on Tuesday and release them publicly on Thursday.