- Home

- House AMT "Patch" Bill Is Fiscally Respo...

House AMT "Patch" Bill is Fiscally Responsible

Also Includes Child Tax Credit and Carried Interest Provisions That Would Make the Tax Code More Fair

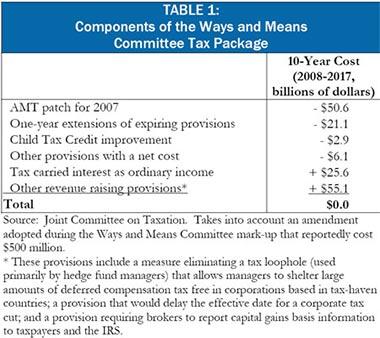

Later this week, the House of Representatives is expected to vote on legislation that would “patch” the Alternative Minimum Tax for 2007 (H.R. 3996). This analysis highlights three praiseworthy features of the tax package, which was adopted by the Ways and Means Committee November 1.

- The cost of the package is fully offset. Its adoption by the Ways and Means Committee last week marked the first time in at least seven years that the Committee voted out major tax legislation that would not increase the deficit. [1]

- The largest and most controversial offset in the bill would enhance the equity and efficiency of the tax code. The offset would change the tax treatment of “carried interest,” eliminating an unwarranted tax break for managers of private equity funds.

- The bill includes an important fix to the Child Tax Credit. This provision would temporarily address key flaws in the credit, making it available to millions more children in low-income working families next year.

Adherence to PAYGO is Highly Commendable

Pay-As-You-Go budget rules, which require that the costs of any increases in entitlement spending or reductions in tax revenues be offset, were reinstated in the House and Senate earlier this year, and to date Congress has lived by those rules. Some have suggested, however, that Congress should waive the PAYGO rules and deficit finance the AMT patch. (The AMT patch is the temporary increase in the AMT exemption level that Congress has provided each year since 2001 to keep the number of AMT taxpayers from rising sharply.) One claim that has been made to justify waiving PAYGO is that the AMT patch — with its $51 billion price tag — is just too expensive to offset.

The Ways and Means Committee tax package establishes definitively that Congress can, if it chooses, provide AMT relief, extend expiring tax provisions, and live by PAYGO. It should put to rest claims that offsetting the cost of the patch is not possible.

PAYGO Rules Even More Important When Legislation in Question Is Costly

The PAYGO rules reflect a few basic principles:

- Things worth doing are worth paying for: program expansions and tax cuts should be enacted only if they are valuable enough that it is worth scaling back other programs or raising taxes to pay for them.

- Given the massive fiscal challenges the nation faces in coming decades, it is irresponsible to foist the cost of new budget and tax policies off on future policymakers and taxpayers; rather, policymakers should face up to these costs now.

- Large, persistent deficits have costs for the economy; policymakers should therefore avoid adding to deficits and should pay for desired policy changes when they enact them.

Each of these points takes on greater significance when the program expansions or tax cuts in question are large. The Ways and Means Committee should be commended for recognizing this and fully offsetting the cost of one of the largest bills yet to be considered in this Congress.

Most Controversial — And Largest — Offset in Package Is Sound Policy in Its Own Right

Probably the most controversial offset in the Ways and Means Committee tax package is the “carried interest” provision. [2] The managers of private equity funds, as part of their contractual arrangement with investors, typically receive a “carried interest” equal to 20 percent of fund profits: that is, they obtain the right to receive 20 percent of the profits ultimately earned by the fund without contributing 20 percent of the fund’s financial capital. Under current law, carried interest income is often taxed at the 15 percent capital gains rate, rather than at the 35 percent regular income tax rate that would normally apply to compensation earned by very high-income individuals. The Ways and Means Committee tax package would eliminate this tax break.

Opponents of the carried interest measure have claimed it shows that PAYGO rules send lawmakers fishing for tax increases. The implication is that PAYGO leads Congress to adopt revenue raisers that, considered on their own merits, are poor tax policy.

