- Home

- New Bells & Whistles But The Same Engine...

New Bells & Whistles But the Same Engine: Pennsylvania’s Spending Limit Proposals are Powered by the Same Formula as Colorado’s Failed TABOR

Four new proposals in Pennsylvania — Senate Bills 4 and 884 and House Bills 2067 and 2082 — would impose tight limits on state expenditures that would shrink available public services such as education and health care in the same way that Colorado’s TABOR has led to a deterioration in that state. Colorado has the strictest tax and expenditure limit (TEL) in the country; under TABOR, the annual growth in Colorado’s state budget is limited to the rate of growth of state population plus an inflation factor. During the twelve years since TABOR was enacted in that state, there have been substantial reductions in basic public services such as health care, roads, K-12 education and higher education. The problems caused by TABOR led Coloradoans to approve in November 2005 a statewide measure to suspend TABOR’s population-growth-plus-inflation formula for five years in order to allow the state to restore a portion of its fundamental public services.

The same inflation plus population growth formula that has caused such problems in Colorado is used in the new Pennsylvania proposals. [1] If the proposals are adopted, they will over time result in a sharp deterioration in public services in Pennsylvania. As in Colorado, Pennsylvania families may find themselves paying for educational activities, supplies, and even teachers the Commonwealth can no longer afford under the limit, more Pennsylvanians are likely to become uninsured, the likelihood of public health emergencies will increase, and companies will find Pennsylvania a less hospitable place to do business as infrastructure and education deteriorates.

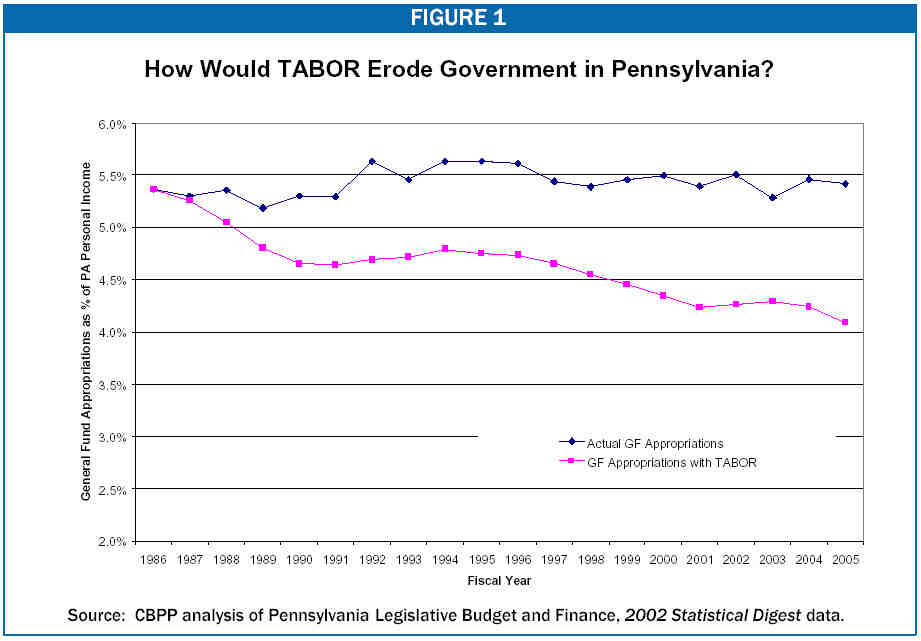

The population-plus-inflation formula is a problem because the cost of many public services, like health care and education, rises faster than inflation, and because populations in need of state services, such as the elderly, are growing faster than the population as a whole. These rising costs normally are manageable because the state’s economy is also growing. Indeed, relative to the economy, Pennsylvania state spending has not grown in more than two decades. State General Fund spending was 5.4 percent of personal income in 1986, 5.4 percent of personal income in 2005, and averaged 5.4 percent over the 20-year period. But the normal growth in the cost of services is not manageable under TABOR, because TABOR would require service provision to shrink as a share of the economy each year.

