BEYOND THE NUMBERS

Critics of proposals to reduce income inequality sometimes cite a 2008 Organisation for Economic Co-Operation and Development (OECD) report that found, among other things, that the United States has the most progressive tax system among developed countries. But, as a whole, the report doesn’t support the implication that the United States does a lot to address income inequality; nor do more recent OECD data.

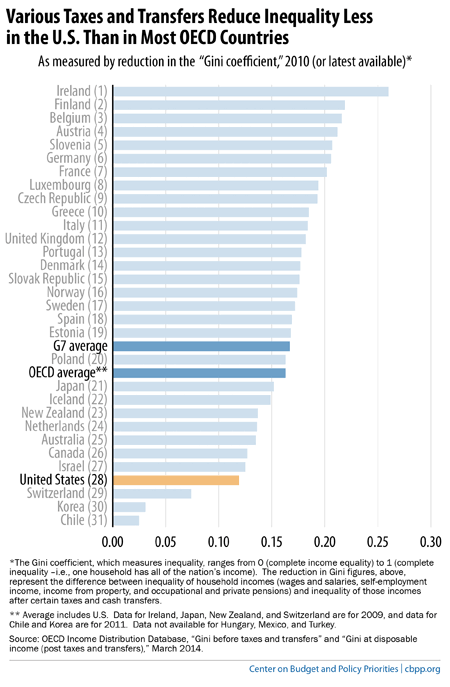

In fact, various taxes and “cash transfer” programs (such as Social Security, unemployment compensation, and means-tested benefits like SNAP) do less to reduce inequality in the United States than in any other OECD country examined except South Korea, Chile, and Switzerland, according to the OECD’s latest data (see graph).

As a result, while the United States had the tenth-highest level of inequality among the roughly 30 OECD countries studied before taxes and transfers, it had the fourth-highest level after taxes and transfers.

There are two main reasons why the U.S. tax and transfer system does relatively little to reduce inequality:

- While the taxes that the OECD analysis examined are more progressive in the United States than in other OECD countries, they also collect less revenue (as a share of household income) than the OECD average.

- U.S. cash transfers are only about half as large as the OECD average, measured as a share of household disposable income; they’re also less progressive than in other OECD countries.

The OECD analysis omits some taxes and transfers due to data limitations. It’s unclear how including all of the missing pieces would affect the findings. But citing only the OECD’s finding about the progressivity of the U.S. tax system while ignoring its other findings, as some have done, provides a misleading picture of the OECD report.