The carried interest provision, however, is sound tax policy in its own right. In fact, the provision showcases one of the major benefits of the PAYGO rules: they lead policymakers to scrutinize existing tax (and expenditure) policies more carefully than they otherwise would.

In addition to raising $26 billion over ten years, eliminating the tax break for carried interest would:

- Make the tax code more equitable. A private equity fund manager who earns $500 million this year in the form of carried interest (a high but far from unprecedented figure for such managers), has no other income, and claims no deductions or exemptions, pays an effective federal income and payroll tax rate of only 15 percent. By comparison, the effective tax rate for a single individual who earns a $45,000 salary — taking into account individual income taxes and the employee side of the payroll tax — will be 20 percent. (The rate is higher if the employer share of the payroll tax is counted as well.) As billionaire financier Warren Buffett has said, there is something questionable about a tax provision that makes it possible for individuals with multi-million dollar incomes to pay tax at lower rates than their secretaries [3] — especially at a time when income concentration is rising rapidly, and the compensation paid to financial industry managers has played a role in this trend. [4]

- Likely make the tax code more efficient, as well. Carried interest income is compensation for management services rendered, not a capital gain on a financial investment. Yet it is being taxed more lightly than almost all other forms of compensation for similar services. Generally speaking, a tax system is more efficient when it treats like activities alike: rather than having tax rates determine how people allocate their resources, it is better for the tax system to create a level playing field. Thus, Congressional Budget Office Director Peter Orszag testified to the Senate Finance Committee, “[The tax treatment of carried interest is] important [because]… anytime you have similar activities taxed in different ways, you create distortions… So an executive in a financial services firm or a manager of a public mutual fund is taxed in a different way for those services than a general partner in a private equity or a hedge fund, and that should be of concern to tax policymakers because of the distortions it can create...” [5] Similarly, Harvard economist Greg Mankiw, former Chair of the Council of Economic Advisors under President George W. Bush, has written that, from an economic perspective, carried interest should be taxed the same as other compensation for services. [6]

It is worth noting that changing the tax treatment of carried interest would do significantly less to enhance efficiency and fairness if, as some have proposed, there are carve-outs or special exceptions for particular industries. The benefits of the carried interest provision in the Ways and Means Committee tax package arise from the fact that it would move the tax system closer to taxing like forms of income alike. It would eliminate an arbitrary tax break that benefits extremely high-income individuals, and it would enable people to make more rational economic decisions. Rather than deciding where to invest, what industry to work in, or what type of compensation to pay based on a tax break, investors and managers could make these decisions based on what activities have the highest economic value. If the tax break were preserved for certain recipients of carried interest and not others, however, some inequities and inefficiencies would remain. In addition, preserving the tax break for some industries and not others could create incentives and opportunities for tax avoidance schemes, reducing the revenue gains from the provision and introducing another source of inequity and inefficiency.

Package Would Provide Relief to Low- and Moderate-Income Working Families Too

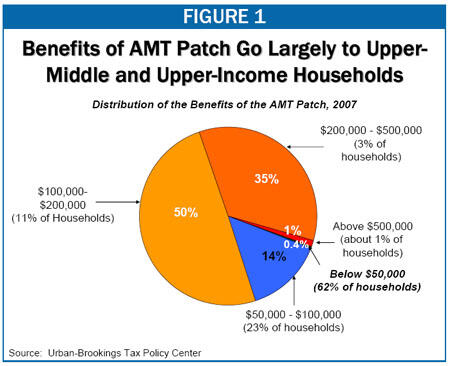

The AMT patch is generally described as a “middle-class tax cut.” But while many middle-income people would be affected, the large majority of the benefits of the patch would go to upper-middle- and upper-income households. As Figure 1 shows, 86 percent of the benefits would go to the 15 percent of households with incomes over $100,000 a year, and 35 percent of the benefits would go to the 4 percent of households with incomes over $200,000. Virtually none of the benefits would go to low- and moderate-income households. (The tax “extenders” — i.e., other expiring tax provisions that the Ways and Means Committee tax bill would extend for one year — are a more diverse collection of provisions, but they, too, would be of little or no value to low- and moderate-income families.)