Proponents of TABOR in Pennsylvania, such as The Commonwealth Foundation and sponsors of the spending limit legislation, contend that their proposals will avoid the problems that TABOR has brought to Colorado. As Pennsylvania House Republican Majority Caucus spokesman Steve Miskin claimed, “We tried to correct what we saw as flaws” in Colorado’s approach.[2] Yet, the additions and tweaks made by the sponsors of Pennsylvania’s legislation are cosmetic and would not change the outcome.

-

The proposed rainy day fund is likely to be insufficient and may not be accessible when needed.

-

Applying the proposal to expenditures rather than revenues has no advantage in a state with a balanced budget requirement. Under a revenue limit, revenues above the limit cannot be spent and thus constitute a limit on expenditures. An expenditure limit directly limits spending; any additional revenues a state collects cannot be spent. The effect is the same.

-

Choosing an inflation measure different from Colorado’s does not make the limit less restrictive. In 11 of the last 13 years, the proposed Pennsylvania measure would have yielded a tighter limit than Colorado’s measure.

-

Applying the limit only to the General Fund is similarly not significantly less restrictive than Colorado. In Pennsylvania, the proposed limit would cover 67 percent of all non-federal state expenditures. Colorado’s TABOR covers 73 percent of all non-federal state expenditures.

None of these changes fix the fundamental flaw inherent in the population-plus inflation formula.

The Population-Growth-Plus-Inflation Formula Is a Faulty Engine

Limiting state budget growth to population change plus inflation shrinks public services over time and severely limits the state’s ability to respond to residents’ needs. Both elements of the formula hinder a state’s ability to provide a constant level of public services and prevent the state from meeting current and emerging needs.

Inflation

“Inflation” as commonly measured does not accurately reflect growth in the costs to government. The measure of inflation in all four Pennsylvania proposals is the nationwide “Consumer Price Index-All Urban Consumers (CPI-U),” which is calculated by the U.S. Bureau of Labor Statistics. The CPI-U measures change in the total cost of a “market basket” of goods and services purchased by a typical urban consumer. Since a typical urban consumer spends a majority of his or her income on housing, transportation, and food and beverages, those items are the primary drivers of the CPI-U. By contrast, Pennsylvania state government spends revenue primarily on education, health care, transportation, and corrections. In short, the market baskets of spending are entirely different.

Pennsylvania’s basket of public services (and every other state’s) is in economic sectors that are less likely to reap efficiency and productivity gains than other sectors of the economy, so it typically faces faster-rising costs than the urban consumers represented by the CPI-U. For example, teachers can only teach so many students, and nurses can only care for so many patients. There is little way to increase those ratios without a significant deterioration in the quality of the services. As it turns out, the items in the “basket of goods” most heavily purchased by governments — such as health care, education, and prescription drugs — have seen significantly greater cost increases in the past decade than the items in the basket of goods that consumers purchase, and those faster-growing costs are expected to continue.

Limiting the growth in government spending to the rate of growth in general inflation will not push down the rate of growth in the cost of medical care or education. Many factors beyond the control of any one state are causing the growth in costs.

Population

The second part of the population-growth-plus-inflation formula is inherently flawed as well. The subpopulations that state governments serve tend to grow more rapidly than the overall population growth used in the formula. An example is senior citizens, who already account for a disproportionately large share of Pennsylvania’s Medicaid costs. According to U.S. Census Bureau projections, Pennsylvania’s total population is projected to increase by only 4 percent from 2000 to 2030, but Pennsylvania’s population aged 65 and older is projected to increase by 51 percent from 2000 to 2030. [3] While total population growth, and thus allowable state spending under a population-plus-inflation formula, is projected to grow slowly in Pennsylvania in the coming decades due to a small increase in overall population, the cost of providing current health services to Pennsylvania residents likely will rise rapidly because of an aging population.

