BEYOND THE NUMBERS

The Case for Fiscal Stimulus

Testifying before the Senate Budget Committee today on policy prescriptions for the economy, Center Chief Economist Chad Stone outlined the importance of increasing overall demand:

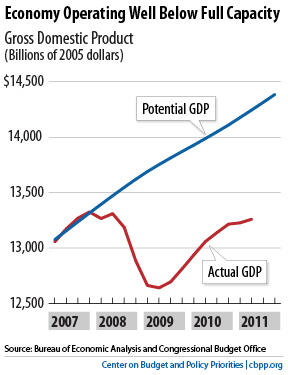

There is tremendous economic waste and human hardship in an economy that is operating well below full capacity. The goods and services that are not produced, the wages and business income that is not earned, and the revenues not received are lost forever. Potential GDP is effectively a ceiling on sustainable production, so periods of severe economic slack such as we are currently experiencing are not offset in the future by periods when actual GDP exceeds potential by a comparable amount.

CBO estimates that the recession and subsequent economic slump have already cost the economy $2½ trillion in lost output (the cumulative gap between actual and potential GDP since late 2007) and that without a pickup in the expected pace of recovery, we will lose another $2½ trillion before getting back to full employment. Moreover, as CBO notes, “Not only are the costs associated with the output gap immense, but they are also borne unevenly, falling disproportionately on people who lose their jobs, who are displaced from their homes, or who own businesses that fail.”

Policies that reduce the size of the output gap along the way to restoring full employment reduce the economic costs and human hardship of an economic slump. Long-term unemployment is at unprecedented levels, and as Tuesday’s grim report from the Census Bureau on income, poverty, and health insurance in 2010 shows, the recovery is proceeding too slowly to reduce that hardship substantially anytime soon.

A large output gap stems mainly from inadequate aggregate demand for goods and services, and policies that increase aggregate demand are likely to be more successful at closing the output gap than policies that give businesses tax incentives to expand production. The problem for most businesses in an economic slump is not that they don’t have enough capacity to meet existing demand but that they don’t have enough demand to fully utilize their existing capacity. Thus policies that put more customers in the stores with more money to spend are likely to be more successful at closing the output gap and creating jobs than giving businesses tax breaks. Policies that focus on raising the purchasing power of unemployed workers and middle- and low-income households are likely to be more successful per dollar of budget costs at increasing spending and creating jobs than policies cutting tax rates for high income taxpayers who are likely to save a significant portion of any tax cut they receive.

Click here for the full testimony. Click here for more charts on the impact of the recession.