Low- and moderate-income families, however, also are affected by problems in the tax code. In particular, under current law, 6.5 million children in low-income working families will not be eligible for the Child Tax Credit in 2008, and an additional 10 million will be eligible for less than the full credit, according to Urban Institute-Brookings Institution Tax Policy Center estimates. Moreover, some families that qualify for the credit this year will lose access to it in 2008.

These problems result from the structure of the credit.

Credit Is Only Partially Refundable

The Child Tax Credit is a $1,000 per-child tax benefit intended to defray some of the costs associated with raising children. In general, tax credits are either refundable or nonrefundable. If a credit is nonrefundable, it is available only to tax filers who can use it to reduce income taxes they otherwise owe. Nonrefundable tax credits thus have no value for people with incomes too low to owe income tax, a group that includes millions of low-income working parents. In contrast, if a tax credit is fully refundable, a tax filer can receive a refund for the amount by which the credit exceeds his or her federal income tax liability, which means that all households who meet the eligibility criteria for the credit can benefit. If a household has no federal income tax liability, it simply receives the credit as a refund check.

The Child Tax Credit falls in between these two categories: it is partially refundable. If a taxpayer’s Child Tax Credit exceeds her income tax liability, she can receive a refund for the remainder, but the refund cannot be more than 15 percent of her earnings in excess of $12,050 (in 2008). For example, a single parent with earnings of $11,000 could not receive the refundable Child Tax Credit since her earnings are below $12,050. A parent with earnings of $13,050 could receive a refund of $150 (15% x [$13,050 - $12,050]). If this individual had one child, she would be missing out on $850 of the credit due to her low earnings. (The Child Tax Credit is worth $1,000 per child for most households.) If she had two children, she would be missing out on $1,850.

Earnings Threshold for the Child Tax Credit Is Indexed for Inflation

The earnings threshold for the refundable Child Tax Credit is indexed for inflation and therefore rises each year. Thus, the 2001 threshold of $10,000 has gradually risen to $12,050 for 2008 and is projected to rise to $12,650 by 2010.

Normally, the purpose of indexing parameters of the tax code for inflation is to make sure that families do not see their tax burdens increase merely because their incomes have grown to keep up with inflation. The underlying principle is that tax burdens should rise only if real income (i.e., income adjusted for inflation) increases. (The key problem with the AMT is that it violates this principle.)

Families Helped by the Child Tax Credit Provision Work Hard in Low-Paying Jobs

Census data* provide important information about the families that would benefit from the Child Tax Credit provision included in the House AMT patch bill and about the jobs the parents hold:

- Most of the children helped live in families in which a parent works throughout the year. Some 70 percent of the children who would benefit live in families in which a parent works 30 or more hours per week for at least 50 weeks during the year. A majority of the remaining families experienced periods of unemployment during the year, but when employed worked at least 30 hours per week.

- Many of the children helped live in families that include individuals with disabilities. Nearly one in ten children — 1.1 million children — who would benefit live in a family where either a parent or a child has a disability. An expanded CTC would provide assistance to these families in which parents struggle to maintain jobs and meet the health and other expenses they incur due to the disability.

- The parents who would be assisted work in a broad range of low paying jobs; many perform difficult jobs that provide critical services, such as caring for the elderly or teaching young children.

- 480,000 parents provide health care services to the elderly or the ill as nursing home workers, home health aides, personal care assistants, medical assistants, and other low-paid health care professionals.

- 240,000 parents provide child care, serve as teaching assistants, or are preschool or kindergarten teachers.

- 310,000 parents earn a living by cleaning or maintaining the grounds of homes, office buildings, schools, or other community institutions.

- 410,000 parents work as cashiers in grocery stores and a broad array of other businesses.

- 470,000 parents work as cooks, waiters or waitresses, or assist cooks with food preparation.

- 360,000 parents earn a living as construction workers, carpenters, or painters.