Changing Priorities and Shifting Costs

There is a further problem with the population-plus-inflation formula. Even if existing services could be financed under the formula, the formula would be insufficient to allow funding of new priorities that may be embraced by the public, such as reduced class sizes or more stringent corrections policies. It would not allow states to adapt to federal mandates that require states to spend more in areas such as security and education, and it would not provide for sufficient emergency spending on natural disasters or other unanticipated problems. [4]

It is also important to note that all programs in the Pennsylvania general fund — not just those with cost pressures exceeding the population-growth-plus-inflation level — are threatened by a rigid population-growth-plus-inflation limit. This is because under all four proposals under consideration, a single cap would apply to the General Fund as a whole. So, if one spending area were to grow faster than the rate allowed under the limit (for instance due to court order, federal mandate or popular demand), then another spending area must grow at a slower pace — which is to say that in terms of the level of service provided, that second spending area must actually shrink.

If state General Fund expenditures were constrained by the tight population-plus-inflation limit, costs might be shifted elsewhere. For example, state policymakers might decide to reduce state aid to local governments and school districts — requiring localities to pick up a greater share of the cost of education and local services. Local governments, in turn, would have to cut services or raise taxes to cover the state’s actions.

The Reality of Spending in Pennsylvania

Advocates of TABOR in Pennsylvania claim that the state needs a strict spending limit because there is “runaway growth of government spending” and the state is not “living within our means.”[5]

These are false claims. Pennsylvania state spending is not out of control. Pennsylvania state government spending has changed little as a share of the economy since at least the 1980s. State General Fund spending was 5.4 percent of personal income in 1986, 5.4 percent of personal income in 2005, and averaged 5.4 percent over the 20-year period.[6] In other words, relative to the ability of the state’s citizens to pay for government services, Pennsylvania’s spending has not grown in the past two decades (See Figure 1).

TABOR would reduce spending relative to the state’s means rather than keep it stable. It would require services to be sharply reduced. If state spending had been limited to changes in population plus inflation from 1986 to 2005, spending would have declined from 5.4 percent of personal income to 4.1 percent of personal income.[7] (see Figure 1) The drop would have required General Fund expenditure in 2005 to have been $5.5 billion, or 24 percent, less than actual spending in 2005. Rather than forcing the state to “live within its means,” TABOR would have forced Pennsylvania to devote fewer and fewer of its resources to public services and to cut deeply into education, health care, public safety and other services on which Pennsylvania residents depend.

“The Derailing of Colorado”

A growing body of evidence shows that Colorado’s Taxpayer Bill of Rights, or TABOR, has contributed to a significant decline in that state’s public services. Colorado voters recently chose to suspend TABOR for five years, in part to restore some of the service cuts induced by TABOR. These developments in Colorado have serious implications for the residents of Pennsylvania, because the proposed spending caps would likely lead to similar outcomes.

The strict TABOR limits in Colorado have contributed to deterioration in the availability and quality of nearly all major government services.

- Since its enactment in 1992, TABOR contributed to declines in Colorado K-12 education funding. Under TABOR, Colorado declined from 35th to 49th in the nation in K-12 spending as a percentage of personal income. Colorado’s average per-pupil funding fell by more than $400 relative to the national average. And Colorado’s average teacher salary compared to average pay in other occupations declined from 30th to 50th in the nation.

- TABOR has played a major role in the significant cuts made in higher education funding. Under TABOR, higher education funding per resident student dropped by 31 percent after adjusting for inflation. College and university funding as a share of personal income declined from 35th to 48th in the nation. As a result, tuitions have risen. In the last four years, system-wide resident tuition increased by 21 percent after adjustment for inflation.

- TABOR has led to drops in funding for public health programs. Under TABOR, Colorado declined from 23rd to 48th in the nation in the percentage of pregnant women receiving adequate access to prenatal care, as defined by the federal Centers for Disease Control and Prevention. Colorado plummeted from 24th to 50 th in the nation in the share of children receiving their full vaccinations. Only by investing additional funds in immunization programs was Colorado able to improve its ranking to 43rd in 2004. At one point, from April 2001 to October 2002, funding was so low that the state suspended its requirement that school children be fully vaccinated against diphtheria, tetanus, and pertussis (whooping cough) because Colorado, unlike other states, could not afford to buy the vaccine.

