off the charts

POLICY INSIGHT

BEYOND THE NUMBERS

BEYOND THE NUMBERS

New House Rule Could Ease Passage of Deficit-Increasing Tax Cuts

Receive the latest news and reports from the Center

Our new paper analyzes a House Republican plan to amend House rules this week to require the Congressional Budget Office (CBO) and Joint Committee on Taxation (JCT) to use “dynamic scoring” for official cost estimates of tax reform and other major legislation. Under dynamic scoring, the official cost estimates would incorporate estimates of how legislation would affect the size of the U. S. economy and, in turn, federal revenues and spending.

Incoming Ways and Means Committee Chairman Paul Ryan has said this change is designed simply to generate more information on the impact of proposed policies. In reality, however, the House would be asking CBO and JCT for less information, not more, and the new rule could facilitate congressional passage of tax cuts that are revenue-neutral only on paper.

As our paper explains:

CBO and JCT already provide macroeconomic analyses of some proposed bills as a supplement to the official cost estimates they produce. These analyses typically present a range of estimates of the legislation’s impact on the economy.

The new House rule, in contrast, asks for an official cost estimate that only reflects a single estimate of the bill’s supposed impact on the economy and the resulting revenue impact. By incorporating additional revenue in the official cost estimate (as a result of an estimate of economic growth), this would enable lawmakers to write bills with deeper tax-rate cuts, or smaller offsetting curbs on tax breaks, than they otherwise could do.

The economic impact of even a well-designed tax reform plan is likely to be modest relative to the size of the U.S. economy. But the estimates of revenue gains from the plan’s estimated dynamic effects could be large in the context of current fiscal debates. Those estimates could also be highly dubious, depending on the models and assumptions used.

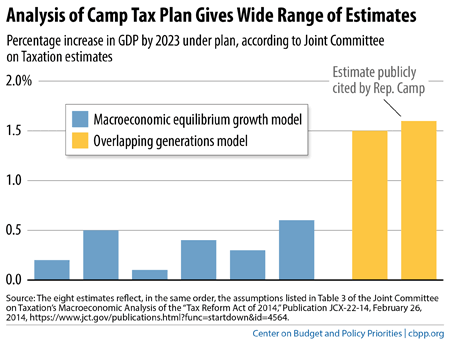

For example, JCT estimated that the tax reform plan that former Ways and Means Chairman Dave Camp produced last year could generate between $50 billion and $700 billion of additional revenue over the decade through faster economic growth (see chart), with the $700 billion estimate reflecting a series of very rosy assumptions — including the assumption that a future Congress will stabilize the debt as a share of gross domestic product (GDP) by approving large spending cuts that aren’t part of the Camp bill. If highly optimistic economic and fiscal assumptions like these are included in official cost estimates but then fail to materialize, the result will be higher deficits and debt. And as CBO, JCT, and other analysts have warned, tax cuts that ultimately expand deficits can slow economic growth, rather than increase it, because the higher deficits can create a drag on saving and investment.

Image