- Home

- Improving The Refundable Child Tax Credi...

Improving the Refundable Child Tax Credit

An Important Step Toward Reducing Child Poverty

Because of their potential impact in reducing child poverty and hardship, proposals to improve the refundable Child Tax Credit have garnered significant bipartisan support. In the Senate, Olympia Snowe (R-ME) and Blanche Lincoln (D-AR) have introduced legislation that would begin to address key flaws in the credit's structure. In the House, Ways and Means Committee Chairman Charles Rangel’s tax reform proposal would make even larger improvements, as would legislation introduced by Representatives Christopher Carney (D-PA) and Todd Platts (R-PA). A temporary version of Chairman Rangel’s measure is included in the tax "extenders" bill scheduled adopted last week by the House Ways and Means Committee.

The Problem: Current Credit Leaves Out Millions of Low-Income Children

The Child Tax Credit is a $1,000 per-child tax benefit intended to defray some of the costs associated with raising children. In general, tax credits can be either refundable or nonrefundable. If a credit is nonrefundable, it is available only to tax filers who can use it to reduce positive income tax liability. Thus, nonrefundable tax credits have no value for those with incomes too low to owe taxes, a group that includes millions of low-income working parents.

In contrast, if a credit is fully refundable, a tax filer can receive a refund for the amount by which the credit exceeds his or her federal income tax liability, meaning that all households who meet the eligibility criteria for the credit can benefit. If a household has no federal income tax liability, it receives the entire credit as a refund.

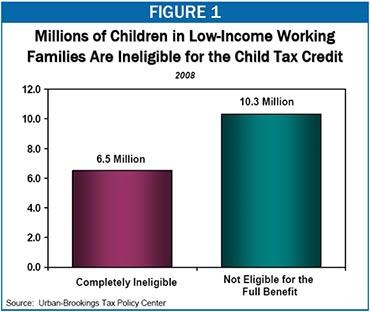

The Child Tax Credit falls in between these two categories; it is partially refundable. While the credit does benefit millions of families with incomes too low to owe taxes, millions of others are left out or qualify for only a partial credit. In total, some 6.5 million children in low-income working families will be ineligible for the Child Tax Credit in 2008, according to estimates by the Urban Institute-Brookings Institution Tax Policy Center. An additional 10.3 million children will receive less than the full credit amount.[1] (See Figure 1.)

The refundable Child Tax Credit works as follows. If a taxpayer’s Child Tax Credit exceeds her income tax liability, she can receive a refund for the remainder, but the refund cannot be more than 15 percent of her earnings in excess of $12,050 (in 2008). For example, a single parent with earnings of $11,000 could not receive the refundable Child Tax Credit, since her earnings are below $12,050. A parent with earnings of $13,050 could receive a refund of up to $150 (15% x [$13,050 - $12,050]). If this individual had one child, she would be missing out on $850 of the credit due to her low earnings. If she had two children, she would be missing out on $1,850.

As a result of the Child Tax Credit’s current structure:

- Working-poor families cannot qualify for the full credit; as Table 1 shows, families need earnings well above the poverty line to receive the full benefit. In 2008, a single parent with two children would need earnings of $22,630,[2] while a married couple with two children would need earnings of $25,190.

- Full-time minimum wage workers with children will not qualify for the full Child Tax Credit even when the minimum wage increases to $7.25 an hour in 2009 (at which point an individual working 40 hours a week, 50 weeks a year at minimum wage will have annual earnings of $14,500). A parent with one child earning $14,500 in 2009 will qualify for a credit of only $323 that year.

- Low-income workers who experience periods of joblessness — including parents moving from welfare to work and those completing training programs and entering the workforce — are often rendered ineligible for the credit due to insufficient earnings. (Most low-wage workers work full time or close to full time in the weeks when they are employed, but many experience periods of joblessness over the course of the year, in part because low-wage jobs typically lack paid sick leave and other benefits that can help working parents weather family illnesses and other challenges.)

The Child Tax Credit’s unavailability to millions of low-income children substantially reduces its effectiveness in combating child poverty and hardship. For example, the credit lifts about 1.2 million fewer people out of poverty than it would if it phased in from the first dollar of earnings, and 2.6 million fewer people than it would if it were fully refundable.[3]

| Table 1: | |||

| Earnings Needed to Benefit At All | 2008 Poverty Line (estimated) | Earnings Needed to Benefit in Full in 2008 | |

|---|---|---|---|

| Single Parent, One Child | $12,050 | $14,698 | $17,230 |

| Single Parent, Two Children | $12,050 | $17,180 | $22,630 |

| Single Parent, Three Children | $12,050 | $21,700 | $28,030 |

| Married Couple, Two Children | $12,050 | $21,624 | $25,190 |

| Source: CBPP estimates based on CBO inflation projections. | |||

Current Structure Also Punishes Working Parents Whose Earnings Stagnate

The earnings threshold for the refundable Child Tax Credit is indexed for inflation. The 2001 threshold of $10,000 has gradually risen to $12,050 (for 2008) and is projected to rise to $12,650 by 2010.

