BEYOND THE NUMBERS

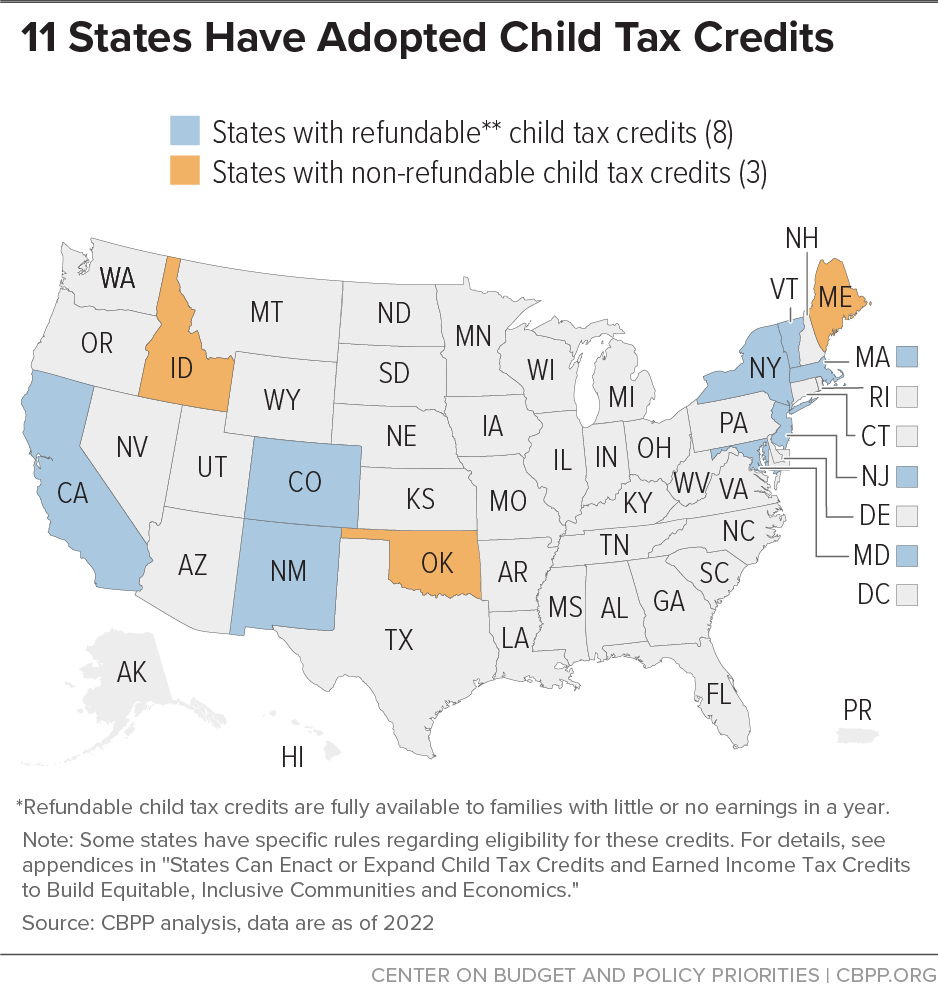

The federal Child Tax Credit helps families make ends meet and has a proven record of reducing child poverty and improving outcomes for children in the near and long term. A growing movement of legislators and governors across the country are working to create or expand state child tax credits to help families better meet their basic needs. At least 18 states are considering creating or expanding a child tax credit this year. These efforts continue strong momentum from last year, when three states created new child tax credits and one improved an existing credit.

Key features of effective child tax credits include providing a credit for all children under age 18 and a larger credit for children under 6, adjusting the credit for inflation so it maintains its value over time, ensuring the full value of the credit is available to all families — especially those with little to no earned income — and ensuring that people who file taxes with an Individual Taxpayer Identification Number are eligible.

States with promising proposals to create and expand child tax credits include:

- Montana. Governor Greg Gianforte proposed a child tax credit of $1,200 per child under age 6. As originally proposed, the credit would have been available to families with no earned income (that is, “fully refundable”); this is crucial because those families often face the highest barriers to employment and struggle the most to afford the basics. The credit was not enacted this year but provides an opportunity for discussion in future years.

- Minnesota. A proposal from Governor Tim Walz would provide a $1,000 refundable credit for each child under age 6 (up to $3,000 per family).

- New Jersey. Governor Phil Murphy’s budget proposes to double the state’s child tax credit from $500 to $1,000 per child.

- Utah. The state enacted a measure to provide a $1,000 non-refundable child tax credit for each child ages 1 up until 4. Utah should continue to improve the credit by making it fully available to families regardless of income and expanding the credit’s age eligibility.

Some states are considering offering child tax credit payments more than once a year, as the temporarily expanded Child Tax Credit from the American Rescue Plan did. While states should consider this change because it would be helpful for many families, periodic payments of state tax credits could also jeopardize families’ ability to receive support from some federal public assistance programs. States should also consider these interactions between tax credits and public assistance programs, ensure that families can choose the schedule under which they wish to receive child tax credit payments, and create a comprehensive outreach plan to notify credit recipients about the change.

Child tax credits are an important way that policymakers can help families make ends meet and help children thrive now and in the future. People of color, people who immigrated to the U.S., and women are among those who often face higher barriers to opportunity due in part to ongoing and historical discrimination and bias, and as a result they are disproportionately likely to be paid wages insufficient for their needs. Rising food and energy prices also continue to strain families’ budgets.

Most state tax systems ask the most as a share of income from families earning the least. A strong and well-designed child tax credit can help make state tax codes fairer and more equitable while helping families afford the basics and overcome everyday financial challenges.