BEYOND THE NUMBERS

Senate Republicans vowed this week to block all legislation until the Senate “prevented the tax increase that is currently awaiting all American taxpayers.” But despite all the public attention to the ongoing tax debate, few seem to recognize that the major GOP tax proposals that have been put forward — such as those from Senate Minority Leader Mitch McConnell and from Congressman Mike Pence and Senator Jim DeMint — wouldn’t extend President Obama’s expiring tax cuts, only President Bush’s.

This means that under these proposals, millions of middle- and low-income working families would each lose tax cuts worth hundreds of dollars or more starting in January.

Letting Obama’s tax cuts for low- and middle-income families expire also would weaken the economy by reducing consumer spending. People living paycheck to paycheck spend most of what they have to feed their families, pay the mortgage or rent, and cover other expenses; when their taxes go up, their spending goes down significantly. High-income people don’t reduce their spending as much in response to a tax increase because they save rather

than spend a larger share of their income than less-affluent people do. That’s why the Congressional Budget Office found that, on a dollar-for-dollar basis, extending the Obama tax cuts would have more than double the positive impact on a weak economy than extending the high-end Bush tax cuts would.

Below are the tax cuts that the Republican plans omit. They’ll all expire at the end of December unless Congress extends them.

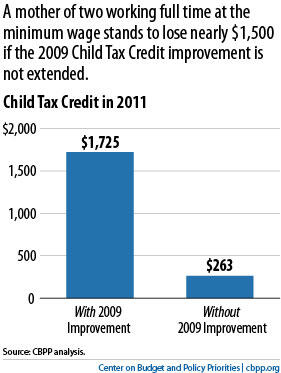

- Child Tax Credit expansion. The 2009 Recovery Act allowed low-income working families to count more of their earnings in calculating the value of their Child Tax Credit. If Congress doesn’t extend this provision, 10.7 million families will lose part or all of their child credit. For example, a single mother with two children who works full time, year round at the minimum wage and earns around $14,000 — someone who is trying to support her family through work rather than welfare — would see her child credit plummet by nearly $1,500, from $1,725 to $263 (see graph).Image

- EITC improvements for married couples and larger families. Some low-income working couples receive a smaller Earned Income Tax Credit if they marry than if they had remained single. The Recovery Act included marriage penalty relief that reduced this financial penalty by allowing married couples to receive somewhat larger EITC benefits. Families with nearly 5 million adults and more than 8 million children will be affected if this change expires.The Recovery Act also expanded EITC benefits for families with three or more children. Prior to 2009, these families — which make up a disproportionate share of all low-income working families — received the same EITC benefits as families with two children. The Recovery Act, by boosting EITC benefits for larger families, strengthened work incentives for more than 3 million low-income working families with children.

- Making Work Pay. Created in the Recovery Act, this tax credit reduces the amount the federal government withholds from the paychecks of more than 90 percent of working Americans; it’s worth up to $800 per couple. If Congress doesn’t extend it, working families would see their paychecks go down starting on January 1. For example, a nurse and a machinist who have two children and earn a combined $65,000 would have an extra $800 withheld from their paychecks over the course of 2011. (The tax bill that the House passed yesterday didn’t extend Making Work Pay, but it did extend the child credit and EITC improvements.)

Given that tax cuts aimed at low- and middle-income families have much more bang for the buck in boosting the economy than costly high-end tax cuts, it’s hard to see why we should let the former expire and extend the latter. Which President signed the tax cut shouldn’t be the deciding factor.