In general, the purpose of indexing tax parameters for inflation is to make sure that families do not see their tax burdens increase just because their incomes have grown to keep up with inflation. The underlying principle is that tax burdens should rise only if real income (adjusted for inflation) increases.

The result of indexing the Child Tax Credit threshold, however, is to reduce tax benefits for workers whose real incomes fall. Many low-income families have not seen income gains commensurate with inflation over the past few years. Instead of cushioning the blow for these families, the tax system has compounded their difficulties by reducing their Child Tax Credit each year.

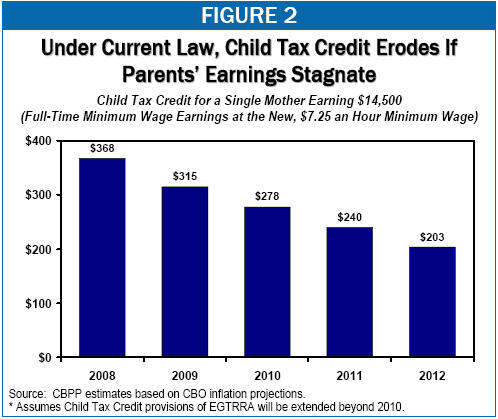

To see the problem, consider the case of a single mother working full time at $7.25 an hour, beginning in 2008. ($7.25 an hour is the new minimum wage, which takes effect in 2009.) As Figure 2 shows, in 2008 she is eligible for a Child Tax Credit of $368. By 2010, if she is still working at minimum wage, her Child Tax Credit falls to $278. The value of the Child Tax Credit for full-time minimum wage workers will continue to decline in future years (as long as the minimum wage is not increased or indexed for inflation). Meanwhile, each year, some children lose access to the credit altogether because their parents’ earnings stagnate. For example, a parent working full-time at the $5.15 an hour minimum wage that prevailed until this year would have received a small Child Tax Credit in 2001 but lost access to the credit in 2004.

Congressional Proposals Would Extend Child Tax Credit to Millions More Children and Protect Workers Whose Earnings Stagnate

Several proposals introduced in Congress would make important improvements in the refundable Child Tax Credit, extending it to several million more low-income children. These bills would de-index the earnings threshold for refundability, meaning that it would cease to increase with inflation in future years. They also would lower the threshold. The Snowe/Lincoln Senate legislation (S. 218) would return the threshold to its 2001 level of $10,000. (Notably, a $10,000 threshold without indexing was precisely the policy the Senate adopted in 2001; the indexing of the threshold was added in conference.) The Rangel tax reform bill (H.R. 3970) would lower the threshold to $8,500, while the Carney/Platts House bill (H.R. 2126) would lower it still further, to $5,000. The tax “extenders” bill (H.R. 6049) adopted by the House Ways and Means Committee last week would lower the threshold to $8,500 for 2008.

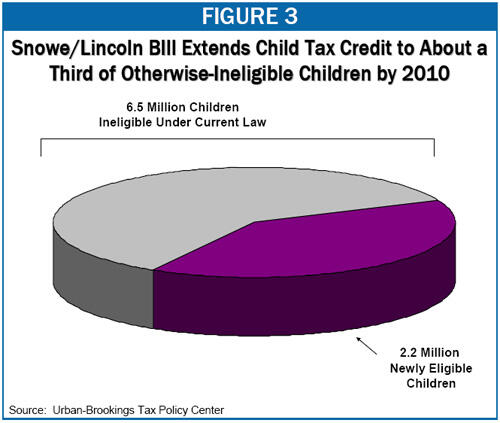

In 2008, returning the refundability threshold to $10,000 would extend the benefits of the Child Tax Credit to 1.8 million children who would otherwise be ineligible, according to Tax Policy Center estimates. Moreover, the number of children who would gain access to the credit would increase each year, as the gap between the $10,000 threshold and the threshold that would be in place under current law (with inflation indexing) increased. By 2010, the Snowe/Lincoln proposal would reach 2.2 million low-income children.

