Statement by Chad Stone, Chief Economist, on the March Employment Report

With the continued sharp deterioration in the labor market in March, the pace of job losses in this recession now is far worse than even during the deep 1981-82 recession. Thus, Congress acted wisely this week in rejecting calls to cut federal spending in 2010, at a time when the economy clearly will still be quite weak and need continued strong stimulus.

Congress must not undermine the effectiveness of stimulus spending that it included in the economic recovery act just as it is starting to take effect in the economy. The time for deficit reduction will come once a solid economic recovery is underway. Right now, however, the top priority is turning the economy around so that a recovery can start.

Moreover, for the recovery act to stem the tide of job losses and lay the groundwork for a strong recovery as quickly and effectively as possible, federal, state, and local governments must get programs up and running quickly. In particular, states must use the money that Congress provided to them as intended so that it will have maximum effectiveness as stimulus. (See the Center on Budget and Policy Priorities analysis, “If States Fail to Use Stimulus Funds as Intended, Efforts to Strengthen the Economy Could Be Undercut,” available at https://www.cbpp.org/2-24-09sfp.htm .)

About the Jobs Report

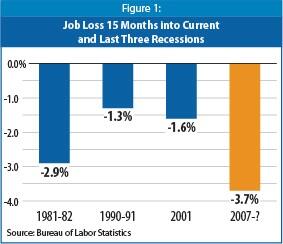

The recession that began in December 2007 has entered its 16th month, and the pace of job losses is far worse than it was even in the deep 1981-82 recession (see chart). Given the depth of the recession, stimulus will continue to be important in fiscal years 2010 and 2011. Congress should continue to reject efforts to undo the provisions of the recovery act that provide such stimulus.

The bad news in today’s jobs report is pervasive.

- Private and government payrolls combined have shrunk for 15 straight months, and net job losses since the start of the recession total 5.1 million. (Private sector payrolls have shrunk by 5.3 million jobs over the same period.)

- Job losses have averaged 667,000 a month over the last five months, accounting for almost two-thirds of the job losses so far.

- The official unemployment rate, which was 4.9 percent at the start of the recession in December 2007, reached 8.5 percent last month.

- Other indicators show the breadth of labor market weakness. For example, the percentage of the population with a job (59.9 percent) has fallen to its lowest level since July 1985.

- The Labor Department’s most comprehensive alternative unemployment rate measure — which includes people who want to work but are discouraged from looking and people working part time because they can’t find full-time jobs — stood at 15.6 percent in March, up 6.9 percentage points since the recession began and the highest level on record in data that go back to 1994.

- Almost one-quarter (24.2 percent) of the 13.2 million unemployed have not been able to find a job despite looking for 27 weeks or more. (Regular unemployment insurance benefits typically run out after 26 weeks.)

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.