BEYOND THE NUMBERS

Critical debates over the role of state revenues in supporting people’s needs are playing out in statehouses nationwide, with serious implications for family well-being, economic opportunity, and support for vital public services ranging from quality schools to safe drinking water. As this year’s Tax Day approaches, here are five trends we’re watching across the states.

Some states are adopting bold, progressive revenue-raising policies.

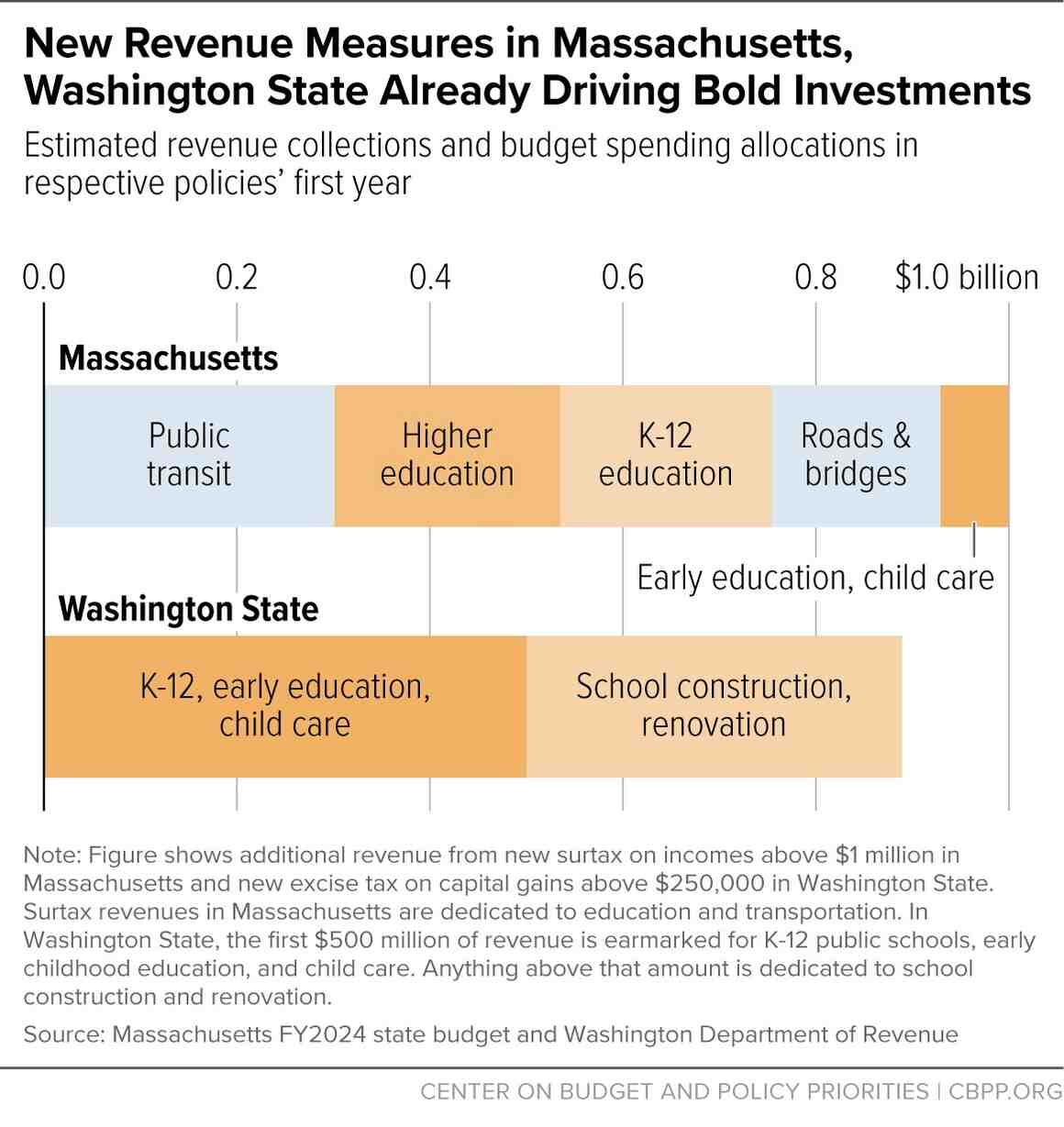

From 2021 to 2023, nine states adopted meaningful revenue-raising measures that now are driving substantial new investments, such as more affordable housing in Washington, D.C.; free community college and better transit in Massachusetts; universal free meals for public school students and a new paid leave program in Minnesota; and early learning supports, child care, and K-12 school construction and repair in Washington.

More states are considering following this path in 2024. Leading the way is New Mexico, which recently enacted a measure to bolster the corporate income tax and raise additional revenue from investment income to finance targeted tax reductions for low- and middle-income taxpayers. Measures to boost funding for key services and help ensure wealthy households and corporations pay their fair share are also on the table in Maryland, New Jersey, and Vermont, among other states.

Policymakers in a few states are considering strong action against corporate tax avoidance.

Every year, large multinational corporations avoid federal tax on much of their income by shifting hundreds of billions of dollars in profits earned in the United States on to the books of subsidiaries formed in foreign tax havens. Because most state corporate income taxes are linked to the federal tax, this massive profit shifting has considerable impact on state tax collections too — draining billions of dollars each year that could otherwise go to strengthening schools, expanding health coverage, or a host of other vital needs.

A handful of states have been striving to crack down on the problem, most prominently by exploring a reform known as “worldwide combined reporting.” This policy would all but eliminate state corporate tax avoidance by enabling states to tax a percentage of a corporation’s total profits worldwide, rather than just the partial profits it chooses to book on its U.S. balance sheets.