- TABOR has hindered Colorado’s ability to address the lack of medical insurance coverage for many children and adults in the state. Under TABOR, the share of low-income children lacking health insurance has doubled in Colorado, even as it has fallen in the nation as a whole. Colorado now ranks last among the 50 states on this measure. TABOR has also affected healthcare for adults. Colorado has fallen from 20th to 48th for the percentage of low-income non-elderly adults covered under health insurance. In 2002, Colorado ranked 49th in the nation in both the percentage of low-income non-elderly adults and low-income children covered by Medicaid.

Source: David Bradley and Karen Lyons, A Formula for Decline: Lessons from Colorado for States Considering TABOR, Center on Budget and Policy Priorities, October 2005. Available at: https://www.cbpp.org/10-19-05sfp.htm

Click image to enlarge

Bells and Whistles Do Not Change the Engine of TABOR

As part of their campaign to distance the Pennsylvania proposals from Colorado’s TABOR, proponents of TABOR in Pennsylvania have made changes to (in Miskin’s words) “correct the flaws” of Colorado’s TABOR. These changes include using the TABOR mechanism to finance a rainy day fund, imposing the limit on expenditures rather than revenues, using a different measure of inflation, and applying the TABOR formula to General Fund appropriations rather than all appropriations.

Nevertheless, the core feature of Colorado’s TABOR — the population-plus-inflation limit — is not altered in the Pennsylvania bills. For example, House Bill 2082 sets the appropriations limit as the previous year’s level of appropriations, “adjusted by the lesser of the average percentage change in personal income in Pennsylvania or the average percentage change in inflation plus the average percentage change in state population.” [8] Similar language is featured in all four Pennsylvania proposals. That language is simply intended to obfuscate the fact that the inflation plus population change formula will be the operative one under most circumstances. For example, in the past 20 years, there has been only one three-year period — 1991 to 1993 — in which average personal income growth was slightly lower than population-plus-inflation.

Pennsylvania TABOR supporters claim that the Pennsylvania proposals offer “more leeway” than Colorado’s TABOR because they require a portion of state revenue to go to a “rainy day fund.”[9] But the rainy day fund created by any of the four Pennsylvania proposals would make little difference.

The new rainy day fund is capped at 7.5 percent of the general fund appropriations. The current rainy day fund has rarely if ever exceeded 6 percent of appropriations. The new rainy day fund would effectively replace rather than augment the existing fund. The very small increase in the rainy day fund from 6 percent to 7.5 percent of appropriations is unlikely to be much help during a downturn, particularly a downturn of more than one year. For example, in the most recent downturn, the average state entered the most recent downturn with reserves equivalent to 10.4 percent of a year’s expenditures, far more than was on hand in either of the previous two downturns. But those reserves filled only one-fifth of the typical state’s cumulative budget gaps over the several years of the downturn. The inadequacy of Pennsylvania's proposed rainy day fund is particularly likely since in economic downturns, expenditures naturally grow as unemployment rises and the need for state services increases at a rate well above population growth plus inflation. Moreover, the proposals would require a two-thirds majority vote from the General Assembly to use money from the rainy day fund; thus the funds may or may not be accessible when needed.

A second asserted difference between the Pennsylvania proposals and Colorado’s TABOR is that the Pennsylvania TABOR limits state spending growth, not revenue collections.[10] But in a state with a balanced budget requirement, in which expenditures cannot exceed revenues, it makes little difference whether it is revenues or expenditures that are capped. Under a revenue limit, revenues above the limit cannot be spent and thus constitute a limit on expenditures. An expenditure limit directly limits spending; any additional revenues a state collects cannot be spent. The effect is the same. Pennsylvania has a balanced budget requirement, and so would fare the same under a revenue or expenditure limit.

A third purported difference is that the inflation factor in the Pennsylvania proposals is higher, and thus more generous, than the inflation factor in Colorado’s TABOR.[11] This is a misleading claim. Inflation in Colorado’s TABOR is measured by the CPI for the Denver-Boulder-Greeley metropolitan area, whereas the Pennsylvania proposals are based the CPI-U for the U.S. as a whole. Due to a variety of factors, including a booming housing market in Colorado until recently, inflation in the Denver area has been higher than the inflation limit in the Pennsylvania proposals. Since Colorado’s TABOR was adopted in 1992, inflation in the Denver metropolitan area has been higher than in the nation as a whole for 11 of 13 years. Only in 2003 and 2004 did the national CPI-U exceed that for the Denver metropolitan area. Contrary to the claims of Pennsylvania TABOR supporters, the proposed inflation limit would have been more, not less, restrictive than the limit used in Colorado.

