BEYOND THE NUMBERS

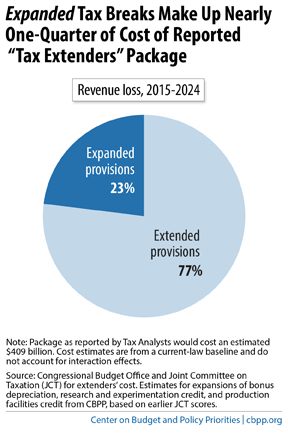

We’ve explained that the package that emerged last week to permanently extend several temporary tax breaks (“tax extenders”) and enlarge some of them would raise deficits — thereby putting more pressure on domestic programs for cost-saving cuts — while favoring large corporations and leaving out millions of working families. Following a presidential veto threat, the package now appears dead; but as lawmakers continue to consider options for what to do about the extenders, they should recognize another serious flaw in that package: nearly a quarter of its roughly $400 billion cost would have come from expanding tax cuts for businesses, not just extending them (see chart).

We’ve explained that the package that emerged last week to permanently extend several temporary tax breaks (“tax extenders”) and enlarge some of them would raise deficits — thereby putting more pressure on domestic programs for cost-saving cuts — while favoring large corporations and leaving out millions of working families. Following a presidential veto threat, the package now appears dead; but as lawmakers continue to consider options for what to do about the extenders, they should recognize another serious flaw in that package: nearly a quarter of its roughly $400 billion cost would have come from expanding tax cuts for businesses, not just extending them (see chart).

In particular, the package doubled the tax credit for research and experimentation, raising its ten-year cost from $75 billion to $151 billion. Making this and other extenders permanent without paying for them would be fiscally irresponsible; expanding some of them while doing so would be even more egregious.

Our report detailed the package’s main flaws:

- It would have given back more than half of the revenue raised by the 2012 “fiscal cliff” legislation. If it had become law, more than 85 percent of the deficit reduction achieved since 2010 would have come from budget cuts rather than new revenues.

- Congressional Republicans insist that future congressional budget plans balance the budget in ten years with no new revenues, cuts in Social Security benefits for current retirees, or defense cuts. Such a plan would already demand deep cuts in important areas; the extenders package would require even deeper cuts. As incoming House Budget Committee Chairman Tom Price (R-GA) said recently, “anything that’s made permanent now makes it more difficult to get to [budget] balance.”

- While permanently extending and expanding tax benefits mostly for businesses, the package failed to extend temporary tax provisions for low-income working families with children. Those provisions — in the Earned Income Tax Credit and the low-income piece of the Child Tax Credit — lift more than 16 million people out of poverty or closer to the poverty line each year, including nearly 8 million children. Their omission would make it less likely they will continue beyond 2017, when they are slated to expire.

- If policymakers make a number of extenders permanent now, without paying for them, they won’t have to offset the cost of making them permanent as part of tax reform. That would enable them to produce a tax reform bill that cuts the top tax rate more deeply, curbs fewer special-interest tax breaks, or both — and yet still is labeled “revenue neutral.”