BEYOND THE NUMBERS

As states make final decisions about their budgets for the coming fiscal year, some are doing themselves more harm than good. Others, fortunately, are choosing approaches that will pay off for their future economies. Let’s take a look at one of each:

The poster child for states making irresponsible and economically damaging fiscal decisions this year is Kansas, where Governor Sam Brownback signed a massive income tax cut that will cost the state over $800 million a year in revenues.

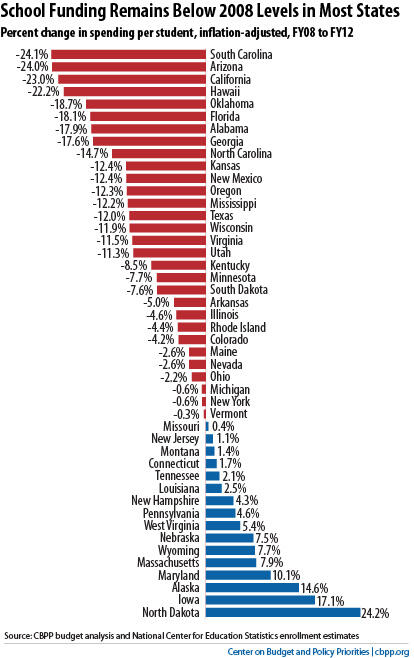

As my colleague Nick Johnson wrote earlier this week, Kansas’ approach weakens the state’s future by forcing very large cuts in state spending on schools and other public services essential to prosperity and growth. (The only way to avoid these damaging cuts is to impose large offsetting tax increases, which would slow the economy and shift taxes away from wealthy people and profitable corporations to middle- and low-income families). Kansas already has made some of the deepest cuts in the nation to its K-12 school system, having reduced per-pupil funding by 12 percent over the last four years. The bill that Governor Brownback signed this week greatly increases the chances that, over the next few years, these cuts will only get deeper, further weakening the state’s future economic potential.

Other states, such as Maryland, are responding to the recession-driven fiscal crisis more thoughtfully, in ways that will support the economy in the short term and protect long-run funding for schools and other public necessities.

Maryland recently adopted a more balanced approach of spending cuts and revenue increases that saved the state from making more than $400 million in cuts to schools and other state programs. The revenue increases are targeted to households with high incomes, an approach that a number of prominent economists have described as the most effective during periods of economic weakness. This balanced approach also will pay off in the long run; by protecting their schools from big cuts today, Maryland will boost the productivity of its workforce tomorrow.

Maryland had begun to boost state aid for local school districts when the recession hit, and it has chosen largely to maintain that program. Since 2008, the state has increased its per-pupil spending for schools by 10 percent, putting itself in a much stronger position to compete in the future with Kansas and other states that responded to the recession with deep school funding cuts.

States that are still debating tax and spending changes should look carefully at the packages that Kansas and Maryland have adopted. There’s little doubt about which one made the wiser choice.