off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

Broadening state sales taxes to cover more services makes sense for several reasons, as my new report on estimating the revenue impact of such a step points out:

- It can generate substantial revenue. States could generate $50-$100 billion annually by taxing all services that households buy except health care, education, housing, and a few others. States that tax very few services, like California, Illinois, Massachusetts, and Virginia, probably could increase their sales tax revenue by more than one-third if they taxed most of the services that households consume.

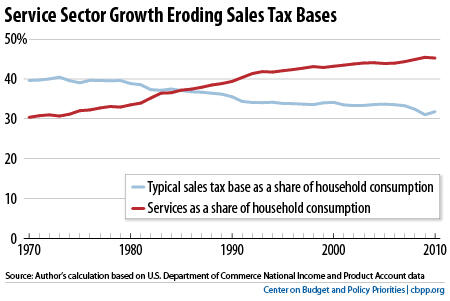

- It is essential to prevent the long-term erosion of sales tax revenue. For decades, household spending has been shifting from goods, which are largely taxable, to services, which are mostly tax exempt (see graph). If this trend continues, states will need to include services in the tax base to maintain sales tax revenues over the long term.

- It can reduce the year-to-year volatility of sales tax collections. Sales tax bases are dominated by purchases of “big-ticket” durable goods (such as cars, appliances, and furniture), which often decline sharply during economic downturns. Purchases of some services do not rise and fall as sharply in response to changes in the economy. Including more services in the sales tax base thus could slightly moderate the volatility of sales tax revenues over the course of the business cycle.

- It will make the sales tax fairer. The sales tax is intended to be a general tax on consumption. There is little reason to distinguish between consumption of goods and consumption of services, which in fact can substitute for one another. For example, it is unfair to tax the person who rents a DVD of a movie but not the person who watches the same movie on pay-per-view.

Image

For details on the issues involved in expanding the sales tax base, see

.

Topics:

Stay up to date

Receive the latest news and reports from the Center