BEYOND THE NUMBERS

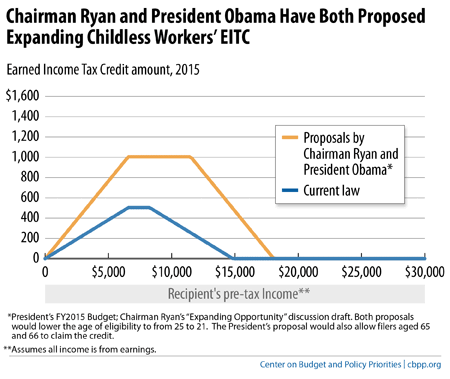

House Budget Committee Chairman Paul Ryan highlighted the Earned Income Tax Credit (EITC) today as one of the most effective anti-poverty programs and joined growing bipartisan calls to expand it for childless adults (including non-custodial parents), the lone group that the federal tax system taxes into poverty. We applaud this step, though we encourage him to reconsider some of his proposals to offset the cost — which would hit vulnerable families — and his opposition to a much-needed increase in the minimum wage. Ryan proposes lowering the eligibility age for the EITC for workers not raising minor children from 25 to 21, doubling the maximum credit to about $1,000, and phasing in the credit more quickly as a worker’s income rises. Ryan’s poverty proposal makes a strong, and broadly shared, case for these changes:

- It notes that young adults’ labor force participation has dropped precipitously in recent years and their unemployment rate is very high. “[T]he sooner young adults join the workforce, the more experience they will gain and the stronger their attachment will be,” it points out.

- It cites the findings by the University of Wisconsin’s John Karl Scholz, one of the country’s top EITC experts, that strengthening the EITC for childless workers could lower unemployment, promote marriage, and reduce incarceration rates. (See our report for more on these issues.)

President Obama has proposed a very similar EITC expansion, and Senator Marco Rubio (R-FL) has highlighted the need to increase wage subsidies for childless workers. Congressional Democrats have also championed substantial improvements to the EITC for childless workers.