Statement by Chad Stone, Chief Economist, on the October Employment Report

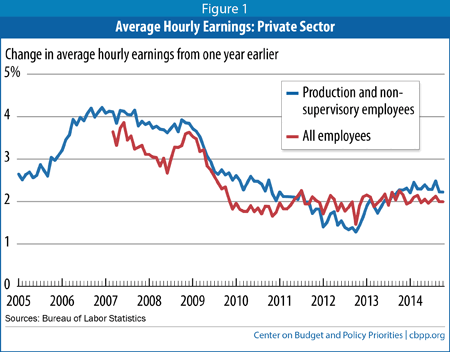

Today’s solid jobs report shows the labor market continues to improve in important ways but that wage growth continues to languish (see chart) — suggesting that the Federal Reserve should wait until the labor market improves enough to boost wages before raising interest rates.

Average hourly earnings of production and non-supervisory (non-management) employees on private payrolls were 2.2 percent higher in October than a year earlier, before adjusting for inflation. Average hourly earnings of all employees on private payrolls (for which we only have data that go back to the mid-2000s) are growing even more slowly. Inflation has been modest as well, but over the course of the economic recovery, real (inflation-adjusted) wages have hardly grown and are lagging behind increases in workers’ productivity. Consequently, the share of businesses’ earnings going into owners’ pockets has been expanding at the expense of workers’ paychecks.

Over a normal business cycle, profits fall more than earnings in a recession and bounce back faster as the economy begins to recover, followed by a recovery in wages. The jobs slump in the wake of the Great Recession was so deep and protracted, however, that wages have yet to bounce back.

Although unemployment has fallen substantially, other labor market indicators suggest that the amount of “slack” in the labor market (people not currently working but who want to be or people who want to be working more hours than they now are) is larger than what the unemployment rate alone suggests. Economists are now debating how much of the sharp declines in labor force participation and in the share of the population with a job reflects reversible slack and how much reflects the normal retirement patterns of an aging population. Ongoing wage weakness suggests that slack remains an important element of the story.

Strong demand for goods and services is the cure for labor market slack and sluggish wage growth. The Federal Reserve has stressed that its decision to begin “normalizing” monetary policy by raising short-term interest rates will depend on how inflation and labor market conditions behave over the coming year. If we see inflation at the Fed’s target of 2 percent and productivity returns to about 1.5 percent annual growth, wage growth could increase to something like 3.5 percent without threatening employers’ normal profit margins.

The Fed seems willing to wait until we are on such a path before raising rates. Lawmakers should similarly forgo near-term budget cuts that would throw us off that track.

About the October Jobs Report

Employers reported solid payroll growth in October. In the separate household survey, the unemployment rate fell to 5.8 percent, as the labor force grew, employment rose, and unemployment fell. Average hourly earnings rose modestly.

- Private and government payrolls combined rose by 214,000 jobs in October and the Bureau of Labor Statistics revised job growth in the previous two months upward by a total of 31,000 jobs. Private employers added 209,000 jobs in October, while overall government employment rose by 5,000. Federal government employment fell by 3,000, while state government rose by 1,000 and local government rose by 7,000.

- This is the 56th straight month of private-sector job creation, with payrolls growing by 10.6 million jobs (a pace of 189,000 jobs a month) since February 2010; total nonfarm employment (private plus government jobs) has grown by 10.0 million jobs over the same period, or 179,000 a month. Total government jobs fell by 554,000 over this period, dominated by a loss of 313,000 local government jobs.

- The job losses incurred in the Great Recession have been erased. There are now 1.8 million more jobs on private payrolls and 1.3 million more jobs on total payrolls than at the start of the recession in December 2007. Because the working-age population has grown since then, however, the number of jobs remains well short of what is needed to restore full employment. Employers have expanded their payrolls at a 229,000-a-month pace this year, and such growth must continue to restore normal labor market conditions in a reasonable period of time.

- Average hourly earnings on nonfarm payrolls rose by 3 cents in October to $24.57. Over the last 12 months they have risen just 2.0 percent. For production and non-supervisory workers, average hourly earnings rose 4 cents to $20.70, or 2.2 percent higher than a year earlier.

- The unemployment rate fell to 5.8 percent in October, and 9.0 million people were unemployed. The unemployment rate was 4.8 percent for whites (0.4 percentage points higher than at the start of the recession), 10.9 percent for African Americans (1.9 percentage points higher than at the start of the recession), and 6.8 percent for Hispanics or Latinos (0.5 percentage points higher than at the start of the recession).

- The recession drove many people out of the labor force, and the ongoing lack of job opportunities has kept many potential jobseekers on the sidelines and not counted in the official unemployment rate. October’s strong increases in the number of people in the labor force (up 416,000) and the number with a job (up 683,000), together with a drop of 267,000 in the number of unemployed, were all encouraging signs of an incipient improvement. (Data on the number of people with a job and the number of jobs on employers’ payrolls come from separate surveys.)

- The labor force participation rate (the share of the population aged 16 and over in the labor force) edged up to 62.8 percent in October. The sharp decline in labor force participation during the recovery appears over, but prior to recent years, the labor force participation rate hasn’t been this low since the 1970s. October’s rate remains among the lowest since 1978.

- The share of the population with a job, which plummeted in the recession from 62.7 percent in December 2007 to levels last seen in the mid-1980s and has remained below 60 percent since early 2009, edged up to 59.2 percent in October.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking (those marginally attached to the labor force) and people working part time because they can’t find full-time jobs — fell to 11.5 percent in October. That’s well down from its all-time high of 17.2 percent in April 2010 (in data that go back to 1994) but still 2.7 percentage points higher than at the start of the recession. By that measure, about 18 million people are unemployed or underemployed.

- Long-term unemployment remains a significant concern. More than three in ten (32.0 percent) of the 9.0 million people who are unemployed — 2.9 million people — have been looking for work for 27 weeks or longer. These long-term unemployed represent 1.9 percent of the labor force. Before this recession, the previous highs for these statistics over the past six decades were 26.0 percent and 2.6 percent, respectively, in June 1983, early in the recovery from the 1981-82 recession. A year after peaking at 2.6 percent, however, the long-term unemployment rate had dropped to 1.4 percent, well below the current rate.

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.