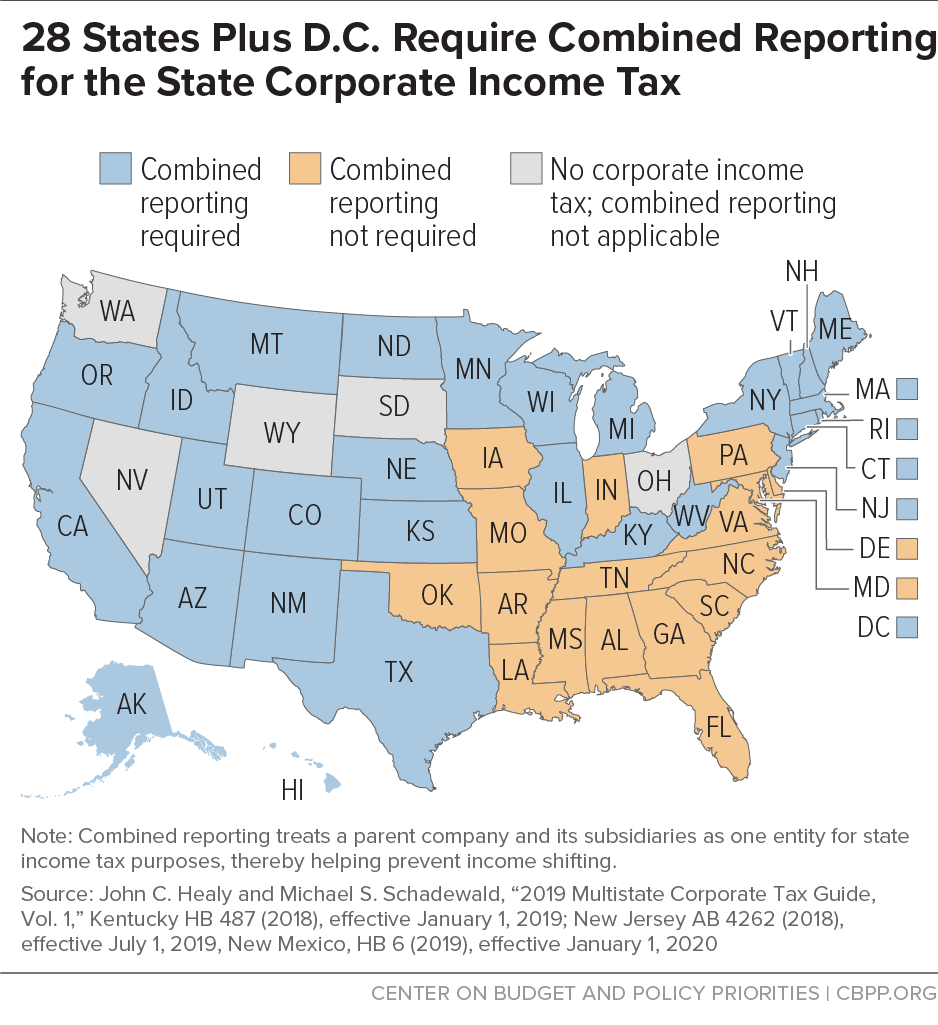

Adopting worldwide combined reporting would build on laws already on the books in more than half of the states that limit state-to-state tax avoidance through “water’s edge” combined reporting (see graphic). It would also conform with a longer history of states taxing multinational corporate profits more adequately than they do today. Twelve states had implemented worldwide combined reporting by the early 1980s, but they abandoned it under pressure from multinational corporations and the Reagan Administration (and a few states still allow it under some circumstances today).

Just this year and last, policymakers in states including Maryland, Minnesota, Tennessee, and Vermont have given serious consideration to worldwide combined reporting.

A large and growing number of states are using targeted tax credits to bolster people’s incomes.

Another positive way states are wielding tax policy is by expanding targeted tax credits for workers and families. As of this year, 14 states have enacted a child tax credit, while 31 states plus the District of Columbia and Puerto Rico have enacted their own version of the federal Earned Income Tax Credit (EITC). And momentum continues to grow. In 2023 alone, 18 states either established a new child tax credit or EITC or improved an existing one, and several additional states — such as Connecticut, Illinois, and New York — are weighing targeted tax credit expansions in 2024.

Research is clear that these targeted state credits, along with other forms of income assistance, are effective in reducing poverty and helping families afford the basics. This, in turn, helps families thrive in the long run through improved child and maternal health, school achievement, and other gains.

The credits also advance equity, since people of color, women, and people who immigrated to the U.S. are overrepresented in low-paid work and in families with little to no earnings. And the credits play a meaningful role in sustaining local economies, as recipients spend the income in local businesses or use it to pursue new entrepreneurial or creative endeavors.

States Should Continue Enacting and Expanding Child Tax Credits and Earned Income Tax Credits

States with a state Earned Income Tax Credit or Child Tax Credit

Other states are taking a more harmful path — especially with costly income tax cuts for the wealthy.

