BEYOND THE NUMBERS

Ryan Roundup: Everything You Need to Know About Chairman Ryan's Budget

Updated: Saturday, August 11, 2012

Below is a compilation of the CBPP analyses, blog posts, and graphics on the budget that House Budget Committee Chairman Paul Ryan proposed, and the House of Representatives passed, in March. At the bottom of the compilation, we also list the Center's analysis of the Ryan "Roadmap" budget plan.

Overview/General

- Blog post: Greenstein Statement

March 21, 2012

“The new Ryan budget is a remarkable document — one that, for most of the past half-century, would have been outside the bounds of mainstream discussion due to its extreme nature. In essence, this budget is Robin Hood in reverse — on steroids. It would likely produce the largest redistribution of income from the bottom to the top in modern U.S. history and likely increase poverty and inequality more than any other budget in recent times (and possibly in the nation’s history).”- Full statement: Robert Greenstein, President, on Chairman Ryan's Budget Plan

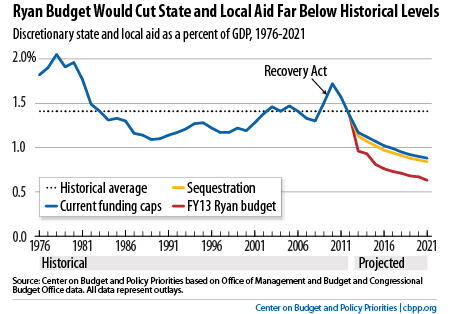

- Blog post: Unbalanced Deficit-Reduction Package Would Slash Funds to States and LocalitiesImage

August 8, 2012

As we explain in a new analysis, a deficit-reduction plan that lacks significant revenues would almost certainly deeply cut federal funds that support states and localities as they educate children, build roads and bridges, protect public health, and provide law enforcement.

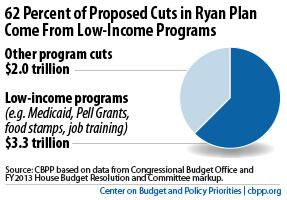

- Blog post: Low-Income Programs Would Bear the Brunt of Ryan Cuts

March 23, 2012

The Ryan budget would get at least 62 percent of its $5.3 trillion in nondefense budget cuts over ten years (relative to a continuation of current policies) from programs that serve people of limited means.

- Blog post: House Budget Committee Votes to Break Budget Deal

May 8, 2012

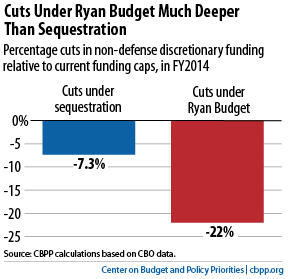

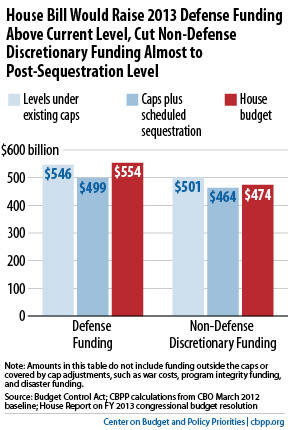

The House Budget Committee approved legislation yesterday that would alter last summer’s bipartisan budget deal and enable Congress to set defense funding above the agreed-upon cap, while cutting deeply into various non-defense programs, particularly those for lower-income families, as we explain in two reports.- Analysis: House Budget Bills Would Target Programs for Lower-Income Families While Breaking Last Summer's Bipartisan Deal — Package Would Enable Defense Funds to Be Set Above Agreed-to Caps, While Non-Defense Discretionary Funds Are Cut Nearly As Much As Under Sequestration

- Analysis: A Closer Look at Chairman Ryan's "Sequestration" Proposal

- Blog post: Ryan Plan Unlikely to Balance the Budget for Decades

March 28, 2012

Despite its massive spending cuts, House Budget Committee Chairman Paul Ryan’s budget (which the House is considering this week) would still have a deficit of $287 billion in fiscal year 2022. And the Congressional Budget Office estimates that it wouldn’t produce a surplus until 2040.

- Blog post: When Is a Deal Not a Deal?

March 22, 2012

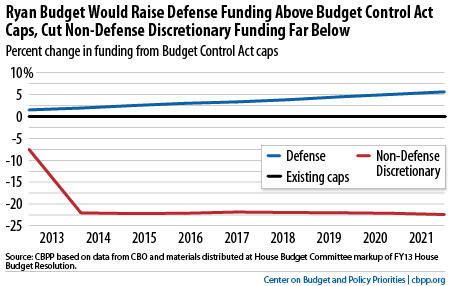

With defense funding well above the Budget Control Act’s funding caps in coming years, and non-defense discretionary funding very far below those caps, the Ryan budget bears little resemblance to the bipartisan agreement reached last summer.