- 120,000 parents work as laborers in the agriculture sector.

* All of the figures presented here are CBPP calculations based on the March 2006 Current Population Survey. Estimates of the number of children who would benefit from the CTC provisions that are based on the March 2006 Current Population Survey are somewhat lower than those computed by the Tax Policy Center. Because TPC has more complete data on tax filing units and tax filers’ taxable income than are available from the Census Bureau, the TPC figures on the total number of children who would benefit are generally considered more accurate than the estimates using the March CPS data. Thus, the estimates we compute from the March CPS data were adjusted to match the TPC figures for the total number of children helped. (The TPC data do not provide information about the characteristics of those helped; that information is only available from the detailed information collected by the Census Bureau.)

But the result of indexing the Child Tax Credit threshold for inflation is to reduce tax benefits for workers whosereal incomes fall. Many low-income families have not seen income gains commensurate with inflation over the past few years. Instead of cushioning the blow for these low-income working families, the tax system compounds their difficulties by reducing their Child Tax Credit each year.

Ways and Means Committee Tax Package Provides a Temporary Solution

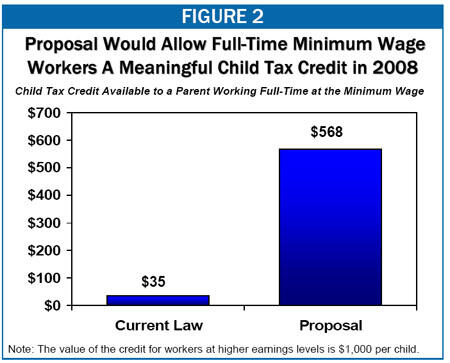

Much as it would patch the AMT for one year, the Ways and Means Committee tax bill would provide temporary relief to low- and moderate-income working families affected by flaws in the Child Tax Credit. Specifically, the package would reduce the earnings threshold for the Child Tax Credit from $12,050 to $8,500 for 2008.

The Ways and Means provision would allow 2.9 million otherwise-ineligible low-income children to qualify for the credit next year. (For further information about who would be helped, see the box above for state-by-state estimates, see Appendix Table 1 below.) The proposal also would provide an increased tax-credit benefit to about 10 million additional children, because with a lower earnings threshold, they would qualify for a larger refundable credit. For example, at an earnings threshold of $8,500, a parent working full time at the minimum wage in 2008 would be able to receive a credit of $568. [7] In contrast, under current law, a full-time minimum wage worker would qualify for a tax credit of just $35. (See Figure 2.)

As with the AMT patch, this temporary improvement in the refundable Child Tax Credit is fully paid for. Its cost is $2.87 billion, or about one-twentieth the cost of the AMT patch.

Fiscally Responsible, Progressive, Permanent AMT Reform Is Badly Needed

While the Ways and Means Committee deserves praise for offsetting the cost of this year’s AMT patch, the manner in which the patch is offset points to the need for a more permanent solution to the AMT problem.

The Ways and Means Committee tax package offsets the cost of a one-year AMT patch with a series of permanent offsets. Since the patch expires at the end of 2007, Congress will presumably want to renew it next year. But at that point, it will not be possible to simply extend the offsets used to pay for this year’s patch: the full savings from those offsets will already have been used up. Moreover, the supply of offset measures will have been somewhat depleted. This year’s offsets are already controversial: it will be even harder to find enough politically viable offsets to pay for a patch next year.