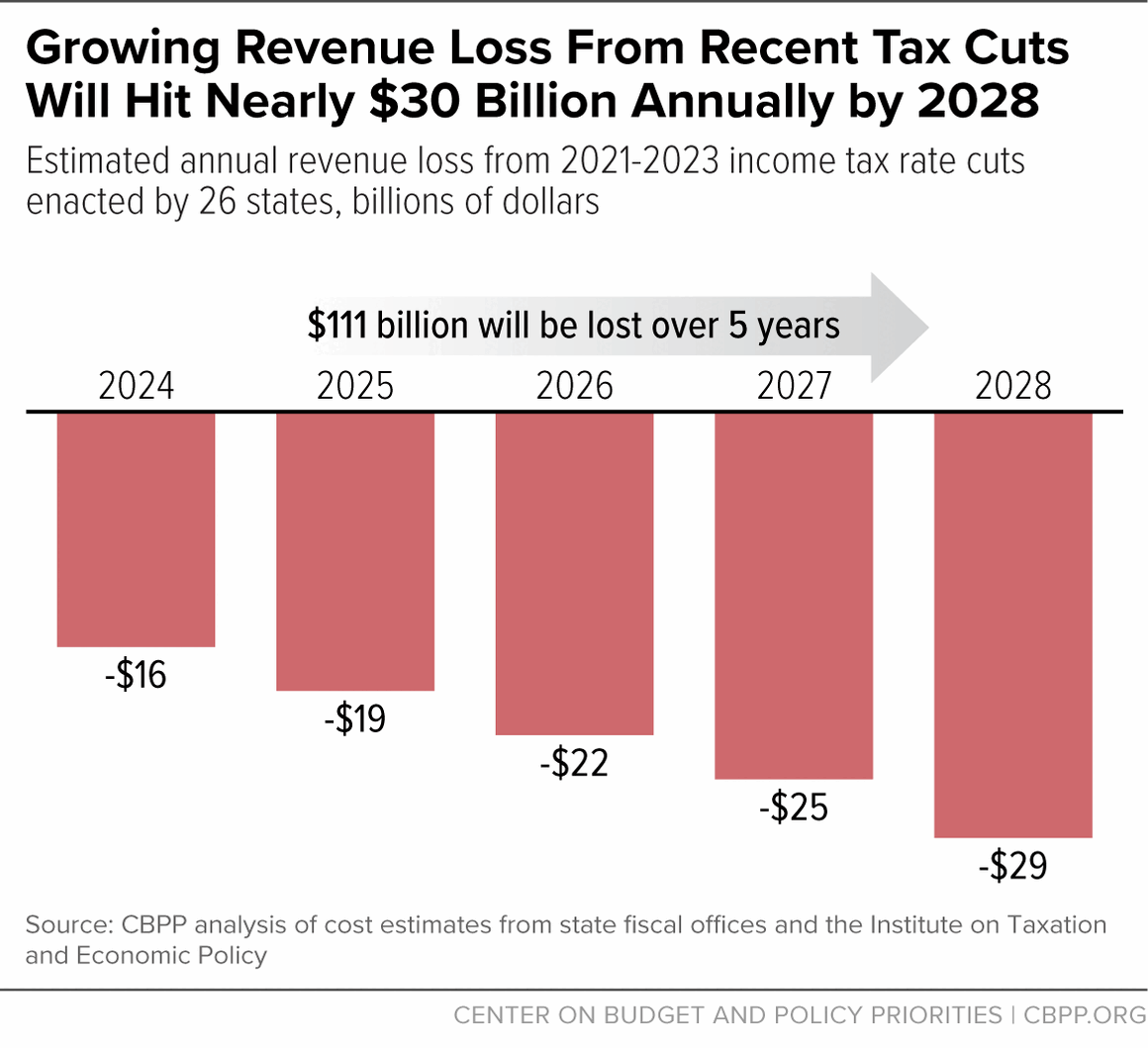

A number of states have instead taken a counterproductive approach to tax policy. Since 2021, more than half of the states have cut their income taxes, often employing various budget gimmicks like triggers and phase-ins to mask the full cost (see graphic). Kentucky, North Carolina, and West Virginia now have mechanisms in place that will eventually eliminate the personal or corporate income tax entirely if certain benchmarks are met, with devastating effects on state services and outsized gains to taxpayers at the very top.

So far in 2024, Utah has enacted legislation to cut its personal income tax rate for the third straight year, while Georgia layered additional tax cuts on top of an already massive package approved in 2022. And large tax cuts are on the table in other states, such as Iowa and Missouri.

On a more positive note, earlier this year governors in Kansas and Wisconsin rejected regressive income tax cuts (although a separate costly plan in Kansas is still under consideration). Other states would be wise to follow their lead. As I noted in a recent article, tax cuts may be “coming home to roost” for states that cut deeply, and work must begin now to reverse the damage on those states’ ability to support core public services.

Many states are cutting tax dollars that specifically support public education.