Reducing the threshold to $8,500 for 2008, as the House-passed AMT legislation would do, would extend the credit to 2.9 million otherwise-ineligible children. The proposal also would provide an increased tax benefit to about 10 million additional children because, with a lower earnings threshold, they would qualify for a larger refundable credit. For example, a family with earnings of $13,000 will qualify for a $143 refundable credit [15% x ($13,000 - $12,050)] if the earnings threshold rises to $12,050 next year as scheduled, but a $743 credit if the threshold is lowered to $8,500 [15% x ($13,000 - $8,500)]. (For further discussion of whom the House-passed provision would help, see the box below.)

For state-by-state estimates of the effects of the Snowe/Lincoln and House-passed proposals, see Appendix Tables 1 and 2.

Families Helped by the Child Tax Credit Provision Work Hard in Low-Paying Jobs

Census data* provide important information about the families that would benefit from the Child Tax Credit provision included in the House AMT patch bill and about the jobs the parents hold:

- Most of the children helped live in families in which a parent works throughout the year. Some 70 percent of the children who would benefit live in families in which a parent works 30 or more hours per week for at least 50 weeks during the year. A majority of the remaining families experienced periods of unemployment during the year, but when employed worked at least 30 hours per week.

- Many of the children helped live in families that include individuals with disabilities. Nearly one in ten children — 1.1 million children — who would benefit live in a family where either a parent or a child has a disability. An expanded CTC would provide assistance to these families in which parents struggle to maintain jobs and meet the health and other expenses they incur due to the disability.

- The parents who would be assisted work in a broad range of low paying jobs; many perform difficult jobs that provide critical services, such as caring for the elderly or teaching young children.

- 480,000 parents provide health care services to the elderly or the ill as nursing home workers, home health aides, personal care assistants, medical assistants, and other low-paid health care professionals.

- 240,000 parents provide child care, serve as teaching assistants, or are preschool or kindergarten teachers.

- 310,000 parents earn a living by cleaning or maintaining the grounds of homes, office buildings, schools, or other community institutions.

- 410,000 parents work as cashiers in grocery stores and a broad array of other businesses.

- 470,000 parents work as cooks, waiters or waitresses, or assist cooks with food preparation.

- 360,000 parents earn a living as construction workers, carpenters, or painters.

- 120,000 parents work as laborers in the agriculture sector.

* All of the figures presented here are CBPP calculations based on the March 2006 Current Population Survey. Estimates of the number of children who would benefit from the CTC provisions that are based on the March 2006 Current Population Surveyare somewhatlower than thosecomputed by the Tax Policy Center. Because TPC hasmore complete data on tax filing units and tax filers’ taxable income than are available from the Census Bureau,the TPC figures on the total number of children who would benefit aregenerally considered more accurate than the estimates using the March CPS data. Thus, the estimateswe compute from the March CPS datawereadjusted to match the TPC figures for the total number of children helped. (The TPC data do notprovide information about the characteristics of those helped; that information is only available from the detailed information collected by the Census Bureau.)

For state-by-state estimates of the effects of the Snowe/Lincoln and House-passed proposals, see Appendix Tables 1 and 2.

| TABLE 2: | ||

| State | Children Newly Eligible for the Credit | Children Receiving a Larger Credit |