This reality points to the need for legislation that would resolve the AMT problem once and for all and do so in a fiscally responsible manner. Ways and Means Committee Chairman Rangel laid out one approach to such reform recently, when he introduced major tax legislation that would repeal the AMT and offset the cost with an income-tax surcharge on high-income taxpayers. Those who oppose that proposal should come to the table with their own options for reforming or repealing the AMT on a permanent, deficit-neutral basis.

|

APPENDIX TABLE 1: |

||

| State | Children Newly Eligible for the Credit | Children Receiving a Larger Credit |

| Alabama | 52,711 | 182,594 |

| Alaska | 5,271 | 18,259 |

| Arizona | 77,017 | 266,760 |

| Arkansas | 33,677 | 116,657 |

| California | 458,589 | 1,588,565 |

| Colorado | 40,705 | 141,003 |

| Connecticut | 19,620 | 67,965 |

| Delaware | 6,443 | 22,317 |

| D.C. | 4,685 | 16,231 |

| Florida | 169,555 | 587,343 |

| Georgia | 96,638 | 334,755 |

| Hawaii | 11,128 | 38,548 |

| Idaho | 18,742 | 64,922 |

| Illinois | 114,794 | 397,648 |

| Indiana | 58,568 | 202,882 |

| Iowa | 22,256 | 77,095 |

| Kansas | 27,527 | 95,354 |

| Kentucky | 37,191 | 128,830 |

| Louisiana | 50,662 | 175,493 |

| Maine | 8,492 | 29,418 |

| Maryland | 35,141 | 121,729 |

| Massachusetts | 32,213 | 111,585 |

| Michigan | 88,145 | 305,337 |

| Minnesota | 34,848 | 120,715 |

| Mississippi | 36,898 | 127,816 |

| Missouri | 55,347 | 191,723 |

| Montana | 8,200 | 28,403 |

| Nebraska | 14,935 | 51,735 |

| Nevada | 26,649 | 92,311 |

| New Hampshire | 4,685 | 16,231 |

| New Jersey | 58,568 | 202,882 |

| New Mexico | 27,234 | 94,340 |

| New York | 161,355 | 558,940 |

| North Carolina | 96,345 | 333,741 |

| North Dakota | 4,393 | 15,216 |

| Ohio | 94,588 | 327,654 |

| Oklahoma | 40,119 | 138,974 |

| Oregon | 34,848 | 120,715 |

| Pennsylvania | 91,659 | 317,510 |

| Rhode Island | 8,492 | 29,418 |

| South Carolina | 45,390 | 157,233 |

| South Dakota | 7,028 | 24,346 |

| Tennessee | 60,032 | 207,954 |

| Texas | 344,967 | 1,194,974 |

| Utah | 31,041 | 107,527 |

| Vermont | 4,685 | 16,231 |

| Virginia | 50,954 | 176,507 |

| Washington | 52,711 | 182,594 |

| West Virginia | 17,863 | 61,879 |

| Wisconsin | 40,412 | 139,988 |

| Wyoming | 4,393 | 15,216 |

| United States | 2,928,412 | 10,144,093 |

|

Source: Tax Policy Center national estimate, distributed by state based on CBPP analysis of the 2005 American Community Survey |

||

End Notes

[1] Other tax bills adopted by Ways and Means during this Congress have also been paid for, but were far smaller.

[2] The carried interest issue is discussed in greater detail in Aviva Aron-Dine, “An Analysis of the ‘Carried Interest’ Controversy,” Center on Budget and Policy Priorities, revised August 1, 2007, https://www.cbpp.org/7-31-07tax.htm. That analysis also addresses some of the main arguments that have been made for maintaining the current tax treatment of carried interest.

[3] Tom Bawden, “Warren Buffett Says Rich Should Pay More Taxes,” London Times, June 27, 2007, http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article1995931.ece

4] Steven N. Kaplan and Joshua Rauh, “Wall Street and Main Street: What Contributes to the Rise in the Highest Incomes?” National Bureau of Economic Research Working Paper No. 13270, July 2007, http://www.nber.org/papers/w13270.

[5] Transcript of Senate Finance Committee Hearing, “Carried Interest: Part I,” July 11, 2007, obtained through Federal News Service.

[6] “The Taxation of Carried Interest,” http://gregmankiw.blogspot.com/2007/07/taxation-of-carried-interest.html.

[7] The minimum wage will stand at $5.85 an hour until July 24, 2008, when it will increase to $6.55 an hour. (On July 24, 2009, it will increase to $7.25 an hour.)

More from the Authors