BEYOND THE NUMBERS

The Need to Rebalance Federal Housing Policy, Part 2: Affordability Worsening For Low-Income Renters

The first installment of this blog series explained why it’s the right time to establish a federal renters’ tax credit. Today, we look at the affordability problems that low-income renters encounter.

Over the past several decades, the nation’s housing policy has focused predominantly on increasing homeownership — particularly for people who typically could afford to buy a home without subsidies. Meanwhile, low-income renters have increasingly struggled to afford housing.

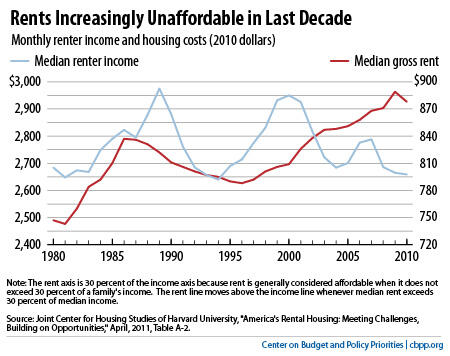

More than 7 million low-income families without rental assistance pay more than half their income for housing, the threshold for being considered “severely cost burdened.” That number is up 42 percent since 2001 and is part of a long-term trend of worsening renter affordability (see chart).

Moreover, renters are far more likely than homeowners to struggle with severe housing cost burdens, even at the same income levels. Renters are more than twice as likely as owners to pay more than half their income for housing, according to Harvard University’s Joint Center for Housing Studies. While the rates of severely cost-burdened households among both renters and owners grew during the last decade, affordability worsened for a larger share of renters than owners. Among the poorest fifth of households — those with incomes below about $20,000 — a larger share of renters than owners are severely cost burdened.

At the same time that rents are rising, renter incomes are not. If these trends persist, current affordability problems for renters will continue or worsen.

When housing costs are too high, families lack sufficient income to meet other basic needs and are more likely to experience homelessness and housing instability — problems that harm children’s long-term health and development. The effect on low-income renters can be severe and enduring, as we’ll discuss in a subsequent post.

Supply shortages in some housing markets exacerbate the pressure on rents, making it important to address supply imbalances through policy tools such as reform of land-use regulations and subsidies for housing development. But the underlying problem is that many low-income renters cannot afford housing that meets current safety and acceptability standards. The most direct way to address this problem is through subsidies — such as the renters’ tax credit that we propose in our new paper — that help reduce the gap between market rents and the rent that low-income families can afford.

Tomorrow, we’ll take a closer look at how existing supports for low-income renters fall short.