BEYOND THE NUMBERS

In Case You Missed It...

This week on Off the Charts, we focused on the safety net, federal taxes, Social Security, food assistance, and health policy.

- On the safety net, we excerpted Robert Greenstein’s commentary on House Budget Committee Chairman Paul Ryan’s “Opportunity Grant” proposal and highlighted his discussion of the Ryan poverty plan on MSNBC’s “The Last Word with Lawrence O’Donnell.” Stacy Dean excerpted a post by Olivia Golden of the Center for Law and Social Policy debunking myths about safety net programs. Arloc Sherman explained that there are fewer poor children in America but more very poor children since the 1996 welfare law. Donna Pavetti pointed out the discrepancy between Chairman Ryan’s rhetoric and the reality of his poverty plan. She also listed three reasons why the 1996 welfare law should not be a model for reforming other safety net programs and four reasons why Ryan’s proposed work requirements are cause for concern. And we rounded up all of our writings to date on the Ryan plan.

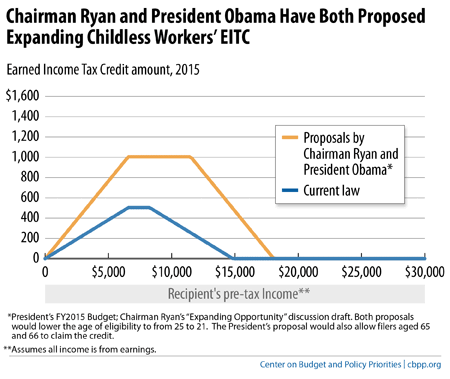

- On federal taxes, Chuck Marr applauded Chairman Ryan’s call for an expansion of the Earned Income Tax Credit while noting two serious flaws in his plan. He also pointed out the contradiction between Ryan’s new poverty plan and House Republicans’ vote to permanently change the Child Tax Credit in ways that will increase poverty. Chye-Ching Huang excerpted her New York Times piece calling on Congress to address the growing number of corporate tax inversions. Arloc Sherman excerpted his commentary on issues related to marginal tax rates and government benefits. Michael Mazerov urged Congress not to extend the ban on state and local sales taxation of Internet access fees unless pairing with legislation enabling states and localities to collect sales taxes on purchases from out-of-state Internet and catalog sellers.

- On Social Security, Kathy Ruffing previewed Monday’s 2014 Social Security trustees’ report. Paul Van de Water highlighted our new chart book on Social Security Disability Insurance.

- On food assistance, we excerpted Stacy Dean’s testimony before a House Agriculture subcommittee on SNAP (food stamps) as a successful and influential part of the safety net.

- On health policy, Edwin Park explained what the recent conflicting court rulings on federal marketplace subsidies mean for health reform.

We issued papers on how “direct certification” can enable more low-income children to receive school meals, the increase in deep poverty among children in the welfare law’s first decade, and why the House’s Child Tax Credit bill will leave millions of low-income working families behind. We also released a chart book on Social Security Disability Insurance. Arloc Sherman released a commentary on the effects of marginal tax rates on low- and moderate-income people. Robert Greenstein released commentaries previewing Chairman Ryan’s poverty plan and examining Ryan’s “Opportunity Grant” proposal. Stacy Dean testified before a House subcommittee on SNAP’s role in the safety net. And we updated our backgrounder on how many weeks of unemployment compensation are available.

CBPP’s Chart of the Week:

A variety of news outlets featured CBPP’s work and experts recently. Here are some highlights:

Beware the Balanced Budget Amendment

U.S. News and World Report

July 25, 2014

Paul Ryan’s poverty plan attacks the wrong problem and comes up with the wrong solution

Washington Post

July 24, 2014

End the Deception on Profits and Taxes

New York Times

July 22, 2014

Don’t miss any of our posts, papers, or charts — follow us on Twitter and Instagram.