|---|---|---|

| Alabama | 39,000 | 166,000 |

| Alaska | 4,000 | 17,200 |

| Arizona | 58,800 | 250,200 |

| Arkansas | 25,900 | 110,100 |

| California | 344,600 | 1,465,700 |

| Colorado | 29,800 | 126,900 |

| Connecticut | 14,600 | 62,100 |

| Delaware | 4,700 | 20,000 |

| D.C. | 3,300 | 14,200 |

| Florida | 130,100 | 553,400 |

| Georgia | 71,800 | 305,200 |

| Hawaii | 9,000 | 38,300 |

| Idaho | 14,500 | 61,500 |

| Illinois | 86,500 | 368,100 |

| Indiana | 43,900 | 186,600 |

| Iowa | 17,600 | 74,800 |

| Kansas | 20,300 | 86,600 |

| Kentucky | 28,100 | 119,500 |

| Louisiana | 37,500 | 159,600 |

| Maine | 6,400 | 27,200 |

| Maryland | 27,200 | 115,800 |

| Massachusetts | 24,300 | 103,500 |

| Michigan | 62,300 | 265,000 |

| Minnesota | 26,200 | 111,300 |

| Mississippi | 26,800 | 114,000 |

| Missouri | 42,300 | 179,900 |

| Montana | 6,500 | 27,600 |

| Nebraska | 11,400 | 48,700 |

| Nevada | 19,800 | 84,100 |

| New Hampshire | 3,400 | 14,500 |

| New Jersey | 44,100 | 187,500 |

| New Mexico | 20,100 | 85,700 |

| New York | 123,200 | 524,100 |

| North Carolina | 72,300 | 307,500 |

| North Dakota | 3,300 | 14,100 |

| Ohio | 70,700 | 300,600 |

| Oklahoma | 30,500 | 129,800 |

| Oregon | 26,100 | 111,200 |

| Pennsylvania | 69,400 | 295,400 |

| Rhode Island | 6,000 | 25,400 |

| South Carolina | 34,200 | 145,600 |

| South Dakota | 5,200 | 22,000 |

| Tennessee | 44,800 | 190,400 |

| Texas | 257,200 | 1,093,900 |

| Utah | 25,100 | 107,000 |

| Vermont | 3,400 | 14,400 |

| Virginia | 38,100 | 162,200 |

| Washington | 40,200 | 170,900 |

| West Virginia | 13,800 | 58,600 |

| Wisconsin | 30,200 | 128,600 |

| Wyoming | 2,900 | 12,400 |

| United States | 2,202,000 | 9,365,000 |

| Source: Tax Policy Center national estimate, distributed by state based on CBPP analysis of the 2005 American Community Survey | ||

| TABLE 2: | ||

| State | Children Newly Eligible for the Credit | Children Receiving a Larger Credit |

|---|---|---|

| Alabama | 52,711 | 182,594 |

| Alaska | 5,271 | 18,259 |

| Arizona | 77,017 | 266,760 |

| Arkansas | 33,677 | 116,657 |

| California | 458,589 | 1,588,565 |

| Colorado | 40,705 | 141,003 |

| Connecticut | 19,620 | 67,965 |

| Delaware | 6,443 | 22,317 |

| D.C. | 4,685 | 16,231 |

| Florida | 169,555 | 587,343 |

| Georgia | 96,638 | 334,755 |

| Hawaii | 11,128 | 38,548 |

| Idaho | 18,742 | 64,922 |

| Illinois | 114,794 | 397,648 |

| Indiana | 58,568 | 202,882 |

| Iowa | 22,256 | 77,095 |

| Kansas | 27,527 | 95,354 |

| Kentucky | 37,191 | 128,830 |

| Louisiana | 50,662 | 175,493 |

| Maine | 8,492 | 29,418 |

| Maryland | 35,141 | 121,729 |

| Massachusetts | 32,213 | 111,585 |

| Michigan | 88,145 | 305,337 |

| Minnesota | 34,848 | 120,715 |

| Mississippi | 36,898 | 127,816 |

| Missouri | 55,347 | 191,723 |

| Montana | 8,200 | 28,403 |

| Nebraska | 14,935 | 51,735 |

| Nevada | 26,649 | 92,311 |

| New Hampshire | 4,685 | 16,231 |

| New Jersey | 58,568 | 202,882 |

| New Mexico | 27,234 | 94,340 |

| New York | 161,355 | 558,940 |

| North Carolina | 96,345 | 333,741 |

| North Dakota | 4,393 | 15,216 |

| Ohio | 94,588 | 327,654 |

| Oklahoma | 40,119 | 138,974 |

| Oregon | 34,848 | 120,715 |

| Pennsylvania | 91,659 | 317,510 |

| Rhode Island | 8,492 | 29,418 |

| South Carolina | 45,390 | 157,233 |

| South Dakota | 7,028 | 24,346 |

| Tennessee | 60,032 | 207,954 |

| Texas | 344,967 | 1,194,974 |

| Utah | 31,041 | 107,527 |

| Vermont | 4,685 | 16,231 |

| Virginia | 50,954 | 176,507 |

| Washington | 52,711 | 182,594 |

| West Virginia | 17,863 | 61,879 |

| Wisconsin | 40,412 | 139,988 |

| Wyoming | 4,393 | 15,216 |

| United States | 2,928,412 | 10,144,093 |

| Source: Tax Policy Center national estimate, distributed by state based on CBPP analysis of the 2005 American Community Survey | ||

End Notes

[1] For a discussion of racial disparities in who receive the Child Tax Credit, see Leonard E. Burman and Laura Wheaton, “Who Gets the Child Tax Credit?” Tax Notes, October 17, 2005, http://www.urban.org/UploadedPDF/411232_child_tax_credit.pdf.

[2] A filer at this earnings level would apply $410 of the credit against income tax liability and would be eligible to receive the remaining $1,590 as a refund, for a total credit of $2,000 (i.e. $1,000 per child).

[3] CBPP estimate based on analysis of the March 2006 Current Population Survey.

More from the Authors