- Blog post: Who Really Punted on Pell?

April 27, 2012

Pell Grants to help students from low-income families pay for college face a $58 billion shortfall over the next decade — even though the Congressional Budget Office says the program’s costs will remain flat during that period — because the way Congress has funded them in recent years has made the costs appear artificially low.

- Blog post: A First Look at the Ryan Budget: Squeezing Government Over Time

March 20, 2012

The Ryan budget specifies a long-term spending path under which, by 2050, most of the federal government aside from Social Security, health care, and defense would cease to exist.

Taxes

- Blog post: Ryan Budget Would Raise Some Taxes; Guess Who Gets Hit?

April 12, 2012

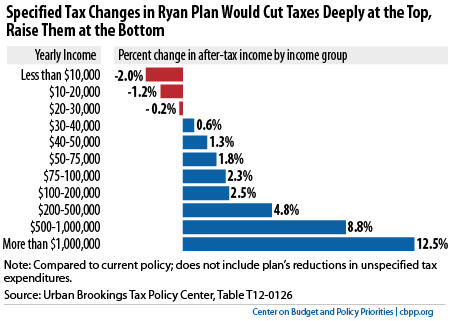

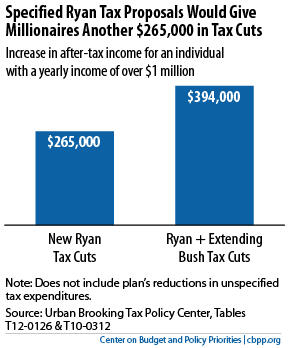

You’ve undoubtedly heard lots about how House Budget Committee Chairman Paul Ryan’s budget plan would give millionaires an average $265,000 apiece in new tax cuts, on top of the $129,000 apiece they would get from Ryan’s call to extend President Bush’s tax cuts. Have you also heard, however, that he wants to raise taxes for some other Americans? Want to guess who would bear the brunt of his tax hikes?

- Blog post: Myths on Spending, Debt, and Taxes Fuel Ryan Vision

April 5, 2012

Chad Stone: In my post for US News & World Report, I identify three myths about spending, debt, and taxes that conservative politicians use to justify the plan of House Budget Committee Chairman Paul Ryan -- one that would set the nation on a path to end most of government other than Social Security, health care, and defense by 2050.- Analysis: Ryan Budget's Claim to Finance Its Tax Cuts for the Wealthy By Curbing Their Tax Breaks Does Not Withstand Scrutiny

March 22, 2012

Despite warning that the nation faces the “perils of debt,” Chairman Ryan introduced a budget on March 20 whose tax proposals would be extremely costly and would disproportionately favor the nation’s highest-income households and large corporations.

- Analysis: Ryan Budget's Claim to Finance Its Tax Cuts for the Wealthy By Curbing Their Tax Breaks Does Not Withstand Scrutiny

- Blog post: Chairman Ryan’s Misleading Chart

March 27, 2012

The lead tax chart in Chairman Ryan’s budget...gives the impression that we can easily eliminate tax expenditures for the very wealthy and thereby pay for lower rates for all taxpayers — including the Ryan plan’s big reduction, to 25 percent, in the top income tax rate. The chart in question is based on data from the Urban-Brookings Tax Policy Center (TPC). But it does not show what Chairman Ryan suggests it does, for two key reasons.

Health Care

- Blog post: Lower Drug Costs Don’t Support Ryan Medicare Proposal

May 15, 2012

We’ve updated and expanded our 2011 analysis of why the Medicare Part D drug benefit, which private insurers deliver, has cost much less than the Medicare trustees and the Congressional Budget Office (CBO) originally expected.

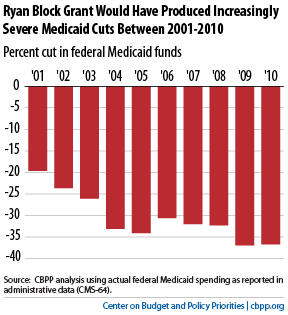

- Blog post: What If Chairman Ryan’s Medicaid Block Grant Were Already in Effect? (w/state-by-state data)

April 23, 2012

House Budget Committee Chairman Paul Ryan’s proposal to block-grant Medicaid would cut federal funding by one-third by 2022 and even more after that, we recently explained. To help show how states would likely fare under the proposal over time, we compared how much federal funding they would have received under the block grant if it had been in effect for fiscal years 2001-2010 to what they actually received (excluding the temporary funding increases that the White House and Congress provided during the last two recessions).Image

- Blog post: Ryan Budget Would Make Big Changes in Medicare

March 29, 2012

House Budget Committee Chairman Paul Ryan’s new budget provides much less detail than last year’s about his proposals in Medicare and other areas — too little for the Congressional Budget Office (CBO) to estimate their impact, as Brookings economist William Gale points out. (CBO estimated that Chairman Ryan’s Medicare proposals last year would have driven up total health care spending and doubled the out-of-pocket costs of a typical 65-year-old.)- Analysis: Medicare in the Ryan Budget