A final difference between Pennsylvania’s TABOR proposals and Colorado’s TABOR is that the Pennsylvania proposals apply to General Fund appropriations, whereas Colorado’s TABOR applies to revenues that fund more than the General Fund. The implication of the different bases is that Pennsylvania’s TABOR provides greater leeway since it purportedly covers a smaller base. The breadth of coverage, however, is not as different as it first appears. In fiscal year 2006, general fund appropriations comprise about 67 percent of all non-federal expenditure in Pennsylvania (federal funds are excluded from both the Pennsylvania proposals and Colorado’s TABOR). In Colorado, TABOR covers about 73 percent of all non-federal state revenue. So, the Pennsylvania proposals are nearly as restrictive as Colorado’s TABOR in their coverage of funding for public services.

Conclusion

The proposed spending limits in Pennsylvania are based on a formula of population change plus inflation and thus would significantly hinder the state’s ability to cope with unanticipated changes, initiate policy changes, accommodate voter and court mandates, or even maintain current service levels. Despite assertions that they have “fixed the flaws” of Colorado’s TABOR, proponents of these measures are pushing legislation that retains TABOR’s central flaw — its formula. New bells and whistles don’t change the fact that if any of these become law in Pennsylvania the fiscal crisis experienced in Colorado is likely to be experienced in Pennsylvania as well. Policymakers would be wise to pause before replacing deliberative, legislative budget processes with an inflexible and unrealistic formula.

End Notes

[1] The growth formula in House Bill 2067 is more restrictive than the three other proposals. Its formula allows only for an inflation adjustment, rather than a population-plus-inflation adjustment.

[2] Bureau of National Affairs, Daily Tax Report, November 18, 2005, No. 222, page H-1.

[3] U.S. Census Bureau, State Interim Population Projections by Age and Sex: 2004-2030, Table 4. Available at http://www.census.gov/population/projections/PressTab4.xls

[4] One of the four Pennsylvania proposals — House Bill 2067 — specifically excludes from the limit appropriations required by federal law, court orders, pension obligations, and all debt. The three other Pennsylvania proposals do not identify any such exceptions.

[5] For example, Steve Miskin, spokesman for the Pennsylvania House Republican Majority Caucus noted, “It [TABOR] … just means living within our means.” quoted in “PA Bills Would Cap Budget Increases,” Philadelphia Inquirer, November 19, 2005. Quotation on “runaway spending” is from Dr. Jim Broussard, Citizens Against Higher Taxes, cited in “Here’s What Supporters Say About the Taxpayer Fairness Act,” available at http://www.pasenategop.com/news/TFAcharts/TFAquotes.pdf

[6] Using personal income as a base for measuring state spending is the best indicator of a state’s “means.” Personal income measures the ability of the state, on average, to pay for government services.

[7] Spending data for Figure 1 are from the Commonwealth of Pennsylvania Executive Budget documents, various years. To calculate state spending under a population-plus-inflation TABOR, the previous year’s allowable spending limit was multiplied by the sum of the percent growth in population plus inflation.

[8] The “average” in the formula refers to a three-year average. This does not affect the restrictiveness of the formula itself, but just smooths its effects out over time.

[9] “PA Bills Would Cap Budget Increases,” Philadelphia Inquirer, November 19, 2005. Also, the Commonwealth Foundation has noted the importance of a “rainy day fund” in correcting Colorado’s problems with TABOR. The proposals vary in their requirements for rainy day fund deposits but all four require some contribution to a fund.

[10] Noted by Steve Miskin, Pennsylvania House Republican Spokesman, in Peter L. DeCoursey, “House GOP Disputes Comparisons of Spending-Cap Bill to Colorado Law,” Capitolwire, October 31, 2005.

[11] Ibid.

More from the Authors