- Home

- 2007 Farm Bill: Description Of The House...

2007 Farm Bill: Description of the House Agriculture Committee Nutrition Provisions

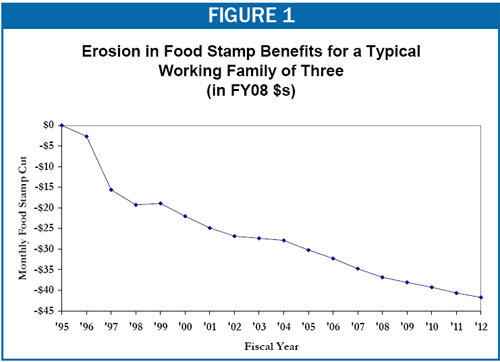

A straight extension of the farm bill with no policy changes, as some in Congress are reportedly advocating if the Senate cannot reach an agreement on floor debate, would lock in food stamp benefit cuts that affect more than 10 million food stamp recipients — including many low-income working families, seniors, and people with disabilities. These cuts grow deeper with each passing year, shrinking the purchasing power of food stamps, because certain aspects of the Food Stamp Program’s rules do not take into account the effects of inflation.

Both the House and Senate farm bills would, if enacted, address each of the inflation-related cuts (and would make additional improvements in Food Stamp benefits, eligibility, and program oversight).[1]

The biggest of the cuts involves the Food Stamp Program’s standard deduction, which has been frozen for most households since 1995. Overall, food stamp benefits average only about $1 per person per meal. The freeze in the standard deduction is the deeper of two across-the-board cuts in food stamps that were enacted in the mid-1990s, and is the one that grows deeper each year.

- In the current fiscal year (2008), a typical working parent with two children is receiving about $37 less in food stamps each month — $444 on an annual basis — than the family would have received without these benefit cuts.

- By 2012, the average benefit cut for a typical family will reach almost $42 a month, or about $500 a year (in 2008 dollars). By 2012 the benefit cuts will cost a typical working parent of two the equivalent of more than one and a half months’ worth of food stamps each year.

- If the farm bill had been enacted before the beginning of fiscal year 2008, under either the House or Senate bill, this typical family would be receiving an additional $4 to $5 a month in 2008, rising to $8 to $11 a month by 2012. As a result of indexing the standard deduction, the food stamp benefit’s purchasing power would no longer shrink each year and some of the lost ground since the mid-1990s would be made up.

Other areas where a straight extension of the Food Stamp Program would lock in continued erosion of food stamp benefits or eligibility limits as a result of failure to adjust for inflation are below. The House and Senate farm bills as currently drafted are in agreement about addressing benefit erosion in every one of these areas.

-

The $10 minimum benefit has not been adjusted for inflation in 30 years. As a result, many elderly individuals, couples, and people with disabilities, can purchase only one-third as much food as they could when the minimum benefit went into effect. The House and Senate bills would raise the minimum benefit to $16 and would adjust the value for inflation in later years.

-

The food stamp asset limit has been frozen since 1986 at $2,000 for most households and $3,000 for households with elderly or disabled members[2]. The House bill would begin indexing the asset limits for inflation. The Senate bill would raise the asset limits to $3,500 and $4,500, respectively, and index them to inflation in future years.

-

The dependent care deduction is capped and has had no adjustment for inflation since 1993, despite the fact that the child care costs that many working families face have more than doubled over that period. Both the House and Senate farm bills would eliminate the cap, so that working families could deduct the full amount of child care costs they incur to work.

-

The funding available for commodity purchases for The Emergency Food Assistance Program (TEFAP) is frozen, so that food banks and the food pantries, soup kitchens, and other emergency feeding sites that food banks support receive fewer resources each year. Funding for commodity purchases for TEFAPwould increase from $140 million to $250 million in 2008 under both the House and Senate farm bills. In the House bill that amount would be adjusted for inflation in future years to preserve its purchasing power.

Because these Food Stamp Program rules do not keep pace with inflation, the food purchasing power of millions of low-income households that receive food stamps shrinks with each passing year. The Farm Bill provides an opportunity to correct this problem, and the House and Senate are in agreement that ending benefit erosion is a significant priority for the 2007 farm bill. If Congress does not make these improvements and instead extends current law, it will lock in food stamp cuts that are built into the Food Stamp Program rules.

(9pp.)

End Notes:

[1] The House passed its 2007 farm bill in July. In the Senate, the Agriculture Committee-passed bill was brought to the floor in early November. A cloture motion that would have limited debate and allowed the bill to move toward final passage failed shortly before the Thanksgiving recess. The Food Stamp Program continues to be funded by a temporary “continuing resolution”.

[2] The 2002 farm bill extended the $3,000 asset limit to households with members who have disabilities. Previously, it applied only to households with elderly members.

More from the Authors