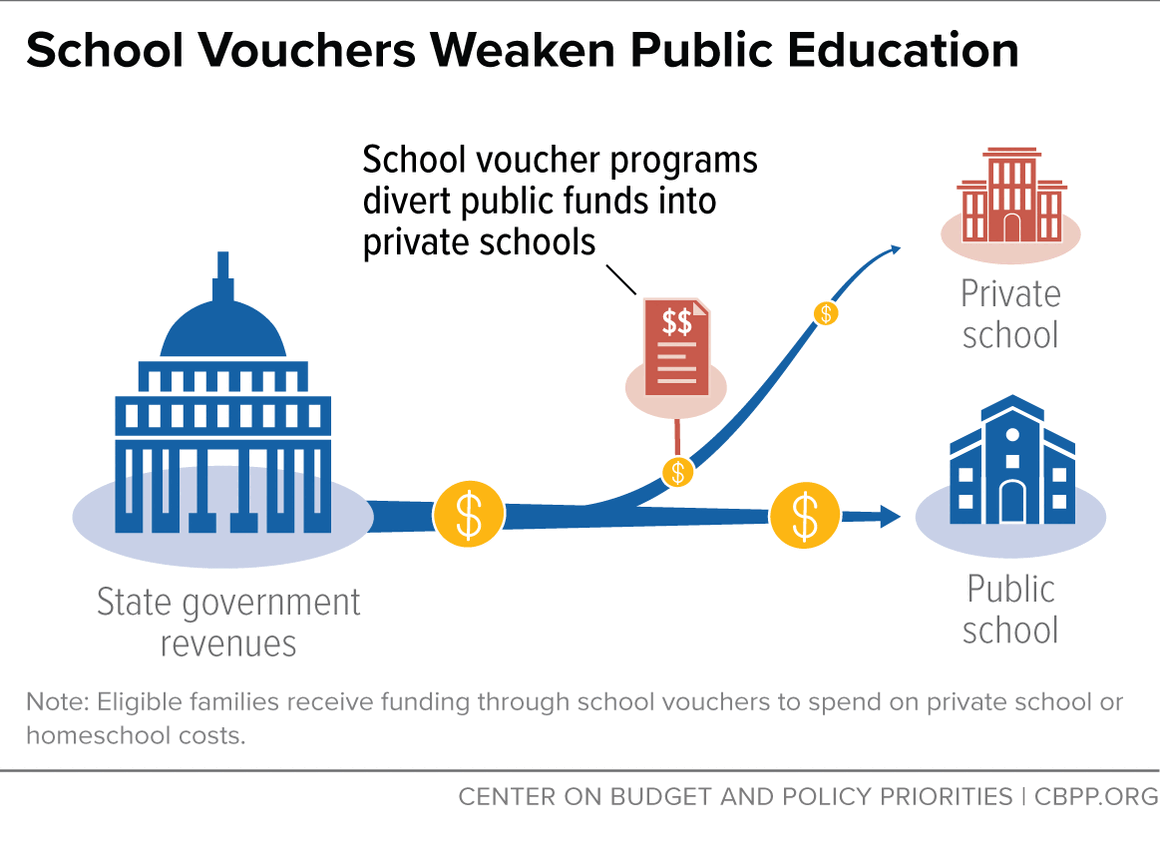

In addition to slashing broad-based revenues for public services generally, several states have targeted public funding for public education specifically, through a one-two punch of expanding private school voucher programs and undermining state and local property taxes.

States have recently seen a rapid proliferation of school voucher programs. These vary in design, but all shift money away from public schools and toward home-school families or private schools, which are less accountable to the public and often more exclusionary. Voucher bills have already been signed into law this year in Alabama, South Dakota, West Virginia, and Wyoming, while significant proposals have cleared the legislature and are awaiting the governor’s action in Georgia, Florida, and Kentucky.

Meanwhile, at least a half-dozen states are weighing proposals to drastically cut or even eliminate state and local property taxes. This would undercut the main funding source for universal public education, at a time when education budgets are already under significant strain from the expiration of remaining COVID-era federal aid for schools. Rather than undermining public funds for public schools, state policymakers should recommit to raising the revenues needed to support a quality public education for every child — a bedrock of our nation’s democratic system.