BEYOND THE NUMBERS

Social Security’s trustees will release their annual review of the program’s finances on Friday. We’re not sure what the report will say, but fluctuations from year to year in the trustees’ long-term estimates are normal. A variety of economic and demographic uncertainties affect Social Security, and the actuaries constantly improve their methods.

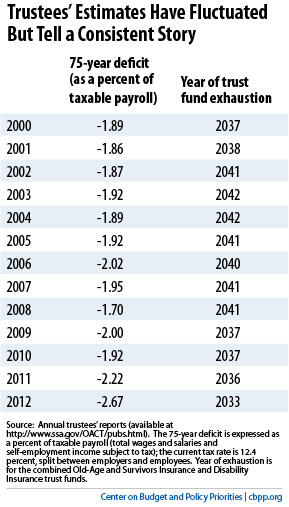

The estimated gap between Social Security’s tax revenues and its expenditures over the next 75 years has fluctuated within a narrow band of 1.70 to 2.67 percent of taxable payroll since the 2000 report (see table). (Taxable payroll is the total wages and self-employment income subject to Social Security taxes.)

The estimated year in which Social Security’s combined trust funds — the Old-Age and Survivors Insurance (OASI) trust fund and the Disability Insurance (DI) trust fund — will be exhausted has ranged in those reports between 2033 and 2042. It’s important to remember that, even after the combined trust funds are exhausted, Social Security could still pay about three-fourths of scheduled benefits using its payroll tax income — a fact that news stories often overlook.

The new report will note that the DI trust fund, which is legally separate from the much larger OASI trust fund, faces exhaustion sooner. (Last year the trustees forecast that would happen in calendar 2016; more recently, the Congressional Budget Office projected DI trust fund depletion early in fiscal year 2017, which begins in October 2016.) But traditionally, Congress has shifted tax rates between the OASI and DI funds as necessary to address such challenges. That’s why analysts usually focus on the outlook for the combined trust funds.

Policymakers shouldn’t address DI in isolation. Instead, they should aim at a balanced package of Social Security reforms that achieves overall long-term solvency while preserving and even strengthening the program’s vital role in protecting breadwinners and their families.

You can find our analysis of last year’s report and our other Social Security analyses here.

We’ll be back soon with a preview of what to look for in the Medicare trustees’ report, and on Friday with our initial reaction to the new reports.