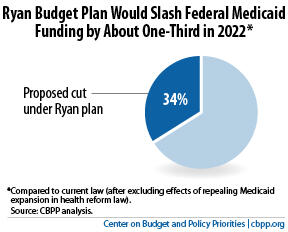

- Analysis: Ryan Medicaid Block Grant Would Cut Medicaid by One-Third by 2022 and More After That

March 27, 2012

The Medicaid block-grant proposal in the Ryan budget that the House of Representatives will vote on this week would cut federal Medicaid funding by 34 percent by 2022 (on top of repealing the health reform law’s Medicaid expansion) because the funding would no longer keep pace with health care costs or with expected Medicaid enrollment growth as the population ages and employer-based health insurance continues to erode.

- Blog post: Chairman Ryan and the Medicare Part D Myth

March 21, 2012

Chairman Ryan claims that his troubling proposal to convert Medicare into a premium support system would control costs and notes that the Medicare Part D drug benefit, which private insurers provide, has cost much less than the Congressional Budget Office expected. But Part D’s reliance on private plans had nothing to do with its lower-than-expected costs. - Blog post: Ryan’s Rx for Medicaid Would Add Millions to the Uninsured and Underinsured

March 20, 2012

The Ryan budget proposes to radically restructure Medicaid by converting it into a block grant and to slash federal funding by about one-fifth over the next decade. All told, it would add tens of millions of Americans to the ranks of the uninsured and underinsured.

- Blog post: The Problems with the Ryan-Wyden Medicare Proposal

March 19, 2012

The Ryan-Wyden proposal would shift substantial costs to Medicare beneficiaries, likely lead to the gradual demise of traditional Medicare, and produce few budgetary savings.

Safety Net

- Blog post: The Massive Hidden Safety-Net Cuts in Chairman Ryan’s Budget

March 21, 2012

A key misunderstood element of the Ryan budget is its proposed cut in spending for non-discretionary programs other than Social Security, Medicare, Medicaid, and other health programs. There is no way to generate the budget’s required savings without extremely severe cuts in these programs, on which the most vulnerable Americans depend.

- Blog post: Ryan Budget Takes Big Bite out of Food Stamps w/state data

March 22, 2012

Millions of people would lose part or all of their SNAP (food stamp) benefits under the Ryan budget.

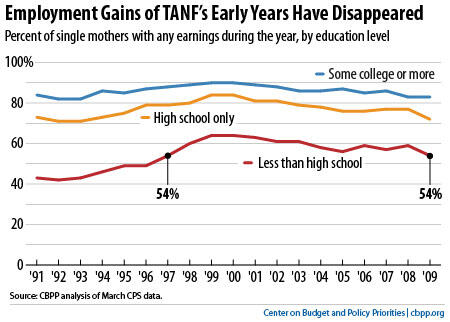

- Blog post: Chairman Ryan’s Call for “Welfare Reform, Round Two” Ignores Inconvenient Facts About Round One

March 21, 2012

Since a safety net is supposed to help people during times of economic need, the true measure of success is how it does during the worst of times, not the best of times. And, 15 years after Congress enacted welfare reform, we can see clearly that it is not the resounding success that Chairman Ryan claims.

Analysis of Ryan "Roadmap" Budget Plan of January 2010

The Ryan Budget's Radical Priorities — Provides Largest Tax Cuts in History for Wealthy, Raises Middle Class Taxes, Ends Guaranteed Medicare, Privatizes Social Security, Erodes Health Care

The Roadmap would give the most affluent households a new round of very large, costly tax cuts by reducing income tax rates on high-income households; eliminating income taxes on capital gains, dividends, and interest; and abolishing the corporate income tax, the estate tax, and the alternative minimum tax. At the same time, the Ryan plan would raise taxes for most middle-income families, privatize a substantial portion of Social Security, eliminate the tax exclusion for employer-sponsored health insurance, end traditional Medicare and most of Medicaid, and terminate the Children’s Health Insurance Program. The plan would replace these health programs with a system of vouchers whose value would erode over time and thus would purchase health insurance that would cover fewer health care services as the years went by.

Related analyses:

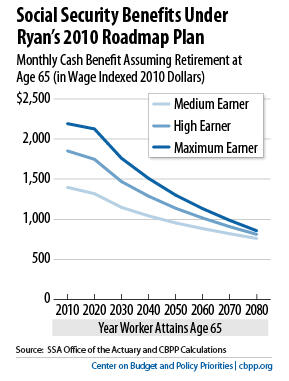

- Ryan Plan Makes Deep Cuts in Social Security

- The Ryan-Sununu Social Security Plan: “Solving” the Long-Term Social Security Shortfall by Raiding the Rest of the Budget